- Australia

- /

- Metals and Mining

- /

- ASX:IGO

How Investors May Respond To IGO (ASX:IGO) CFO Transition Amid Sharpened Battery Minerals Focus

Reviewed by Sasha Jovanovic

- IGO Limited recently announced that Johan van Vuuren will become Chief Financial Officer from April 1, 2026, succeeding Kathleen Bozanic, who will stay on to ensure an orderly transition.

- This leadership change comes as IGO gains attention from higher lithium demand forecasts and exits substantial holder status in Boa Resources, sharpening focus on its core battery minerals exposure.

- Against this backdrop of CFO transition and stronger lithium demand expectations, we’ll explore how these developments influence IGO’s broader investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is IGO's Investment Narrative?

To own IGO today, you really need to believe in the long-term case for battery minerals despite current earnings pain and revenue falling to A$527.8 million with a A$954.6 million loss. The recent 7.1% share price jump on stronger lithium demand forecasts reinforces that short-term catalysts are still dominated by sentiment around lithium pricing and production delivery, rather than boardroom moves. The CFO appointment of Johan van Vuuren for 2026 looks more like a medium-term governance and capital allocation story than a near-term earnings catalyst, especially with an orderly handover from Kathleen Bozanic flagged. Similarly, IGO ceasing to be a substantial holder in Boa Resources nudges attention back to core assets, but is unlikely to change immediate risks, which still centre on price volatility, execution on FY2026 production guidance and the path back to profitability.

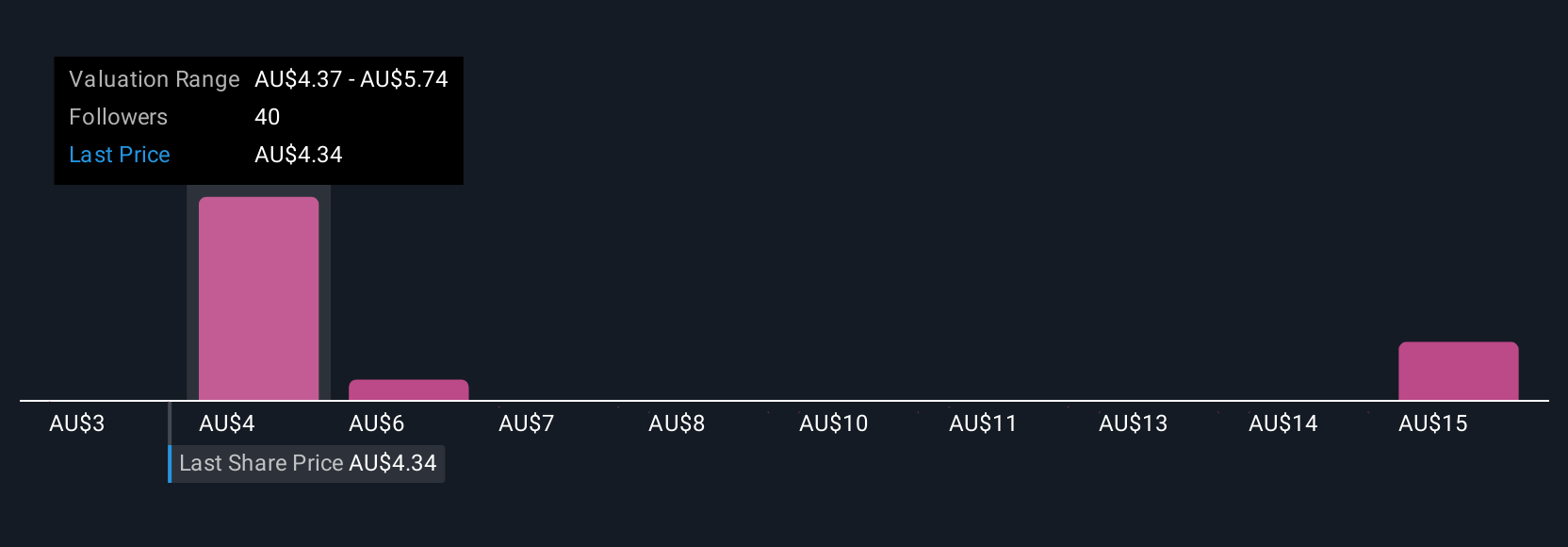

However, investors should be aware of one particular earnings risk hiding behind those lithium headlines. IGO's shares have been on the rise but are still potentially undervalued by 31%. Find out what it's worth.Exploring Other Perspectives

Explore 12 other fair value estimates on IGO - why the stock might be worth less than half the current price!

Build Your Own IGO Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IGO research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free IGO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IGO's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IGO

IGO

IGO Limited, together with its subsidiaries, discovers, develops, and delivers battery minerals in Australia.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026