- Australia

- /

- Metals and Mining

- /

- ASX:IGO

ASX Dividend Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the ASX200 reaches an all-time high of 8,566 points, buoyed by strong performances in mining and real estate sectors, investors are keenly eyeing opportunities that can provide steady returns amidst this bullish market environment. In such a scenario, dividend stocks become particularly attractive as they offer potential income streams alongside capital appreciation, making them a compelling option for those looking to capitalize on the current economic momentum.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Premier Investments (ASX:PMV) | 6.13% | ★★★★★★ |

| Super Retail Group (ASX:SUL) | 7.59% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.37% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.10% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.93% | ★★★★★☆ |

| New Hope (ASX:NHC) | 8.16% | ★★★★☆☆ |

| Sugar Terminals (NSX:SUG) | 7.74% | ★★★★☆☆ |

| Santos (ASX:STO) | 6.92% | ★★★★☆☆ |

| Ricegrowers (ASX:SGLLV) | 5.45% | ★★★★☆☆ |

| Grange Resources (ASX:GRR) | 8.33% | ★★★★☆☆ |

Click here to see the full list of 30 stocks from our Top ASX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Accent Group (ASX:AX1)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Accent Group Limited operates in the retail, distribution, and franchise sectors for lifestyle footwear, apparel, and accessories across Australia and New Zealand with a market capitalization of A$1.21 billion.

Operations: Accent Group Limited generates revenue from its Retail segment at A$1.27 billion and its Wholesale segment at A$463.20 million.

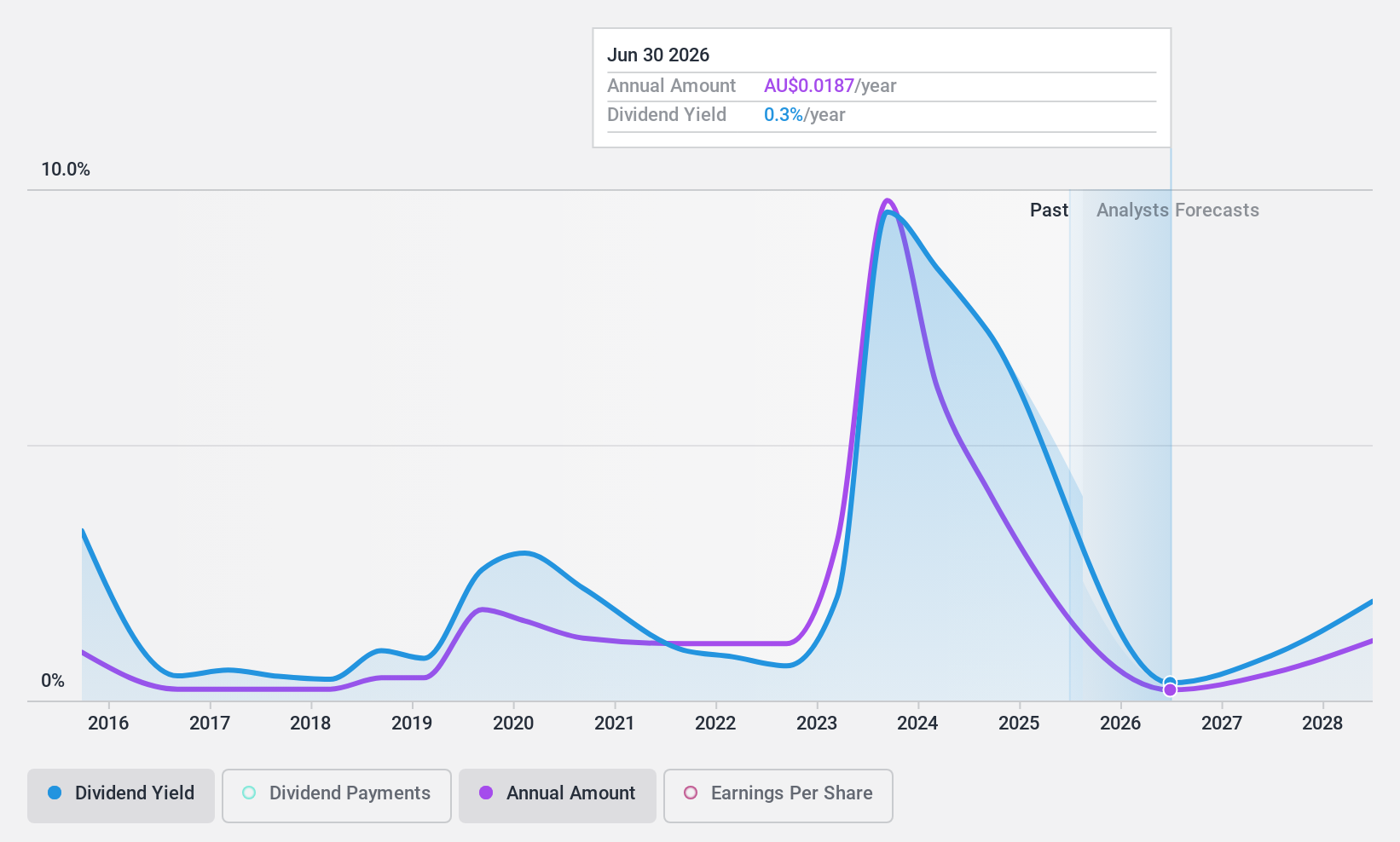

Dividend Yield: 6.1%

Accent Group's dividend yield of 6.1% places it among the top 25% in Australia, yet its sustainability is questionable due to a high payout ratio of 122.5%, indicating dividends are not well covered by earnings despite being supported by cash flows. Although dividends have grown over the past decade, they remain volatile and unreliable. Recent guidance projects first-half FY2025 EBIT at A$80 million, with sales showing modest growth, potentially impacting future dividend stability.

- Get an in-depth perspective on Accent Group's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Accent Group is trading behind its estimated value.

IGO (ASX:IGO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IGO Limited is an exploration and mining company in Australia that focuses on discovering, developing, and operating assets for metals essential to clean energy, with a market cap of A$3.83 billion.

Operations: IGO Limited's revenue segments include A$48.80 million from the Cosmos Project, A$539.10 million from the Nova Operation, and A$234.80 million from the Forrestania Operation.

