Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that First Graphene Limited ( ASX:FGR ) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for First Graphene

How Much Debt Does First Graphene Carry?

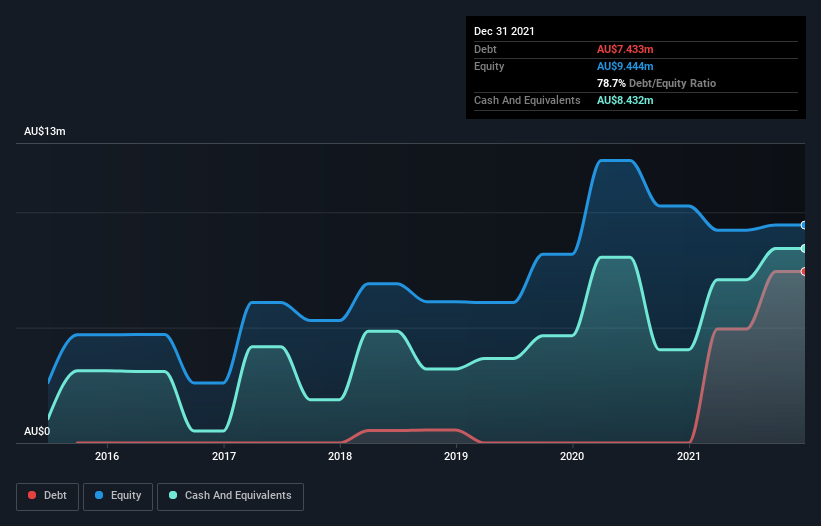

You can click the graphic below for the historical numbers, but it shows that as of December 2021 First Graphene had AU$7.43m of debt, an increase on none, over one year. However, it should be noted that this liability is non-cash in nature and arises from Share Placement Agreement with Specialty Materials Investments LLC.

How Healthy Is First Graphene's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that First Graphene had liabilities of AU$8.18m due within 12 months and no liabilities due beyond that. Owing to the nature of the debt, we understand that it will be covered through the issuance of equity in the company.

The terms of the Share Placement Agreement outline that the Purchase Price is subject to a price floor of $0.16 and if the Purchase Price formla were to result in a purcahse price less than the $0.16, the company may refuse to issue the equity and opt for cash payment instead. In the chance this could eventuate, we still think it's worth monitoring its balance sheet. Simply put, the fact that First Graphene has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is First Graphene's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend .

It seems likely shareholders hope that First Graphene can significantly advance the business plan before too long, because it doesn't have any significant revenue at the moment.

So How Risky Is First Graphene?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months First Graphene lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of AU$7.8m and booked a AU$6.7m accounting loss. While this recent Share Placement Agreement has provided the company with a much needed cash injection, shareholders should be conscious of the dilutive effect it has. With very solid revenue growth in the last year, First Graphene may be on a path to profitability. Pre-profit companies are often risky, but they can also offer great rewards. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 6 warning signs for First Graphene (of which 3 don't sit too well with us!) you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet .

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature.

We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:FGR

First Graphene

Manufactures and sells graphene products in Australia, the United Kingdom, and Sri Lanka.

Excellent balance sheet with moderate risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026