- Australia

- /

- Metals and Mining

- /

- ASX:MLX

IGO And 2 Other Promising Penny Stocks On The ASX

Reviewed by Simply Wall St

The Australian market has been relatively quiet at the start of January, with the ASX 200 expected to open slightly lower amid global economic concerns and a weakening Aussie dollar. In such uncertain times, investors often look for opportunities that might not be immediately obvious. Penny stocks, while sometimes considered niche due to their vintage terminology, can still offer surprising value by potentially pairing financial strength with long-term potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.57 | A$65.64M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.86 | A$238.78M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.525 | A$316.27M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.665 | A$842.94M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$1.995 | A$112.19M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.03 | A$318.31M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$202.29M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.905 | A$103.99M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.90 | A$483.46M | ★★★★☆☆ |

Click here to see the full list of 1,052 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

IGO (ASX:IGO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IGO Limited is an exploration and mining company in Australia that focuses on discovering, developing, and operating assets related to metals for clean energy, with a market cap of A$3.61 billion.

Operations: The company's revenue is primarily derived from its Nova Operation at A$539.1 million and Forrestania Operation at A$234.8 million, with additional contributions from the Cosmos Project at A$48.8 million and Interest Revenue amounting to A$18.1 million.

Market Cap: A$3.61B

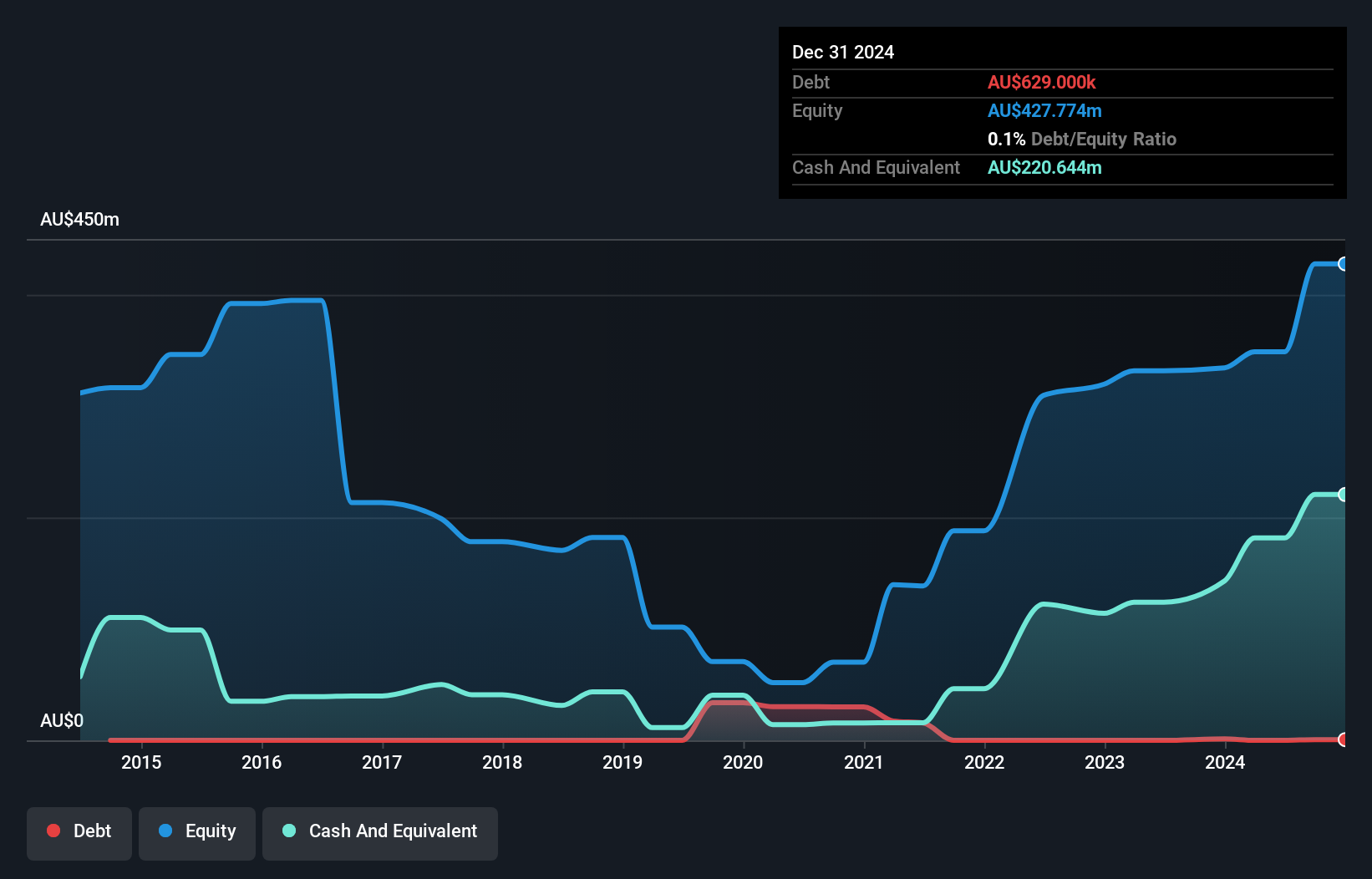

IGO Limited, with a market cap of A$3.61 billion, has been involved in M&A discussions, notably regarding Rio Tinto's Winu Project. Despite its debt-free status and strong short-term asset position (A$759.3M), IGO faces challenges with low profit margins (0.3%) and a recent large one-off loss of A$50.5M impacting financial results. Earnings growth has been negative recently, contrasting with significant past growth over five years at 24.7% annually. The management team is relatively new, averaging 0.5 years in tenure, while the company trades significantly below estimated fair value by 44.9%.

