The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Iluka Resources (ASX:ILU). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out the opportunities and risks within the AU Metals and Mining industry.

How Fast Is Iluka Resources Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Iluka Resources managed to grow EPS by 16% per year, over three years. That's a good rate of growth, if it can be sustained.

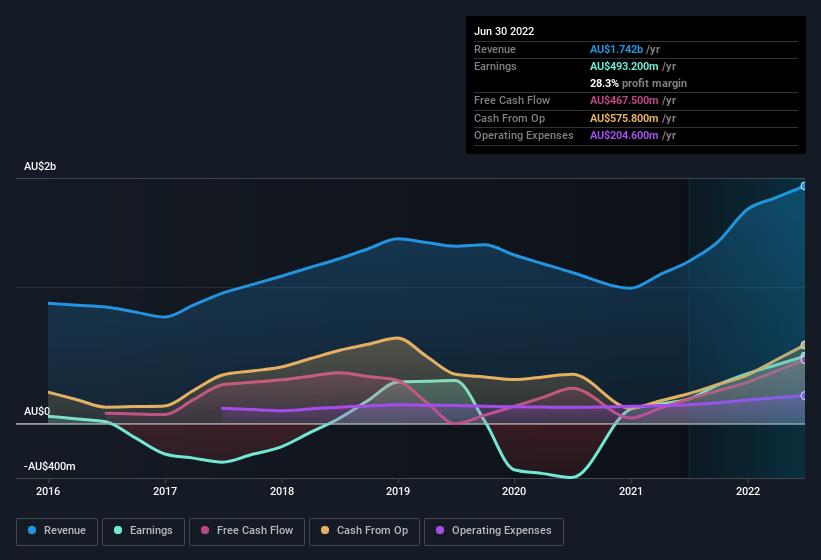

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Iluka Resources is growing revenues, and EBIT margins improved by 14.4 percentage points to 40%, over the last year. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Iluka Resources' future EPS 100% free.

Are Iluka Resources Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We note that Iluka Resources insiders spent AU$191k on stock, over the last year; in contrast, we didn't see any selling. This is a good look for the company as it paints an optimistic picture for the future. Zooming in, we can see that the biggest insider purchase was by Independent Non-Executive Chairman Robert Cole for AU$131k worth of shares, at about AU$8.71 per share.

It's commendable to see that insiders have been buying shares in Iluka Resources, but there is more evidence of shareholder friendly management. Specifically, the CEO is paid quite reasonably for a company of this size. For companies with market capitalisations between AU$3.0b and AU$9.5b, like Iluka Resources, the median CEO pay is around AU$3.5m.

Iluka Resources' CEO took home a total compensation package worth AU$2.9m in the year leading up to December 2021. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Iluka Resources Deserve A Spot On Your Watchlist?

One positive for Iluka Resources is that it is growing EPS. That's nice to see. And there's more to Iluka Resources, with the insider buying and modest CEO pay being a great look for those with an eye on the company. If these factors aren't enough to secure Iluka Resources a spot on the watchlist, then it certainly warrants a closer look at the very least. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Iluka Resources (1 is potentially serious) you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Iluka Resources, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ILU

Iluka Resources

Engages in the exploration, project development, mining, processing, marketing, and rehabilitation of mineral sands in Australia, China, rest of Asia, Europe, the Americas, and internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives