3 ASX Stocks Estimated To Be Trading At Discounts Ranging From 18.5% To 48.3%

Reviewed by Simply Wall St

The Australian market has seen a 1.1% increase over the last week, with the Materials sector leading at 6.8%, and it is up 18% over the past year, with earnings forecasted to grow by 12% annually. In this favorable environment, identifying undervalued stocks can provide opportunities for investors looking to capitalize on potential growth at discounted prices.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| EZZ Life Science Holdings (ASX:EZZ) | A$4.55 | A$8.78 | 48.2% |

| Duratec (ASX:DUR) | A$1.37 | A$2.59 | 47.2% |

| Genesis Minerals (ASX:GMD) | A$2.09 | A$3.93 | 46.8% |

| Charter Hall Group (ASX:CHC) | A$15.59 | A$29.33 | 46.8% |

| Ingenia Communities Group (ASX:INA) | A$5.02 | A$9.39 | 46.5% |

| Little Green Pharma (ASX:LGP) | A$0.086 | A$0.17 | 49.2% |

| MedAdvisor (ASX:MDR) | A$0.435 | A$0.85 | 48.9% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| IperionX (ASX:IPX) | A$3.42 | A$6.62 | 48.3% |

| Superloop (ASX:SLC) | A$1.785 | A$3.31 | 46.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

Domino's Pizza Enterprises (ASX:DMP)

Overview: Domino's Pizza Enterprises Limited operates retail food outlets and has a market capitalization of A$3.15 billion.

Operations: The company generates revenue of A$2.38 billion from its restaurant operations.

Estimated Discount To Fair Value: 18.5%

Domino's Pizza Enterprises shows potential as an undervalued stock based on cash flows, trading at A$34.04, which is 18.5% below its estimated fair value of A$41.78. Despite a recent class action lawsuit and being dropped from the S&P/ASX 100 Index, the company reported strong earnings growth with net income rising to A$95.96 million for FY2024 and earnings projected to grow significantly over the next three years.

- Insights from our recent growth report point to a promising forecast for Domino's Pizza Enterprises' business outlook.

- Dive into the specifics of Domino's Pizza Enterprises here with our thorough financial health report.