- Unlock comprehensive insights into our analysis of IGO stock in this financial health report.

- Gain insights into IGO's outlook and expected performance with our report on the company's earnings estimates.

Metals X (ASX:MLX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Metals X Limited is an Australian company focused on the production of tin, with a market cap of A$371.76 million.

Operations: The company's revenue is derived from its 50% stake in the Renison Tin Operation, generating A$186.22 million.

Market Cap: A$371.76M

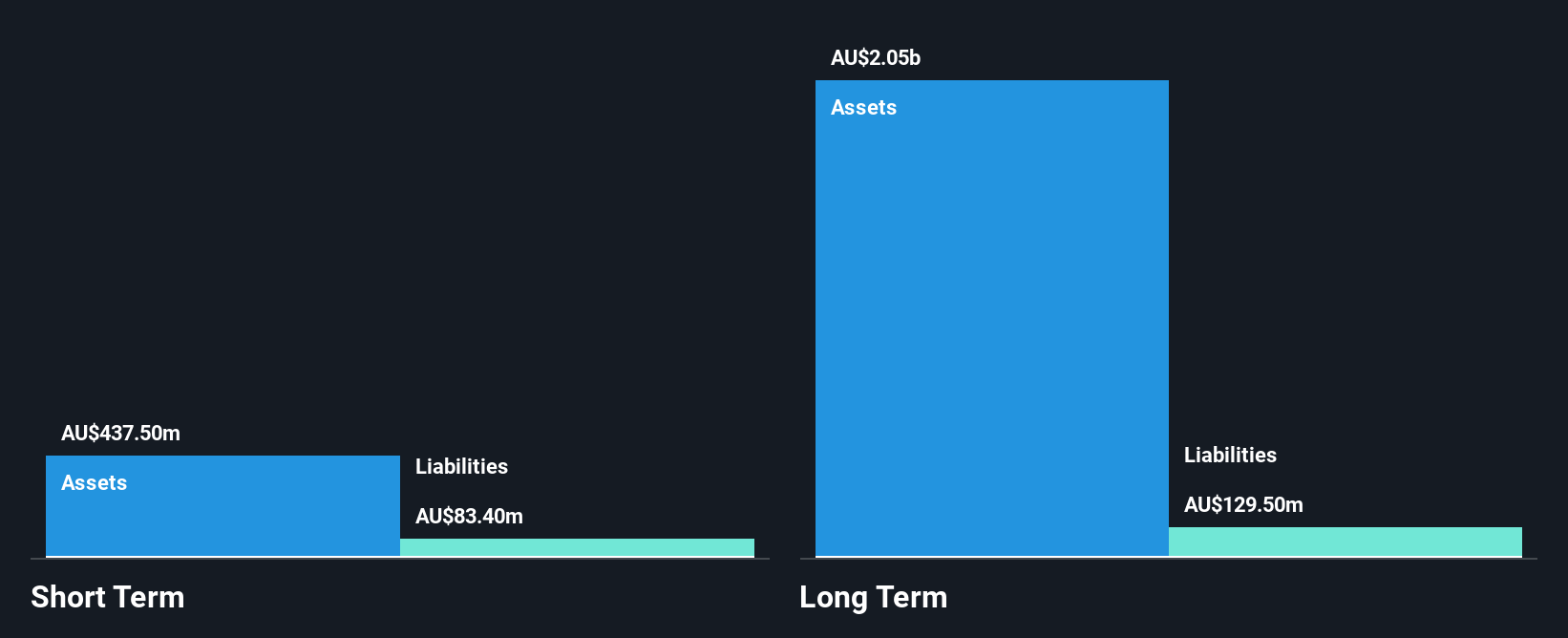

Metals X Limited, with a market cap of A$371.76 million, derives significant revenue from its 50% stake in the Renison Tin Operation, generating A$186.22 million. Despite recent negative earnings growth (-21.2%) and reduced profit margins (9.3% down from 17.1%), the company maintains a robust financial position with short-term assets (A$231.9M) exceeding both short-term (A$37.1M) and long-term liabilities (A$31.2M). The management and board are experienced, averaging over four years in tenure, while debt is well-covered by operating cash flow despite a large one-off loss impacting recent results.

- Click here and access our complete financial health analysis report to understand the dynamics of Metals X.

- Evaluate Metals X's historical performance by accessing our past performance report.

Tyro Payments (ASX:TYR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tyro Payments Limited provides payment solutions to merchants in Australia and has a market cap of A$429.49 million.

Operations: The company's revenue is primarily derived from its Payments segment, which generated A$471.51 million, complemented by A$14.73 million from Banking.

Market Cap: A$429.49M

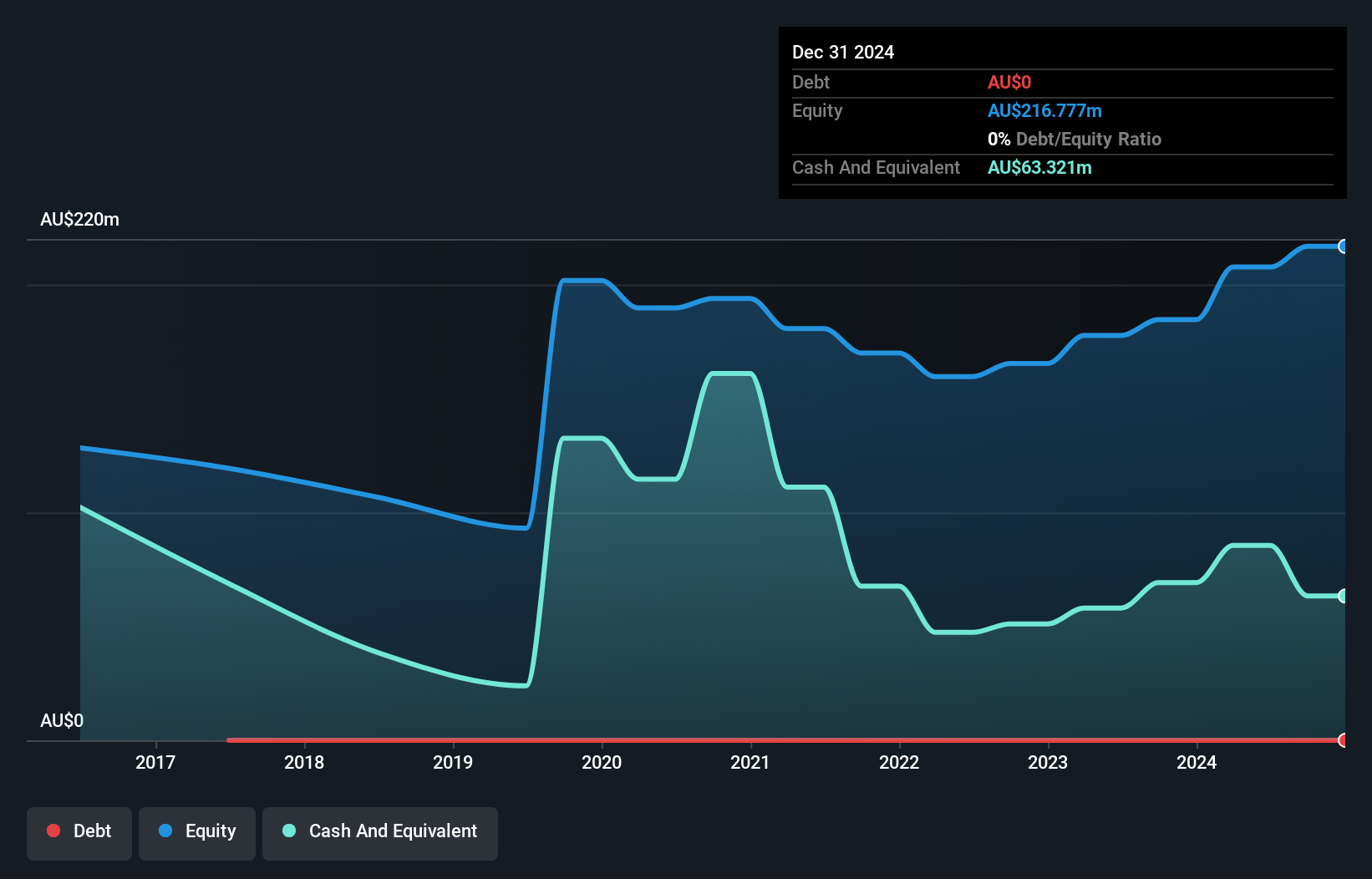

Tyro Payments Limited, with a market cap of A$429.49 million, shows potential within the penny stock space due to its strong financial position and growth trajectory. The company has no debt and maintains sufficient short-term assets (A$188.2M) to cover liabilities, while earnings have surged by 327.5% over the past year, significantly outpacing industry averages despite a one-off loss of A$20M affecting recent results. Its Price-To-Earnings ratio (16.9x) is below the Australian market average, indicating potential value for investors seeking opportunities in this segment without significant shareholder dilution concerns.

- Jump into the full analysis health report here for a deeper understanding of Tyro Payments.

- Assess Tyro Payments' future earnings estimates with our detailed growth reports.

Key Takeaways

- Click through to start exploring the rest of the 1,049 ASX Penny Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MLX

Excellent balance sheet and slightly overvalued.