- Australia

- /

- Metals and Mining

- /

- ASX:ENR

We Think Encounter Resources (ASX:ENR) Can Afford To Drive Business Growth

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So should Encounter Resources (ASX:ENR) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Encounter Resources

Does Encounter Resources Have A Long Cash Runway?

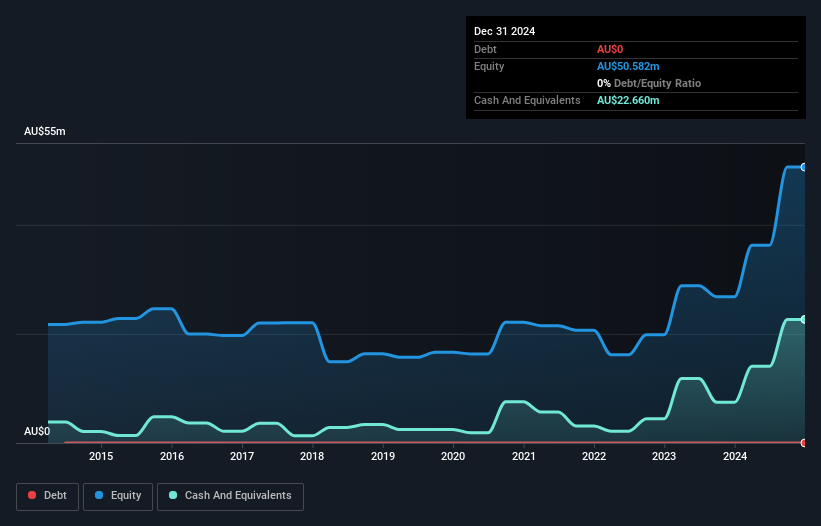

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at December 2024, Encounter Resources had cash of AU$23m and no debt. In the last year, its cash burn was AU$11m. Therefore, from December 2024 it had 2.1 years of cash runway. That's decent, giving the company a couple years to develop its business. The image below shows how its cash balance has been changing over the last few years.

How Is Encounter Resources' Cash Burn Changing Over Time?

Encounter Resources didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. Over the last year its cash burn actually increased by 37%, which suggests that management are increasing investment in future growth, but not too quickly. That's not necessarily a bad thing, but investors should be mindful of the fact that will shorten the cash runway. Admittedly, we're a bit cautious of Encounter Resources due to its lack of significant operating revenues. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

How Hard Would It Be For Encounter Resources To Raise More Cash For Growth?

While Encounter Resources does have a solid cash runway, its cash burn trajectory may have some shareholders thinking ahead to when the company may need to raise more cash. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Encounter Resources' cash burn of AU$11m is about 8.8% of its AU$122m market capitalisation. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

Is Encounter Resources' Cash Burn A Worry?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Encounter Resources' cash burn relative to its market cap was relatively promising. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. On another note, we conducted an in-depth investigation of the company, and identified 4 warning signs for Encounter Resources (2 make us uncomfortable!) that you should be aware of before investing here.

Of course Encounter Resources may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Encounter Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ENR

Encounter Resources

Engages in the mineral exploration, and project generation and development activities in Australia.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026