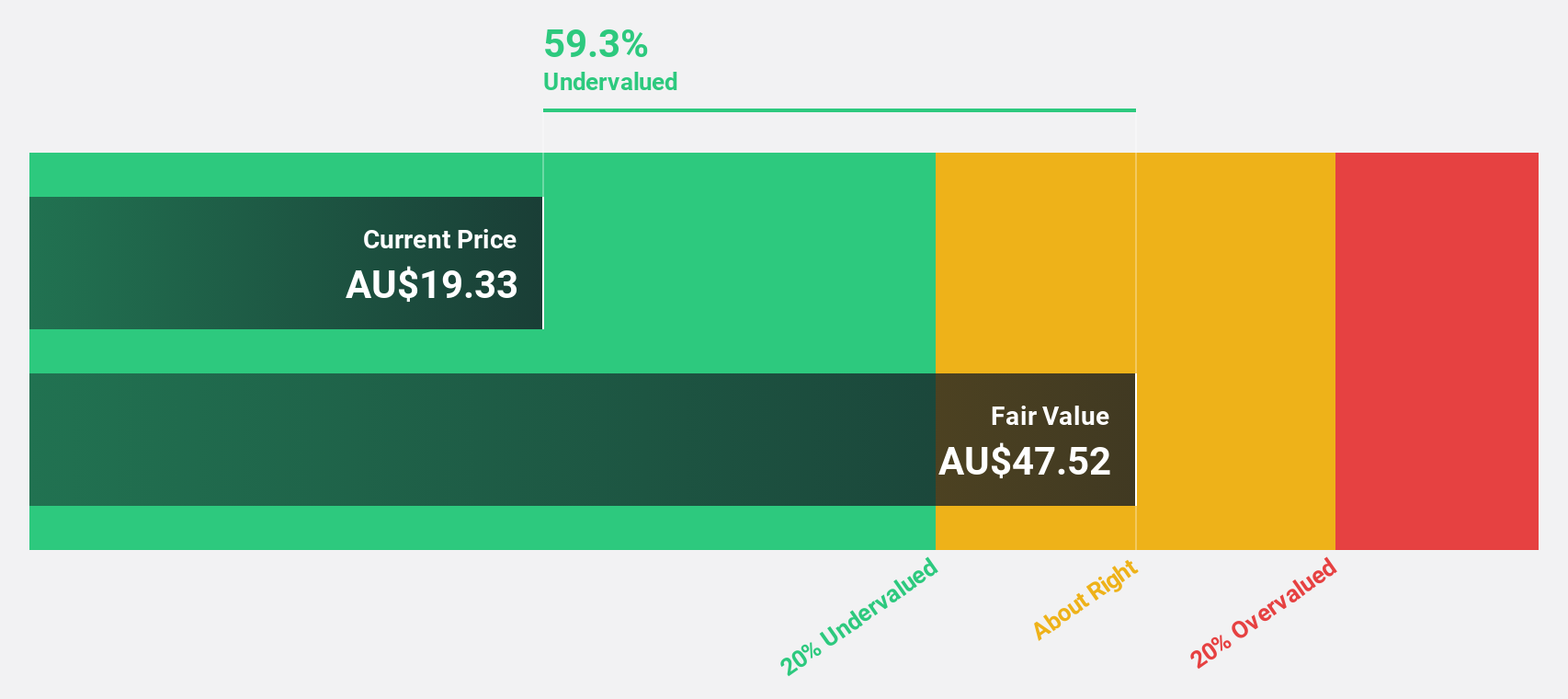

Hansen Technologies (ASX:HSN)

Overview: Hansen Technologies Limited (ASX:HSN) develops, integrates, and supports billing systems software for the energy, utilities, communications, and media sectors with a market cap of A$957.18 million.

Operations: The company generates revenue primarily from its billing segment, amounting to A$347.61 million.

Estimated Discount To Fair Value: 42.5%

Hansen Technologies is trading at A$4.71, significantly below its estimated fair value of A$8.19, reflecting strong undervaluation based on cash flows. Despite a decrease in profit margins from 13.7% to 6%, earnings are forecast to grow significantly over the next three years, outpacing the Australian market average growth rate. Recent developments include a renewed agreement with Norway's Area Nett AS for its cloud-based Customer Information System, potentially enhancing future revenue streams and operational efficiency.

- In light of our recent growth report, it seems possible that Hansen Technologies' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Hansen Technologies' balance sheet health report.

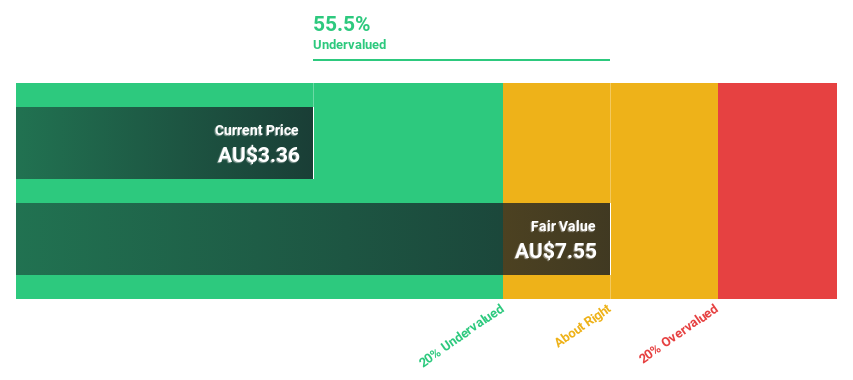

IperionX (ASX:IPX)

Overview: IperionX Limited focuses on the exploration and development of mineral properties in the United States, with a market cap of A$896.20 million.

Operations: IperionX Limited generates its revenue primarily through the exploration and development of mineral properties in the United States.

Estimated Discount To Fair Value: 48.3%

IperionX is trading at A$3.42, well below its estimated fair value of A$6.62, highlighting significant undervaluation based on cash flows. Despite a net loss of US$21.84 million for the year ending June 2024, revenue is expected to grow at 78.6% annually, outpacing the market significantly. The company recently secured a contract with Ford worth US$11 million and achieved technological milestones in titanium production, which could boost future profitability and operational efficiency.

- The analysis detailed in our IperionX growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of IperionX.

Key Takeaways

- Discover the full array of 47 Undervalued ASX Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Hansen Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hansen Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HSN

Hansen Technologies

Engages in the development, integration, and support of billing systems software for the energy, utilities, communications, and media sectors.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives