- Australia

- /

- Metals and Mining

- /

- ASX:IGO

IGO (ASX:IGO) Valuation Check After Naming Johan van Vuuren as Next CFO

Reviewed by Simply Wall St

IGO (ASX:IGO) has caught traders attention after naming Johan van Vuuren as its next Chief Financial Officer, effective April 1, 2026, a move that could influence its capital and growth strategy.

See our latest analysis for IGO.

The timing of van Vuuren’s appointment comes as IGO’s momentum returns, with a 30 day share price return of 36.96 percent and a 90 day share price return of 42.89 percent. However, the three year total shareholder return remains sharply negative, suggesting investors see scope for a turnaround rather than a finished story.

If this kind of rebound has you rethinking your watchlist, it could be worth widening the lens and discovering fast growing stocks with high insider ownership.

But with profits still under pressure, a negative three year return and the share price now well above analyst targets, is IGO trading at a genuine discount or is the market already banking on a sharp earnings recovery?

Price to Sales of 9.9x: Is it justified?

On a price to sales basis, IGO's A$6.93 share price looks demanding relative to peers, even though some models still flag it as trading below fair value.

The price to sales ratio compares a company’s market value to its revenue and is often used for loss making or early stage resource businesses where earnings are volatile or negative. For IGO, a 9.9x price to sales multiple suggests investors are already paying a premium for each dollar of current revenue, despite the company being unprofitable and its losses having grown at over 40 percent per year over the past five years.

Compared with the immediate peer group average of 8x, IGO screens as expensive, implying the market is assigning it a richer valuation than similar names. However, against the much higher Australian Metals and Mining industry average of 123.4x, the same 9.9x multiple looks conservative and could have room to converge higher if sentiment on battery minerals improves or if the company delivers on its forecast path back to profitability. The estimated fair price to sales ratio of 0.2x sits far below the current level, underlining how stretched the present pricing is versus what regression based models suggest the market could eventually move towards.

Explore the SWS fair ratio for IGO

Result: Price to sales of 9.9x (OVERVALUED)

However, lingering losses and a share price above analyst targets raise the risk that any stumble in lithium or nickel prices could trigger a sharp de-rating.

Find out about the key risks to this IGO narrative.

Another View: Discounted Cash Flow

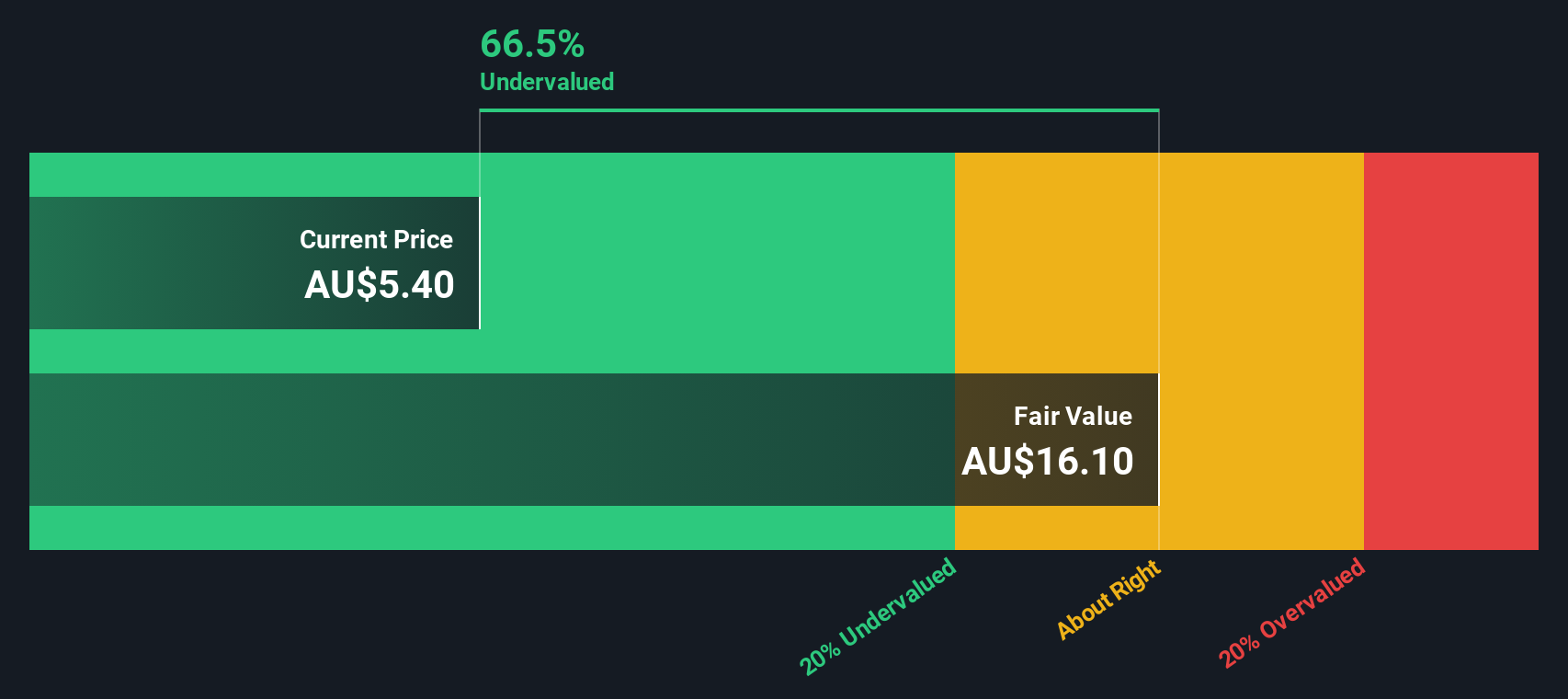

While the 9.9x price to sales ratio looks punchy, our DCF model suggests a fair value closer to A$10 per share, which implies IGO trades about 31 percent below that mark. If cash flows recover as forecast, is the market underestimating the long term earnings power here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out IGO for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 911 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own IGO Narrative

If you see the numbers differently or would rather dig into the data yourself, you can craft a full narrative in under three minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding IGO.

Looking for more investment ideas?

Before you move on, lock in your next smart step by scanning fresh stock ideas on Simply Wall Street that match your strategy and keep you ahead.

- Target reliable income streams by reviewing these 15 dividend stocks with yields > 3% that could strengthen your portfolio with consistent cash returns.

- Amplify your growth potential by assessing these 26 AI penny stocks positioned at the forefront of artificial intelligence innovation.

- Position yourself early in transformative tech by evaluating these 27 quantum computing stocks that may reshape entire industries over the coming decade.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IGO

IGO

IGO Limited, together with its subsidiaries, discovers, develops, and delivers battery minerals in Australia.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026