- Australia

- /

- Metals and Mining

- /

- ASX:GGP

Greatland Resources (ASX:GGP) Valuation in Focus After Major S&P/ASX Index Additions

Reviewed by Kshitija Bhandaru

Greatland Resources (ASX:GGP) has just been added to a collection of major Australian benchmark indexes, including the S&P/ASX 200, the S&P/ASX 300, and the S&P/ASX All Ordinaries. These index inclusions typically put a company on more investor radars, which may open the door to automatic buying by index-tracking funds and potentially bring more day-to-day liquidity. For investors watching Greatland, this shift marks a meaningful moment that could reshape the way the market values the company.

Over the past month, Greatland Resources has gained serious traction, climbing nearly 38% as news of its upcoming index additions spread. Even so, momentum in the past quarter has moderated, and its gains since the start of the year remain modest. While the headline index news is drawing fresh attention today, the stock’s longer-term pattern hints at shifting risk perceptions and the lure of future growth. Recent financial results also show solid revenue and net income growth, adding further context to stock performance.

After these moves, some may wonder whether Greatland Resources is offering a rare buying opportunity or if the market has already adjusted prices for this new growth story.

Price-to-Earnings of 14.8x: Is it justified?

Based on its price-to-earnings ratio, Greatland Resources currently appears undervalued compared to its peers in the metals and mining sector.

The price-to-earnings (P/E) ratio is a standard valuation measure that compares a company’s share price to its earnings per share. For companies in capital-intensive industries such as mining, the P/E ratio helps investors gauge how much the market is willing to pay today for a dollar of current or future earnings.

In this case, Greatland’s P/E multiple of 14.8x is considerably lower than the peer average of 25.6x and is also below the broader industry average of 18.2x. This suggests the market is currently assigning a discount to Greatland’s prospects, potentially underestimating its improved profitability and growth outlook following its recent index inclusion and financial results.

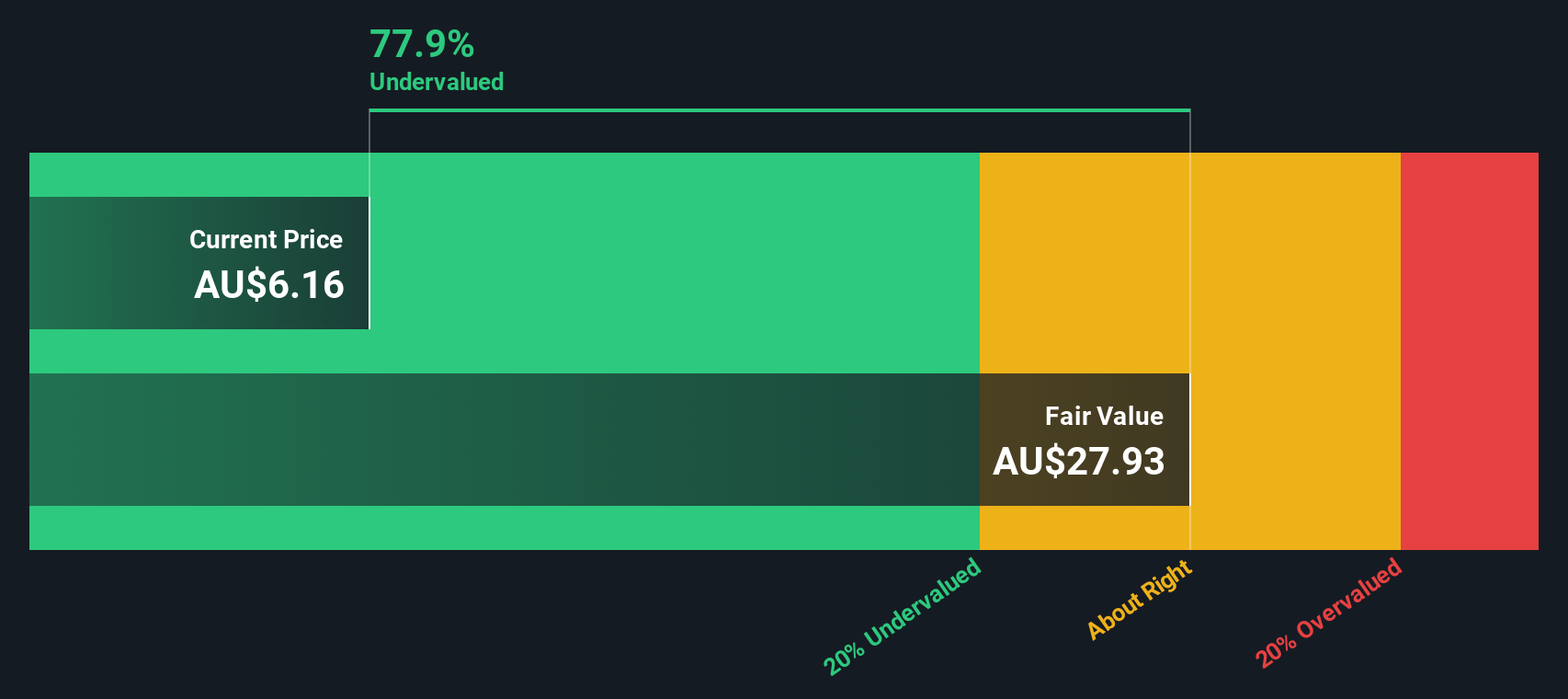

Result: Fair Value of $28.09 (UNDERVALUED)

See our latest analysis for Greatland Resources.However, persistent sector volatility and the possibility of disappointing earnings updates could challenge the optimistic outlook and reduce recent investor enthusiasm.

Find out about the key risks to this Greatland Resources narrative.Another View: Our DCF Model Says Undervalued

Switching gears, the SWS DCF model offers a different lens on Greatland Resources. This approach also suggests the company is undervalued. However, can a cash flow-based estimate capture all the market's moving parts?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Greatland Resources to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Greatland Resources Narrative

Of course, if you see things differently or want a deeper dive into the numbers, you can independently build your interpretation in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Greatland Resources.

Looking for more investment ideas?

Open up more opportunities for growth and smarter investing by checking out these unique stock shortlists, each tailored to fast-moving trends and value-led strategies.

- Boost your portfolio with companies offering steady returns and reliable payouts by using our list of dividend stocks with yields > 3%.

- Spot tomorrow’s tech leaders and ride the AI revolution with our handpicked collection of AI penny stocks.

- Tap into undervalued gems before they draw mainstream attention with our thorough rundown of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GGP

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)