- Australia

- /

- Metals and Mining

- /

- ASX:HRZ

Why Horizon Minerals' (ASX:HRZ) Earnings Are Better Than They Seem

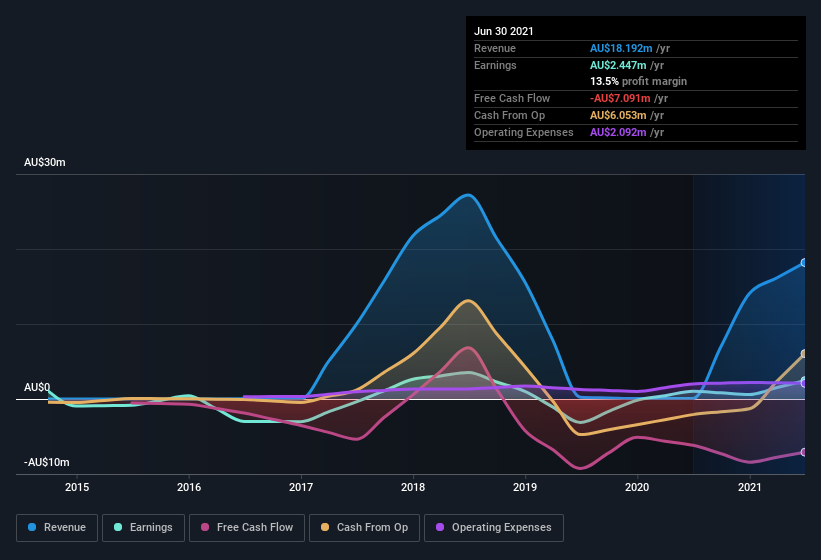

Horizon Minerals Limited (ASX:HRZ) announced a healthy earnings result recently, and the market rewarded it with a strong stock price reaction. This reaction by the market reaction is understandable when looking at headline profits and we have found some further encouraging factors.

View our latest analysis for Horizon Minerals

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. In fact, Horizon Minerals increased the number of shares on issue by 11% over the last twelve months by issuing new shares. That means its earnings are split among a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. Check out Horizon Minerals' historical EPS growth by clicking on this link.

How Is Dilution Impacting Horizon Minerals' Earnings Per Share? (EPS)

As it happens, we don't know how much the company made or lost three years ago, because we don't have the data. The good news is that profit was up 135% in the last twelve months. But EPS was less impressive, up only 87% in that time. So you can see that the dilution has had a bit of an impact on shareholders.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So Horizon Minerals shareholders will want to see that EPS figure continue to increase. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Horizon Minerals.

The Impact Of Unusual Items On Profit

Alongside that dilution, it's also important to note that Horizon Minerals' profit suffered from unusual items, which reduced profit by AU$3.3m in the last twelve months. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's hardly a surprise given these line items are considered unusual. Horizon Minerals took a rather significant hit from unusual items in the year to June 2021. All else being equal, this would likely have the effect of making the statutory profit look worse than its underlying earnings power.

Our Take On Horizon Minerals' Profit Performance

Horizon Minerals suffered from unusual items which depressed its profit in its last report; if that is not repeated then profit should be higher, all else being equal. But unfortunately the dilution means that shareholders now own a smaller proportion of the company (assuming they maintained the same number of shares). That will weigh on earnings per share, even if it is not reflected in net income. Based on these factors, we think that Horizon Minerals' profits are a reasonably conservative guide to its underlying profitability. If you want to do dive deeper into Horizon Minerals, you'd also look into what risks it is currently facing. Case in point: We've spotted 4 warning signs for Horizon Minerals you should be aware of.

Our examination of Horizon Minerals has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you decide to trade Horizon Minerals, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Horizon Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:HRZ

Horizon Minerals

Engages in the exploration, development, and production of gold and other mineral resources in Australia.

Exceptional growth potential and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026