- Australia

- /

- Metals and Mining

- /

- ASX:EMR

Undiscovered Gems in Australia To Explore This February 2025

Reviewed by Simply Wall St

The Australian market has seen mixed movements recently, with the ASX200 closing flat at 8,484 points as gains in certain sectors were balanced by a sell-off in major players like CSL. Amidst these fluctuations, gold's rise to an all-time high reflects investors' search for stability, while industrials and IT sectors show resilience. In this dynamic environment, identifying promising small-cap stocks involves looking for companies with strong growth potential and innovative strategies that can thrive despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Schaffer | 24.98% | 2.97% | -6.23% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Bailador Technology Investments | NA | 11.17% | 10.16% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| K&S | 16.07% | 0.09% | 33.40% | ★★★★☆☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Emerald Resources (ASX:EMR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market capitalization of A$2.92 billion.

Operations: Emerald Resources primarily generates revenue from mine operations, amounting to A$366.04 million. The company's financial focus is on this segment, contributing the majority of its income stream.

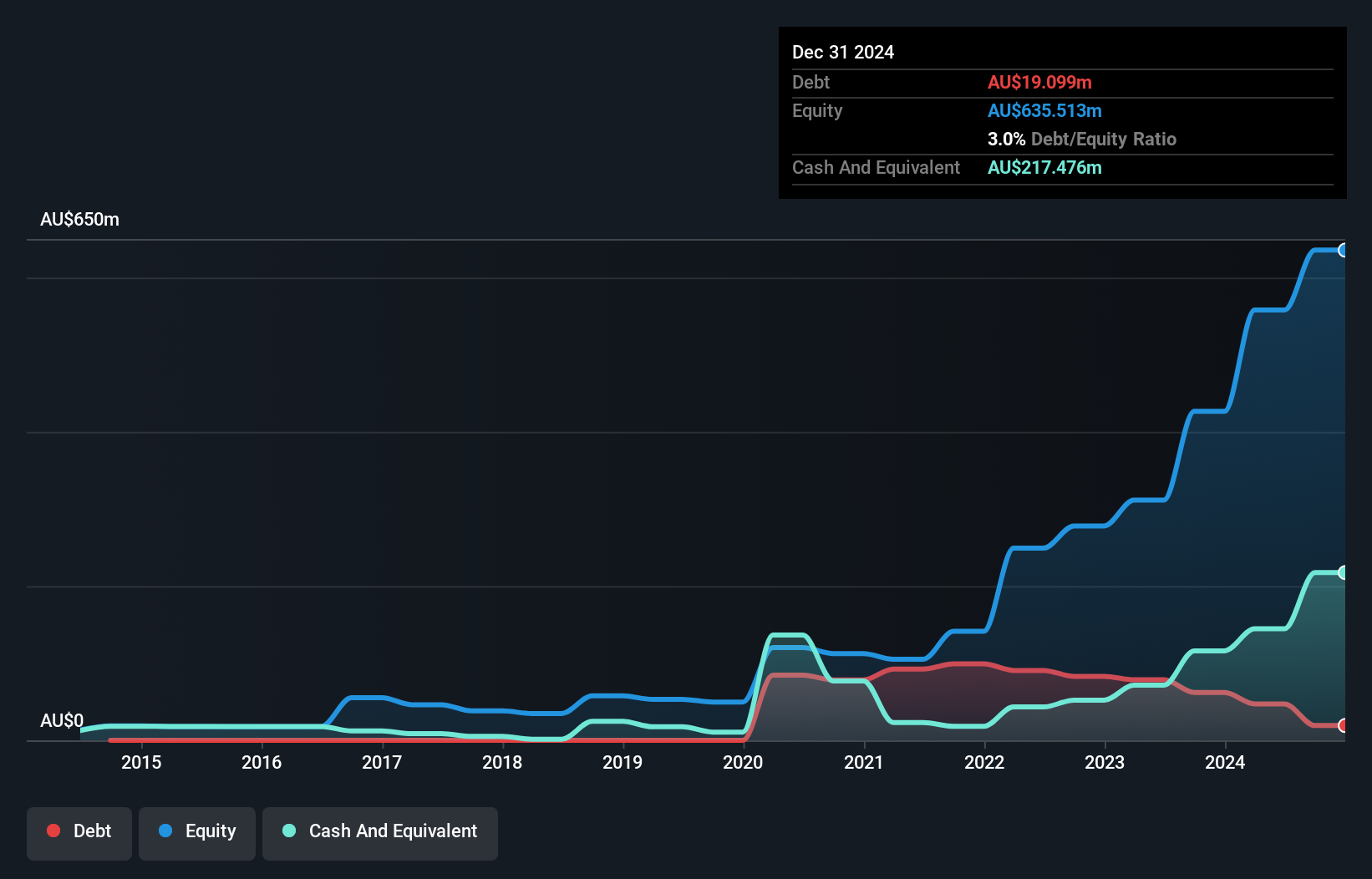

Emerald Resources, a promising player in the mining sector, has shown impressive growth with earnings surging 41.9% over the past year, outpacing the industry average of 0.7%. The company trades at a substantial discount of 56.5% below its estimated fair value, making it an attractive proposition for value seekers. Recent operational enhancements at Okvau Gold Mine have led to record gold production of 31,888 ounces in Q4 2024, surpassing guidance and boosting cash and bullion reserves to A$243 million (US$151 million). With debt well-covered by EBIT at 18.6x interest payments and more cash than total debt, Emerald's financial health appears robust.

- Dive into the specifics of Emerald Resources here with our thorough health report.

Examine Emerald Resources' past performance report to understand how it has performed in the past.

IPD Group (ASX:IPG)