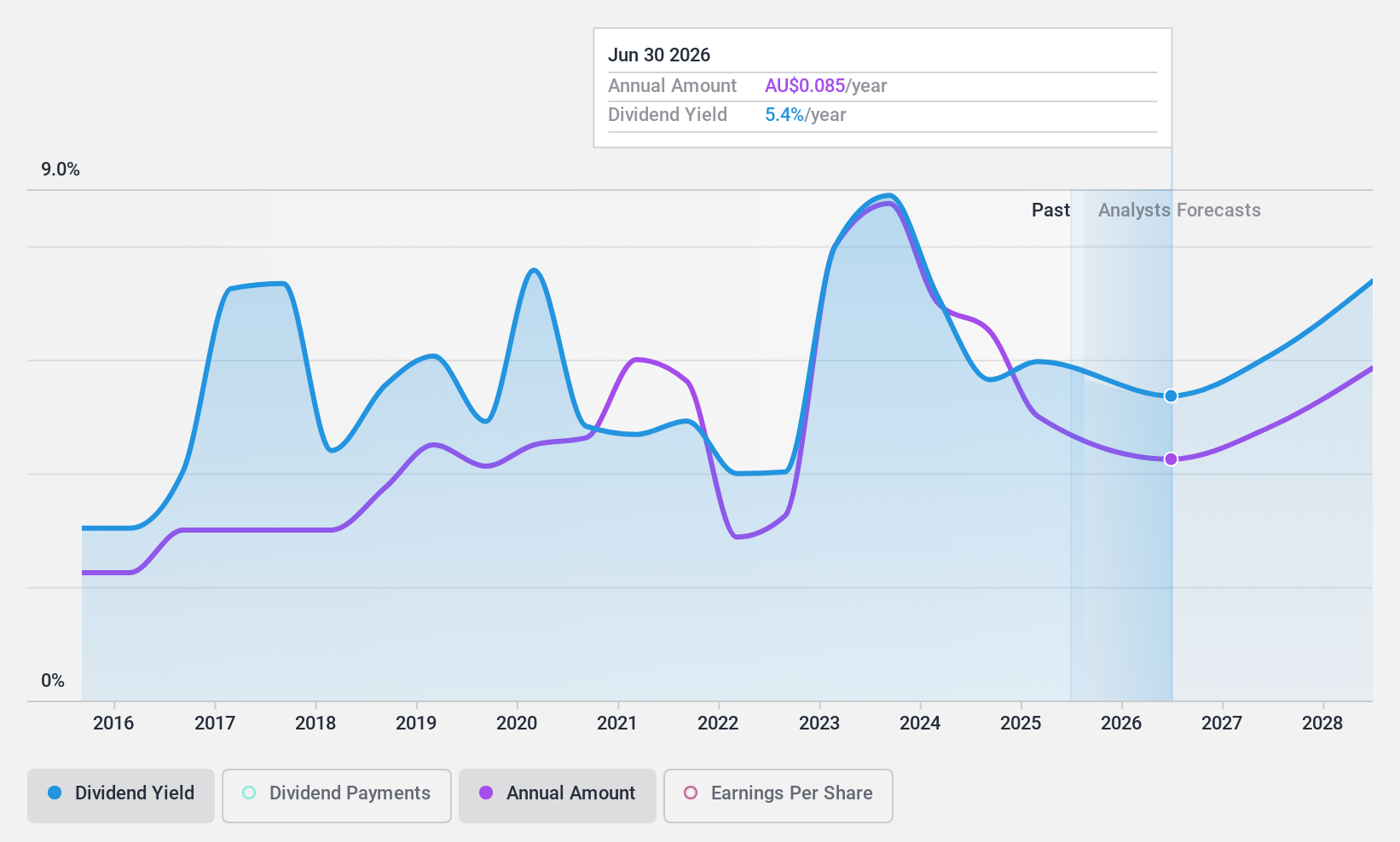

Dividend Yield: 7.3%

IGO offers a dividend yield of 7.31%, positioning it in the top 25% of Australian dividend payers, but its sustainability is concerning due to an exceptionally high payout ratio, indicating dividends are not well covered by earnings despite adequate cash flow coverage. Over the past decade, IGO's dividends have grown yet remain volatile and unreliable. Trading significantly below its estimated fair value, IGO presents potential growth opportunities with forecasted earnings increases.

- Navigate through the intricacies of IGO with our comprehensive dividend report here.

- Our expertly prepared valuation report IGO implies its share price may be lower than expected.

Premier Investments (ASX:PMV)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Premier Investments Limited operates specialty retail fashion chains across Australia, New Zealand, Asia, and Europe with a market cap of A$3.64 billion.

Operations: Premier Investments Limited generates revenue from its retail segment amounting to A$1.61 billion and its investment segment contributing A$208.53 million.

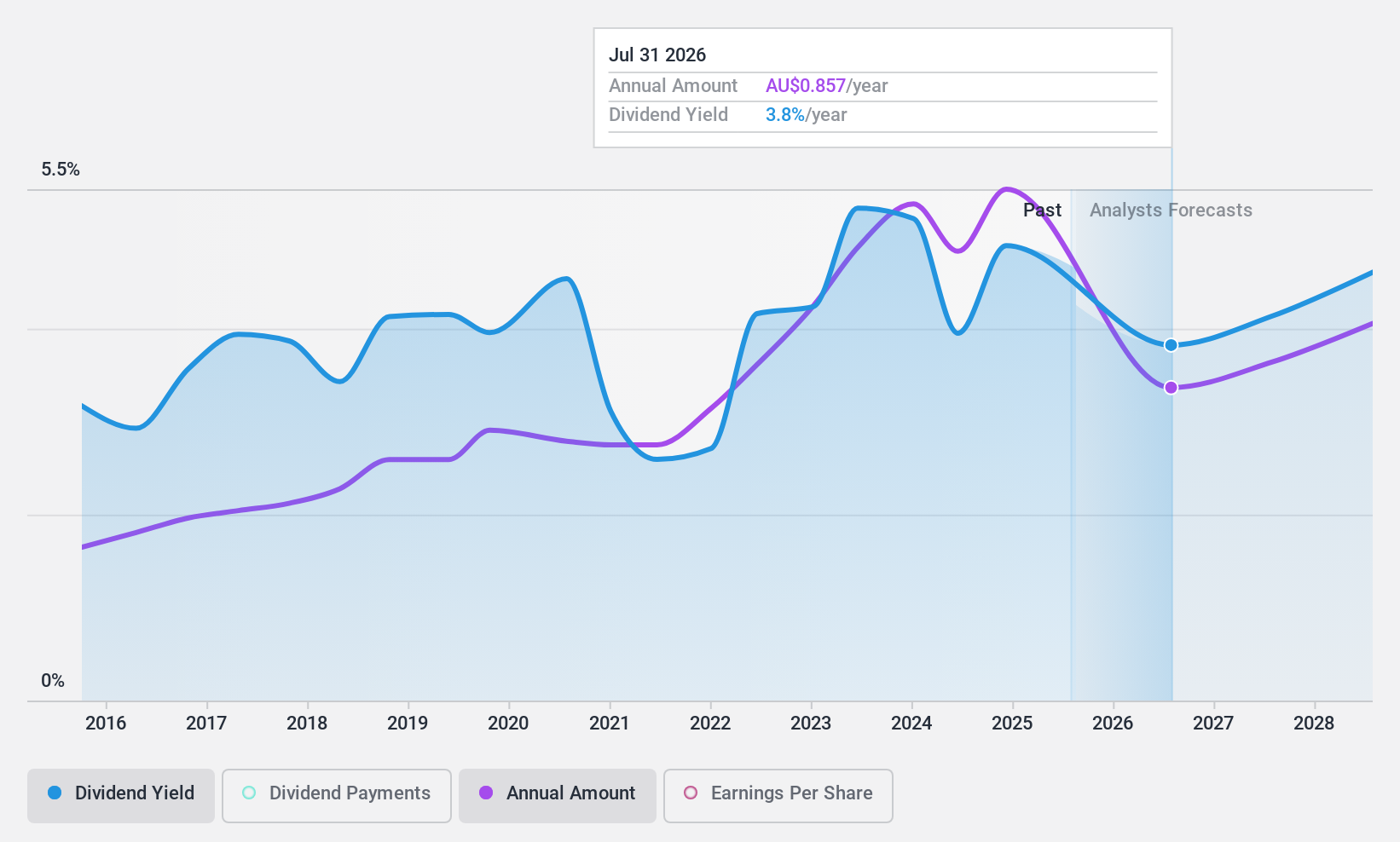

Dividend Yield: 6.1%

Premier Investments provides a stable dividend yield of 6.13%, placing it among the top 25% of Australian dividend payers. Its dividends are well-supported by both earnings and cash flows, with payout ratios of 82.2% and 59.1%, respectively, indicating sustainability. Despite an anticipated decline in earnings over the next three years, Premier's dividends have shown consistent growth and stability over the past decade, while trading at a value below its estimated fair market price.

- Click to explore a detailed breakdown of our findings in Premier Investments' dividend report.

- Our comprehensive valuation report raises the possibility that Premier Investments is priced lower than what may be justified by its financials.

Seize The Opportunity

- Dive into all 30 of the Top ASX Dividend Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IGO

IGO

Operates as an exploration and mining company that engages in discovering, developing, and operating assets focused on metals to enable clean energy in Australia.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives