- Australia

- /

- Metals and Mining

- /

- ASX:HMX

ASX Penny Stocks To Watch In October 2024

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has dropped by 1.5%, yet it has risen by 19% over the past year, with earnings forecasted to grow annually by 12%. In such a dynamic market, identifying stocks with strong financial health and growth potential is crucial for investors seeking opportunities beyond well-known companies. Penny stocks, though an outdated term, continue to attract interest as they often represent smaller or newer companies that could offer surprising value and stability.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.61 | A$66.82M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$126.84M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$100.95M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.845 | A$298M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$833.14M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.19 | A$1.1B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$58.82M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.915 | A$115.04M | ★★★★★★ |

Click here to see the full list of 1,031 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Hammer Metals (ASX:HMX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hammer Metals Limited is an Australian company focused on the exploration and extraction of mineral resources, with a market cap of A$35.46 million.

Operations: The company's revenue segment is derived entirely from Australia, amounting to A$0.18 million.

Market Cap: A$35.46M

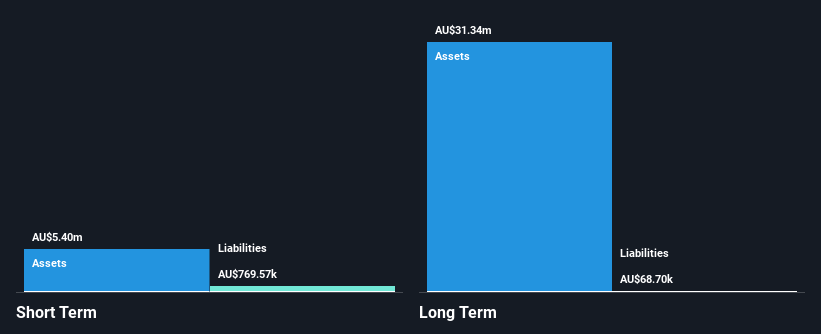

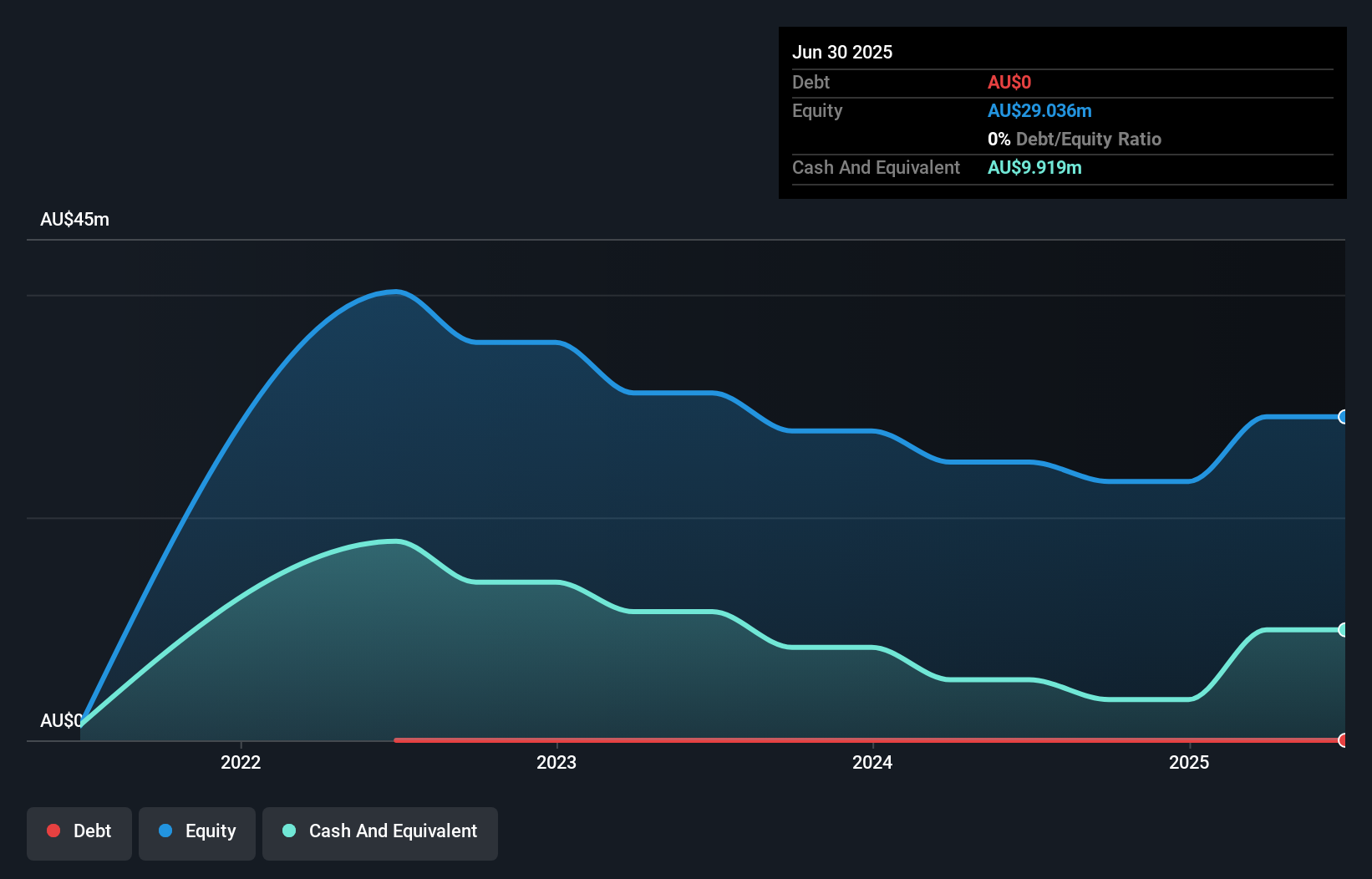

Hammer Metals Limited, with a market cap of A$35.46 million, has transitioned to profitability this year despite being pre-revenue with minimal income of A$0.18 million. The company is debt-free and maintains strong short-term asset coverage over liabilities, indicating solid financial health. Its price-to-earnings ratio of 6.2x suggests potential undervaluation compared to the broader Australian market at 19.6x, though its return on equity remains relatively low at 17.5%. Recent earnings reports show significant improvement, with net income reaching A$6.27 million from a previous loss, reflecting accelerated profit growth and stable volatility levels.

- Unlock comprehensive insights into our analysis of Hammer Metals stock in this financial health report.

- Gain insights into Hammer Metals' historical outcomes by reviewing our past performance report.

LGI (ASX:LGI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: LGI Limited specializes in carbon abatement and renewable energy solutions using biogas from landfill, with a market cap of A$256.66 million.

Operations: The company's revenue is derived from three primary segments: Carbon Abatement (A$14.63 million), Renewable Energy (A$16.15 million), and Infrastructure Construction and Management (A$2.45 million).

Market Cap: A$256.66M

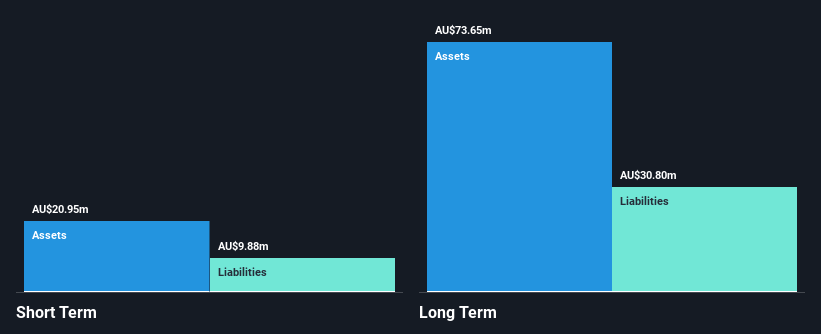

LGI Limited, with a market cap of A$256.66 million, shows a stable financial position in the renewable energy sector. Despite low return on equity at 12.6%, the company maintains solid interest coverage and reduced debt levels, with net debt to equity at 3.2%. Earnings grew modestly by 3.6% last year but have significantly increased by an average of 31.2% annually over five years, although recent growth has slowed compared to its historical pace. The board is experienced; however, management is relatively new with an average tenure of 1.9 years, which could impact strategic continuity moving forward.

- Dive into the specifics of LGI here with our thorough balance sheet health report.

- Gain insights into LGI's future direction by reviewing our growth report.

Southern Palladium (ASX:SPD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Southern Palladium Limited, with a market cap of A$45.32 million, is involved in the exploration and development of platinum group metals through its subsidiaries.

Operations: Southern Palladium Limited has not reported any revenue segments.

Market Cap: A$45.32M

Southern Palladium Limited, with a market cap of A$45.32 million, remains pre-revenue as it focuses on the exploration and development of its 70%-owned Bengwenyama Platinum-Group Metal Project in South Africa. Recent updates highlight significant progress, including a combined Mineral Resource estimate totaling 40.25 Moz after successful drilling campaigns and resource upgrades for both the UG2 and Merensky Reefs. The company benefits from experienced leadership with Roger Baxter's appointment as Executive Chairman, emphasizing governance and strategic relations. Southern Palladium is debt-free with sufficient cash runway exceeding three years but remains unprofitable at this stage.

- Get an in-depth perspective on Southern Palladium's performance by reading our balance sheet health report here.

- Understand Southern Palladium's track record by examining our performance history report.

Key Takeaways

- Click here to access our complete index of 1,031 ASX Penny Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hammer Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:HMX

Hammer Metals

Engages in the exploration and extraction of mineral resources in Australia.

Flawless balance sheet slight.

Market Insights

Community Narratives