Simply Wall St Value Rating: ★★★★★☆

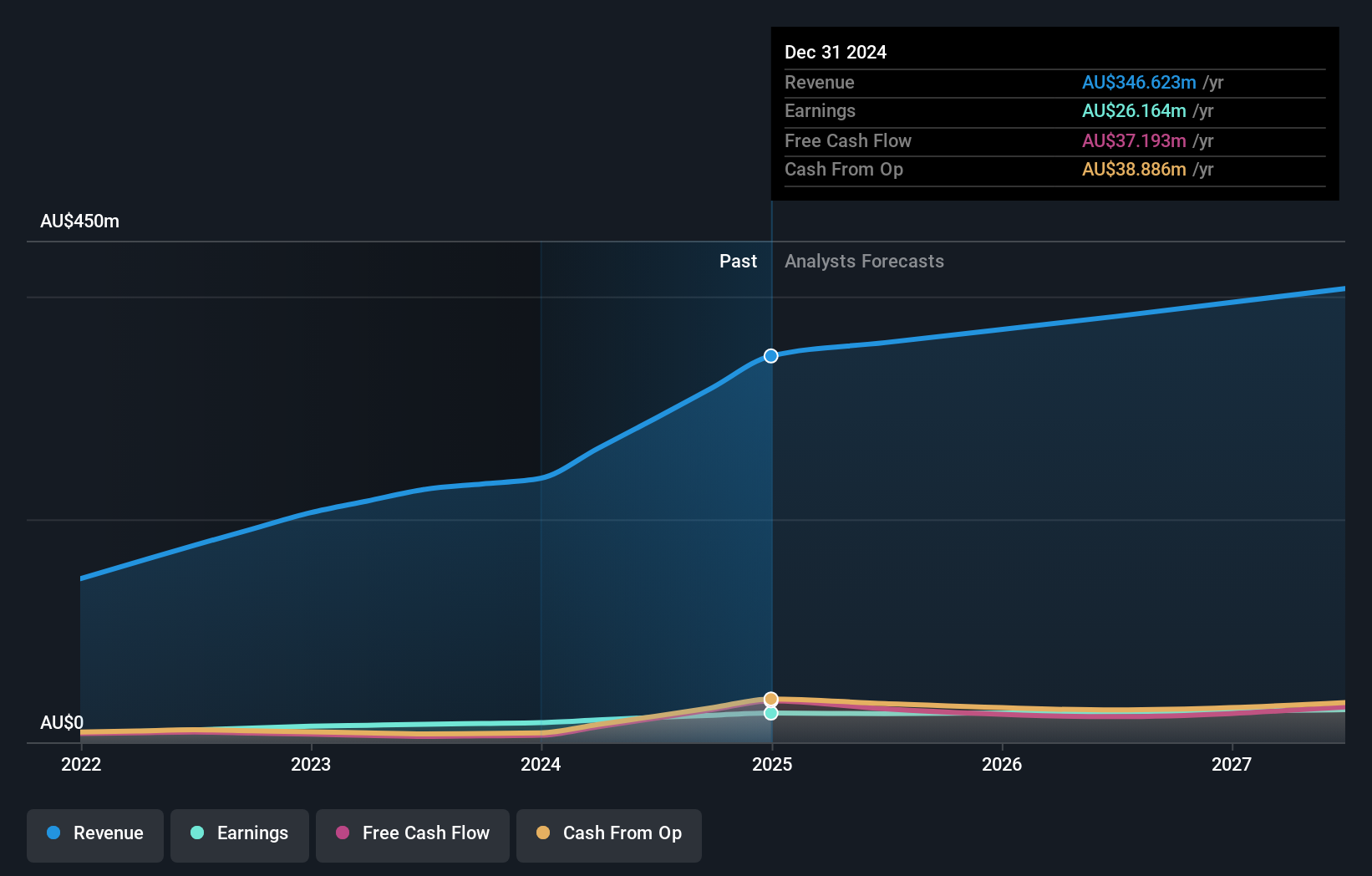

Overview: IPD Group Limited is an Australian company that specializes in the distribution of electrical infrastructure and has a market capitalization of A$451.07 million.

Operations: IPD Group generates revenue primarily through its Products Division, which accounts for A$270.68 million, while the Services Division contributes A$19.74 million. The company's cost structure and financial performance are reflected in its net profit margin, providing insights into profitability trends over time.

IPD Group, a relatively small player in the trade distributors sector, has demonstrated impressive earnings growth of 39% over the past year, outpacing its industry peers. The company's net debt to equity ratio stands at a satisfactory 5.8%, indicating prudent financial management. With interest payments well-covered by EBIT at 46.8 times, IPD's financial health seems robust. The price-to-earnings ratio of 20.2x suggests it is valued attractively compared to the industry average of 24.8x. Looking ahead, IPD forecasts EBIT between A$19 million and A$19.8 million for the upcoming half-year, with revenue expected to surpass previous periods significantly.

Tasmea (ASX:TEA)

