- Australia

- /

- Metals and Mining

- /

- ASX:FFM

How FireFly Metals’ A$85m Equity Raise and Investor Roadshow Will Impact FireFly (ASX:FFM) Investors

Reviewed by Sasha Jovanovic

- In recent weeks, FireFly Metals Ltd completed an A$85,000,000 follow-on equity offering at A$1.70 per share and filed additional equity raises, including a C$30,000,001 common share issue at C$1.56.

- These capital raisings coincided with a series of conference presentations in Sydney, Melbourne and London, broadening FireFly Metals’ visibility among institutional and retail investors.

- We’ll now examine how FireFly Metals’ A$85,000,000 capital raise and heightened conference exposure influence the company’s overall investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is FireFly Metals' Investment Narrative?

To own FireFly Metals, you have to believe its Green Bay copper gold resource can be converted into a viable mine despite zero revenue and continuing losses, and that today’s valuation already reflects much of that risk. The A$85,000,000 raise at A$1.70, plus the C$30,000,001 filing, materially boosts the balance sheet and gives the company more room to keep drilling with six underground rigs and progress studies, which could support key short term catalysts around resource upgrades and potential development decisions. At the same time, the fresh equity adds to dilution in a business still forecast to be unprofitable over the next three years, and recent conference exposure in Sydney, Melbourne and London mainly amplifies that high risk, high reward exploration story rather than changing it.

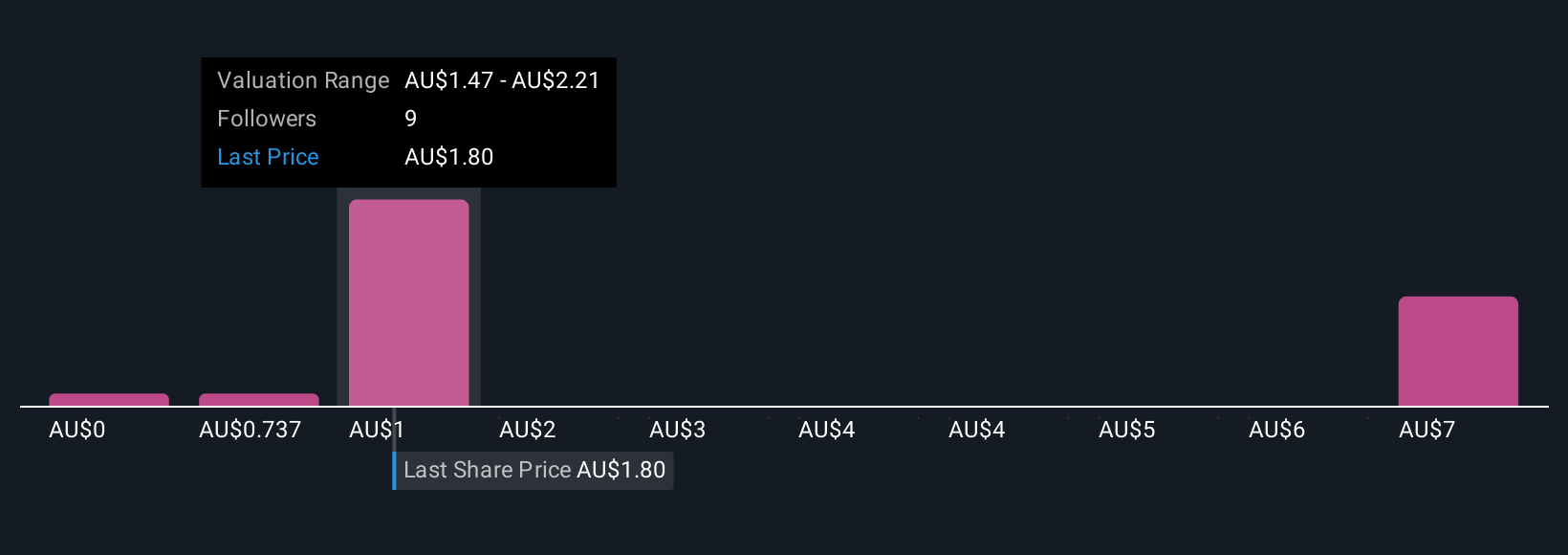

However, there is one funding related risk here that investors should not overlook. The analysis detailed in our FireFly Metals valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

Explore 5 other fair value estimates on FireFly Metals - why the stock might be worth over 4x more than the current price!

Build Your Own FireFly Metals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FireFly Metals research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free FireFly Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FireFly Metals' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FFM

FireFly Metals

Engages in the exploration and evaluation of mineral deposits in Australia and Canada.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026