- Australia

- /

- Metals and Mining

- /

- ASX:GGP

Greatland Resources (ASX:GGP): Assessing Valuation After Havieron Feasibility Study Confirms 17-Year Low-Cost Mine Plan

Reviewed by Simply Wall St

Greatland Resources (ASX:GGP) has just locked in a 17 year mine plan at its Havieron gold copper project, confirming a low cost development that leans heavily on nearby Telfer infrastructure.

See our latest analysis for Greatland Resources.

The strong feasibility news lands after a sharp run, with Greatland Resources’ 90 day share price return of 36.08% and year to date share price return of 13.15% signaling building momentum from earlier lows.

If Havieron’s progress has you thinking about where the next big move could come from, now is a smart time to explore fast growing stocks with high insider ownership for other fast growing ideas with committed insiders.

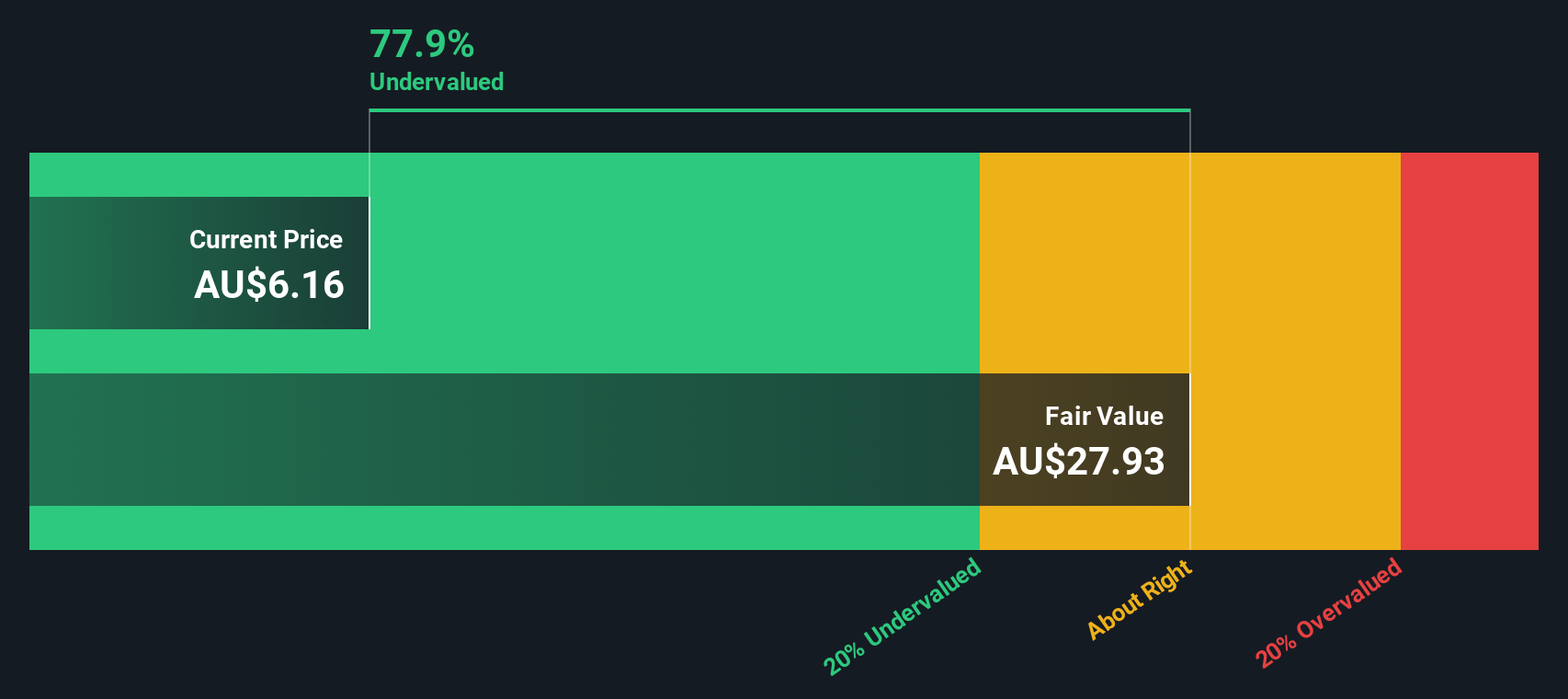

With the feasibility study pointing to a long life, low costs and an intrinsic value almost 50 percent above today’s price, is Greatland still quietly undervalued or already reflecting the next leg of growth?

Price-to-Earnings of 16.4x: Is it justified?

On a last close of A$8.26, Greatland Resources trades on a 16.4x price to earnings ratio that screens as cheaper than many peers.

The price to earnings multiple compares the current share price to per share earnings and is a common yardstick for valuing profitable miners, where profits can swing with commodity cycles. For Greatland Resources, moving into profitability means investors can now benchmark the share price directly against its earnings power.

Relative to the Australian Metals and Mining industry average of 22.6x and a peer average of 29.1x, Greatland Resources’ 16.4x multiple suggests the market is not paying up for its earnings to the same degree as comparable names. When viewed alongside a DCF estimate of fair value at A$16.02, or around 48.5 percent above the current price, that discount indicates investors may still be assigning a conservative view to the company’s long term cash flow potential, even in the context of its recent move into profitability.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 16.4x (UNDERVALUED)

However, investors should weigh execution risk at Havieron and potential commodity price weakness, either of which could delay or diminish the expected earnings uplift.

Find out about the key risks to this Greatland Resources narrative.

Another View: Analyst Targets Paint a Milder Picture

While our valuation work suggests almost 50 percent upside, the analyst price target of A$9.40 implies only about 14 percent above today’s price. That softer upside tempers the underpriced story and raises a key question: is the market or our model being too cautious, or too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Greatland Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 930 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Greatland Resources Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your Greatland Resources research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before the next move in Greatland plays out, steer your research toward fresh opportunities on Simply Wall St’s screener so you are not chasing the market later.

- Explore these 3570 penny stocks with strong financials that combine higher risk with improving fundamentals and the potential for outsized long term gains.

- Consider these 24 AI penny stocks to focus on businesses at the center of automation and data intelligence trends.

- Use these 930 undervalued stocks based on cash flows to identify companies where cash flow strength may not yet be fully reflected in current share prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GGP

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026