Simply Wall St Value Rating: ★★★★★★

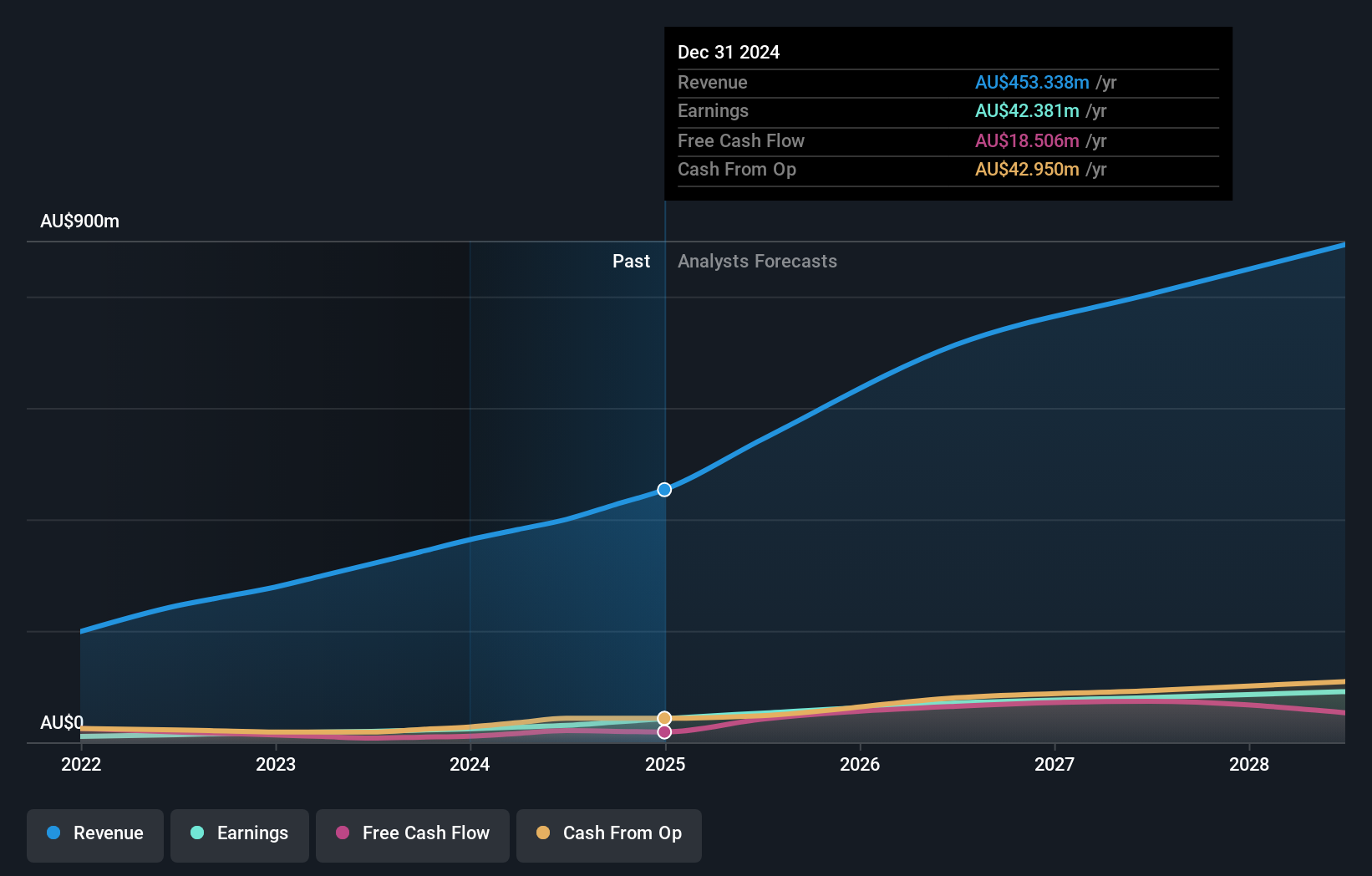

Overview: Tasmea Limited offers shutdown, maintenance, emergency breakdown, and capital upgrade services in Australia with a market capitalization of A$763.41 million.

Operations: Tasmea generates revenue primarily from Mechanical Services (A$141.42 million) and Electrical Services (A$129.44 million), followed by Water & Fluid, Civil, and Corporate Services.

Tasmea, a nimble player in the construction sector, has been making waves with its robust earnings growth of 57.1% over the past year, outpacing industry averages. This performance is bolstered by a significant reduction in its debt to equity ratio from 168.5% to 44.4% over five years, indicating prudent financial management and satisfactory net debt levels at 25.3%. With EBIT covering interest payments twelve times over, Tasmea demonstrates strong operational efficiency. The recent addition of Trent Northover as Executive Director is likely to enhance strategic direction and support ongoing organic growth initiatives for this promising company.

- Click to explore a detailed breakdown of our findings in Tasmea's health report.

Explore historical data to track Tasmea's performance over time in our Past section.

Where To Now?

- Unlock our comprehensive list of 49 ASX Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Emerald Resources, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Emerald Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EMR

Emerald Resources

Engages in the exploration and development of mineral reserves in Cambodia and Australia.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives