- Australia

- /

- Metals and Mining

- /

- ASX:IGO

3 ASX Penny Stocks With Market Caps Under A$7B To Watch

Reviewed by Simply Wall St

As the ASX 200 faces a potential dip, influenced by global economic shifts and local developments, investors are closely monitoring market movements. For those exploring opportunities beyond the established giants, penny stocks—despite their somewhat outdated name—continue to offer intriguing possibilities. These smaller or newer companies can present hidden value when backed by strong financials, providing a chance for significant returns in today's complex market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.58 | A$67.99M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.84 | A$235.47M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.01 | A$327.26M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$322.48M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.75 | A$96.8M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.62 | A$793.93M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.64 | A$121.86M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.97 | A$110.79M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.97 | A$490.37M | ★★★★☆☆ |

Click here to see the full list of 1,047 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Harvey Norman Holdings (ASX:HVN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Harvey Norman Holdings Limited operates in the integrated retail, franchise, property, and digital system sectors with a market capitalization of A$6.02 billion.

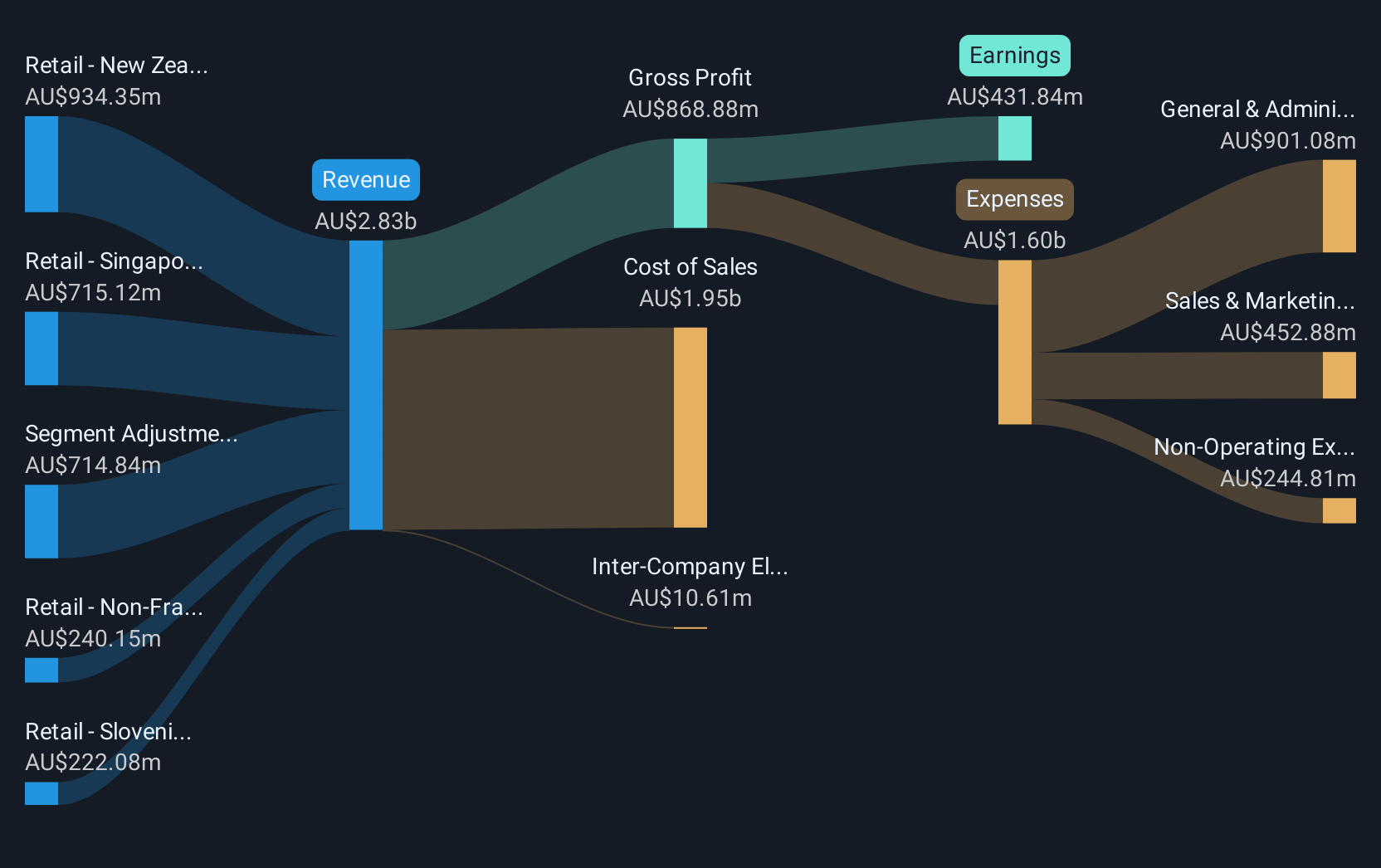

Operations: The company's revenue segments include Retail in New Zealand (A$952.69 million), Slovenia & Croatia (A$215.44 million), Singapore & Malaysia (A$707.72 million), Non-Franchised Retail (A$242.39 million), and Ireland & Northern Ireland (A$693.42 million).

Market Cap: A$6.02B

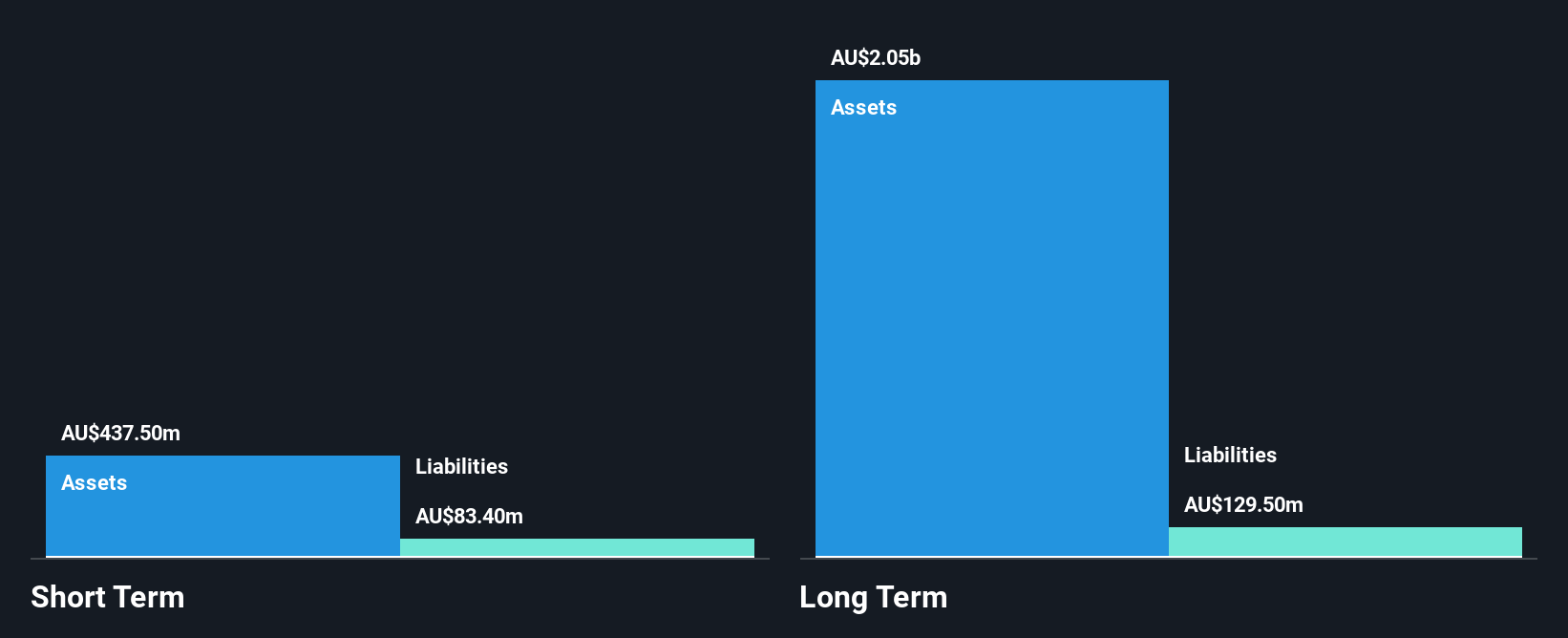

Harvey Norman Holdings, with a market cap of A$6.02 billion, is not typically categorized as a penny stock but offers insights into investment considerations. The company's operating cash flow adequately covers its debt (72.7%), and interest payments are well-covered by EBIT (11.1x). Despite trading at 34.7% below estimated fair value and having high-quality earnings, it faces challenges like declining profit margins and negative earnings growth over the past year (-34.7%). Short-term assets exceed short-term liabilities, though long-term liabilities remain uncovered by short-term assets (A$1.8B vs A$2.6B). Recent events include an extension of its buyback plan until November 2025.

- Jump into the full analysis health report here for a deeper understanding of Harvey Norman Holdings.

- Gain insights into Harvey Norman Holdings' outlook and expected performance with our report on the company's earnings estimates.

IGO (ASX:IGO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IGO Limited is an exploration and mining company in Australia that focuses on discovering, developing, and operating assets related to metals for clean energy, with a market cap of A$3.75 billion.

Operations: The company's revenue is primarily derived from its Nova Operation, which generated A$539.1 million, followed by the Forrestania Operation contributing A$234.8 million, and the Cosmos Project adding A$48.8 million, with additional income from interest revenue amounting to A$18.1 million.

Market Cap: A$3.75B

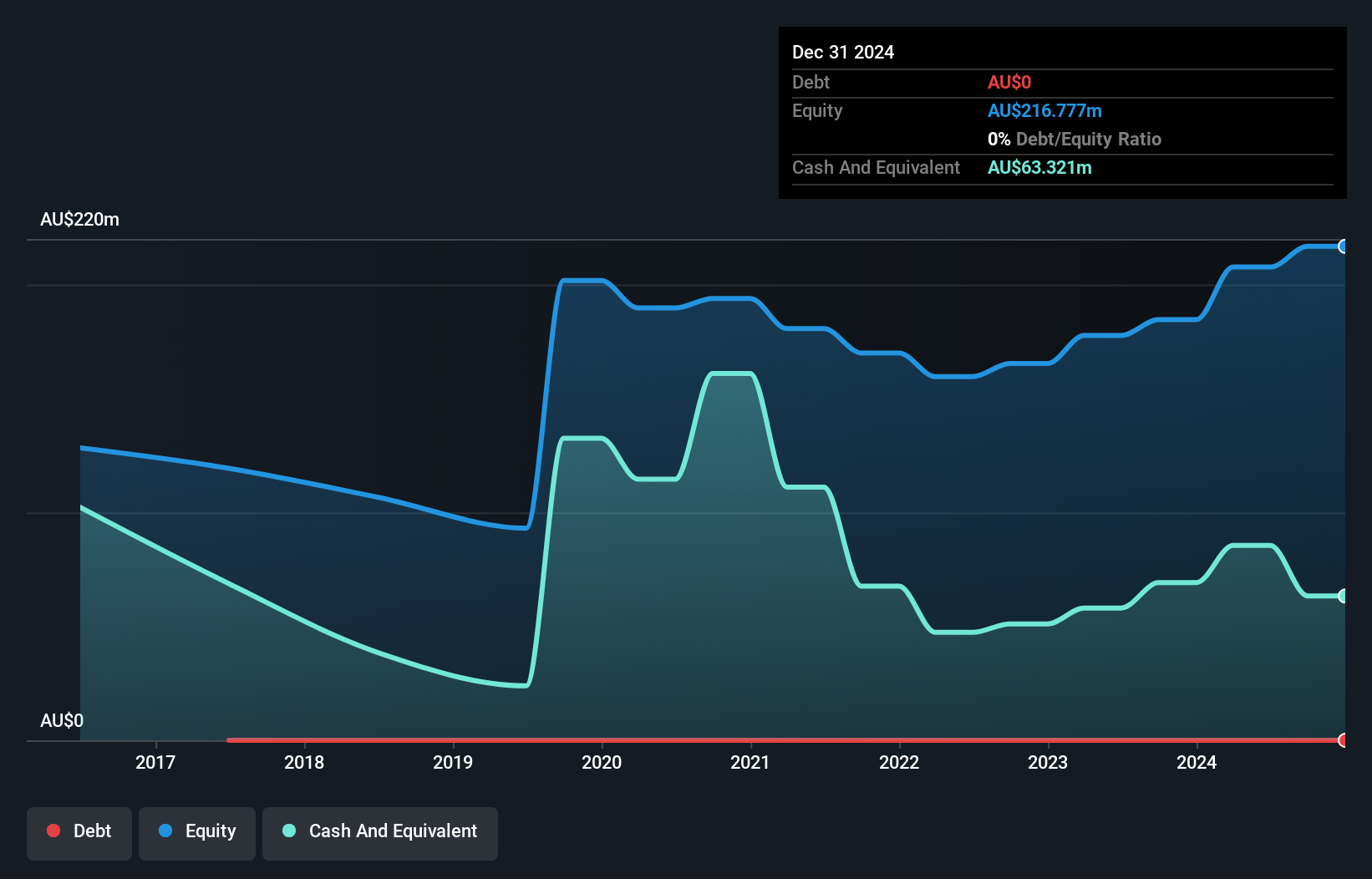

IGO Limited, with a market cap of A$3.75 billion, has seen significant earnings growth over the past five years but faced a substantial one-off loss impacting recent financial results. Despite no debt and strong short-term asset coverage over liabilities, its profit margins have declined sharply from last year. IGO is actively exploring mergers and acquisitions to diversify beyond lithium amidst volatility in that market. Recent developments include potential interest in Rio Tinto's Winu Project, reflecting its strategic focus on copper assets as part of broader efforts to capitalize on clean energy metal demands while navigating complex acquisition landscapes.

- Click here to discover the nuances of IGO with our detailed analytical financial health report.

- Examine IGO's earnings growth report to understand how analysts expect it to perform.

Tyro Payments (ASX:TYR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tyro Payments Limited provides payment solutions to merchants in Australia and has a market cap of approximately A$484.83 million.

Operations: The company generates revenue primarily from its Payments segment, which accounts for A$471.51 million, supplemented by its Banking segment at A$14.73 million.

Market Cap: A$484.83M

Tyro Payments, with a market cap of A$484.83 million, has shown impressive earnings growth of 327.5% over the past year, significantly outpacing the broader Diversified Financial industry. The company is debt-free and maintains strong asset coverage over both short-term (A$188.2M) and long-term liabilities (A$78.4M). Despite a large one-off loss impacting recent results, Tyro's net profit margins have improved to 5.2% from last year's 1.4%. The management team is experienced with an average tenure of 2.2 years, while analysts predict potential stock price appreciation by around 53.7%.

- Unlock comprehensive insights into our analysis of Tyro Payments stock in this financial health report.

- Gain insights into Tyro Payments' future direction by reviewing our growth report.

Make It Happen

- Discover the full array of 1,047 ASX Penny Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IGO

IGO

Operates as an exploration and mining company that engages in discovering, developing, and operating assets focused on metals to enable clean energy in Australia.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives