The Australian market is experiencing a cautious start to the year, with the ASX 200 expected to open slightly lower amid global economic uncertainties and currency fluctuations. Despite these broader market challenges, penny stocks continue to attract attention as viable investment opportunities. Though often seen as relics of past trading days, penny stocks represent smaller or newer companies that can offer significant value when underpinned by strong financials. In this article, we explore three such stocks on the ASX that combine balance sheet strength with potential for growth, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.57 | A$65.64M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.86 | A$238.78M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.525 | A$316.27M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.665 | A$842.94M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$1.995 | A$112.19M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.03 | A$318.31M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$202.29M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.905 | A$103.99M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.90 | A$483.46M | ★★★★☆☆ |

Click here to see the full list of 1,052 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Cogstate (ASX:CGS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cogstate Limited is a neuroscience technology company focused on developing, validating, and commercializing digital brain health assessments for academic and industry-sponsored research, with a market cap of A$179.03 million.

Operations: The company's revenue is derived from two main segments: Healthcare (including Sport), contributing $3.99 million, and Clinical Trials (including Precision Recruitment Tool & Research), generating $39.44 million.

Market Cap: A$179.03M

Cogstate Limited, with a market cap of A$179.03 million, has shown strong financial health and growth potential. The company's revenue is primarily derived from its Clinical Trials segment, generating A$39.44 million. Recent strategic partnerships, such as with Medidata to enhance CNS clinical trials, highlight its commitment to innovation in digital brain health assessments. Financially robust, Cogstate holds more cash than debt and has improved profit margins over the past year. Its earnings growth of 52.8% surpasses industry averages, supported by a stable management team and experienced board of directors.

- Take a closer look at Cogstate's potential here in our financial health report.

- Evaluate Cogstate's prospects by accessing our earnings growth report.

GWA Group (ASX:GWA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: GWA Group Limited is involved in the research, design, manufacture, importation, and marketing of building fixtures and fittings for residential and commercial properties across Australia, New Zealand, and international markets with a market cap of A$641.80 million.

Operations: The company's revenue is primarily derived from its Water Solutions segment, which generated A$413.49 million.

Market Cap: A$641.8M

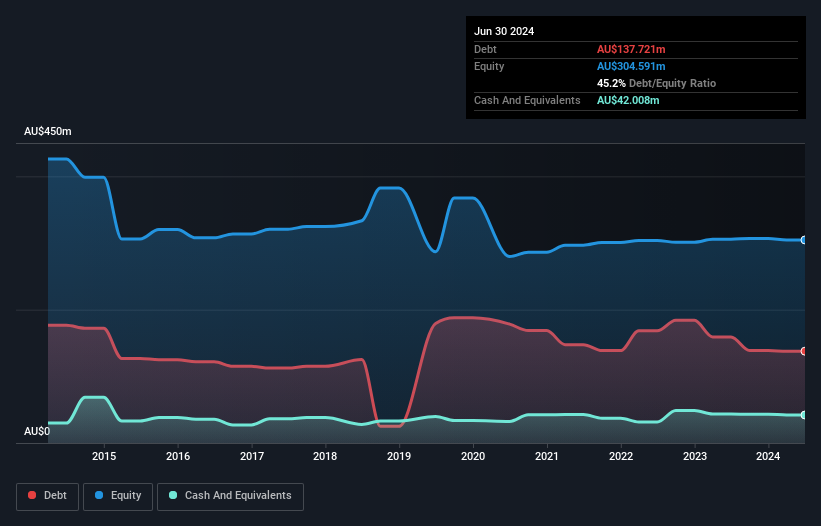

GWA Group, with a market cap of A$641.80 million, faces both opportunities and challenges in the penny stock landscape. Its net debt to equity ratio of 31.4% is satisfactory, and interest payments are well covered by EBIT at 9x coverage. However, GWA's net profit margins have declined from last year, and its long-term liabilities exceed short-term assets. The dividend yield of 6.5% is not fully supported by earnings, raising sustainability concerns. Despite trading below estimated fair value and having high-quality earnings, recent negative earnings growth indicates potential volatility ahead for investors considering this stock.

- Click here and access our complete financial health analysis report to understand the dynamics of GWA Group.

- Examine GWA Group's earnings growth report to understand how analysts expect it to perform.

Magnetic Resources (ASX:MAU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Magnetic Resources NL is involved in the exploration of mineral tenements in Western Australia and has a market cap of A$294.75 million.

Operations: The company's revenue segment is derived entirely from Mineral Exploration, amounting to A$0.50 million.

Market Cap: A$294.75M

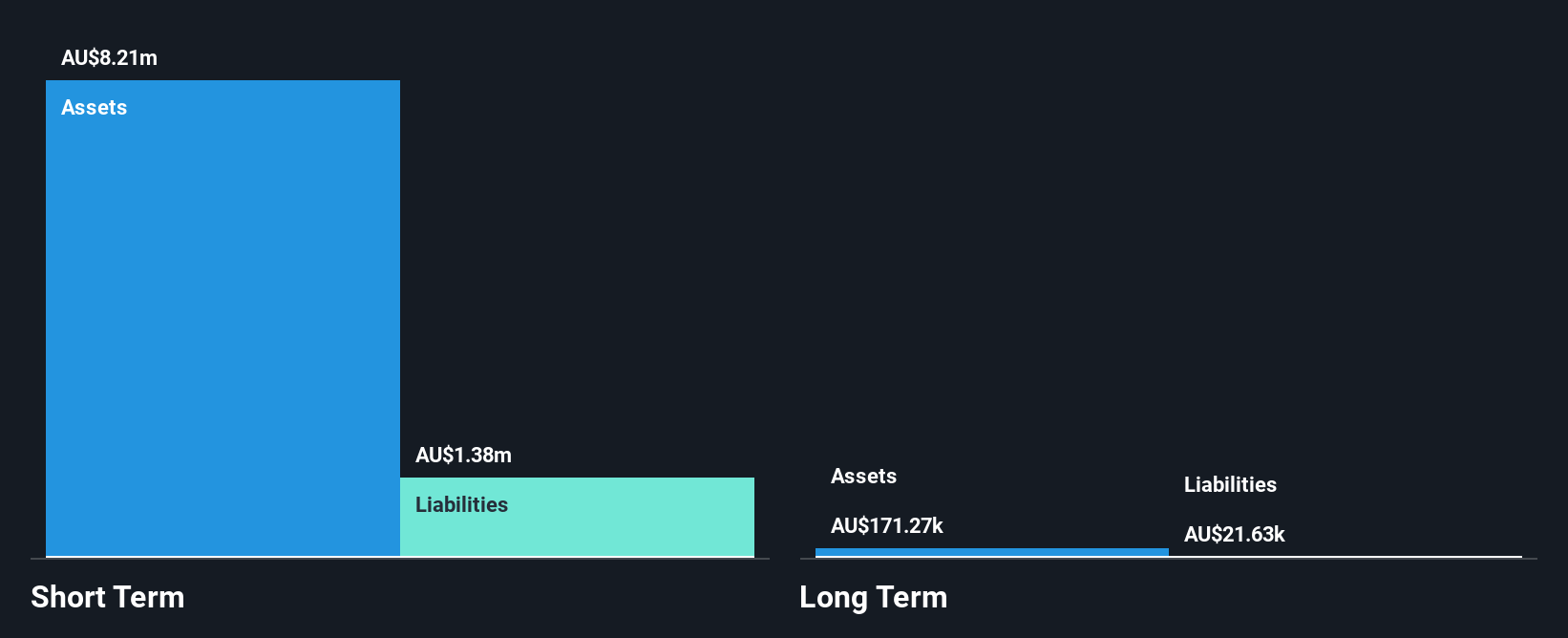

Magnetic Resources, with a market cap of A$294.75 million, operates in the mineral exploration sector and remains pre-revenue, generating less than US$1 million annually. The company is debt-free and has short-term assets of A$9.6 million exceeding its short-term liabilities of A$885.8K, providing some financial stability despite recent shareholder dilution by 9%. However, it faces challenges with increased losses over the past five years at 19% annually and a negative return on equity of -139.41%. Recent capital raising efforts have extended its cash runway beyond the initial 10 months projection as of June 2024.

- Get an in-depth perspective on Magnetic Resources' performance by reading our balance sheet health report here.

- Examine Magnetic Resources' past performance report to understand how it has performed in prior years.

Where To Now?

- Discover the full array of 1,052 ASX Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GWA

GWA Group

Researches, designs, manufactures, imports, and markets building fixtures and fittings to residential and commercial premises in Australia, New Zealand, and internationally.

Excellent balance sheet, good value and pays a dividend.