- Australia

- /

- Metals and Mining

- /

- ASX:EMR

Undiscovered Gems in Australia to Explore This August 2024

Reviewed by Simply Wall St

The Australian market has shown impressive resilience, rising 2.1% over the last week and climbing 11% in the past year, with earnings forecasted to grow by 13% annually. In this favorable environment, identifying promising yet overlooked stocks can offer unique opportunities for investors seeking growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Schaffer | 24.98% | 2.97% | -6.23% | ★★★★★★ |

| Plato Income Maximiser | NA | 11.43% | 14.26% | ★★★★★★ |

| Sugar Terminals | NA | 2.34% | 2.64% | ★★★★★★ |

| SKS Technologies Group | NA | 34.68% | 47.39% | ★★★★★★ |

| Hearts and Minds Investments | NA | 18.39% | -3.93% | ★★★★★★ |

| Lycopodium | 0.23% | 17.36% | 33.85% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Boart Longyear Group | 71.20% | 9.71% | 39.19% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

DroneShield (ASX:DRO)

Simply Wall St Value Rating: ★★★★★★

Overview: DroneShield Limited develops, commercializes, and sells hardware and software technology for drone detection and security in Australia and the United States, with a market cap of A$1.03 billion.

Operations: DroneShield Limited generates revenue primarily from its Aerospace & Defense segment, amounting to A$55.08 million. The company focuses on developing and selling drone detection and security technology in Australia and the United States.

DroneShield, an emerging player in the Aerospace & Defense sector, has recently turned profitable and is debt-free. Despite a highly volatile share price over the past three months, earnings are forecasted to grow 40.21% annually. The company completed a follow-on equity offering of A$120 million in August 2024, issuing 104.35 million shares at A$1.15 each. Shareholders have faced dilution this year but can expect high-quality earnings moving forward as DroneShield continues to expand its market presence.

- Dive into the specifics of DroneShield here with our thorough health report.

Review our historical performance report to gain insights into DroneShield's's past performance.

Emerald Resources (ASX:EMR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emerald Resources NL focuses on the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.66 billion.

Operations: Emerald Resources NL generates revenue primarily from mine operations, which amounted to A$339.32 million.

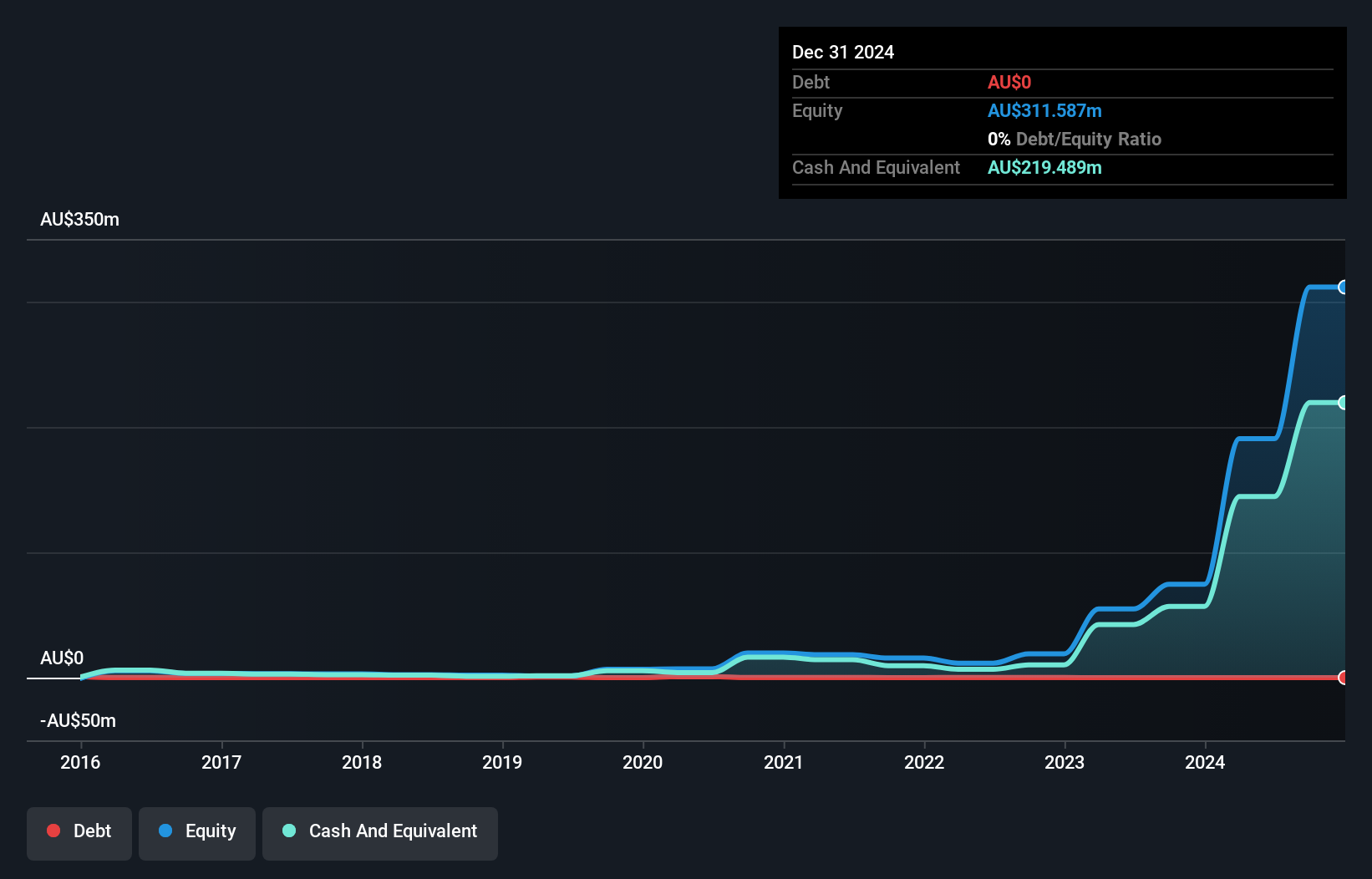

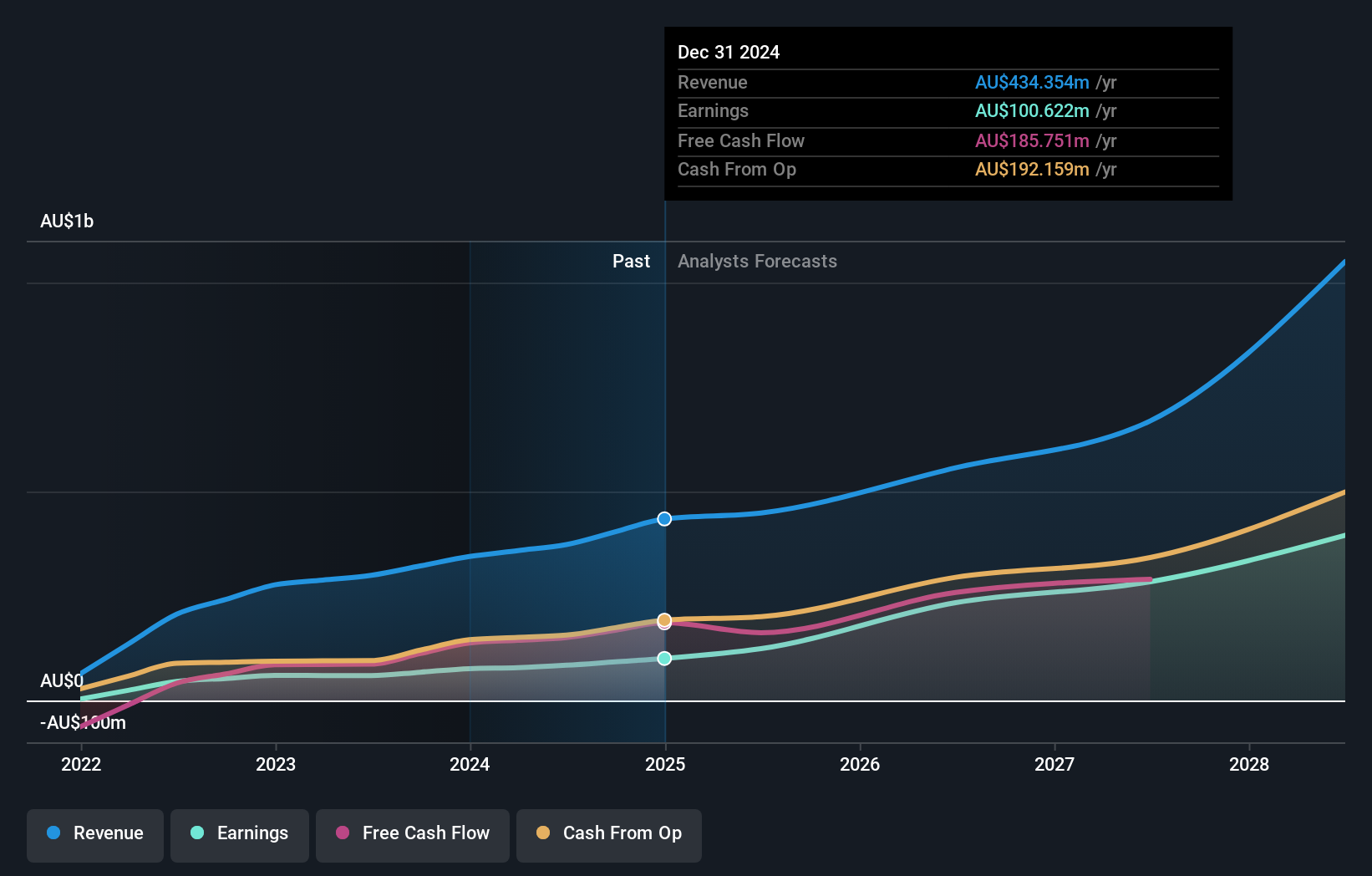

Emerald Resources, a small player in the Australian mining sector, is trading at 56.3% below its estimated fair value. The company’s earnings grew by 53.4% over the past year, outperforming the industry average of -13.4%. With EBIT covering interest payments 14 times over and a debt-to-equity ratio rising from 0% to 14.5% in five years, it shows financial robustness. Additionally, Emerald has high-quality earnings and positive free cash flow projections for future growth.

- Navigate through the intricacies of Emerald Resources with our comprehensive health report here.

Explore historical data to track Emerald Resources' performance over time in our Past section.

Westgold Resources (ASX:WGX)

Simply Wall St Value Rating: ★★★★★★

Overview: Westgold Resources Limited engages in the exploration, operation, development, mining, and treatment of gold assets primarily in Western Australia and has a market cap of A$2.90 billion.

Operations: Westgold Resources generates revenue primarily from its Bryah and Murchison segments, contributing A$153.05 million and A$537.63 million respectively.

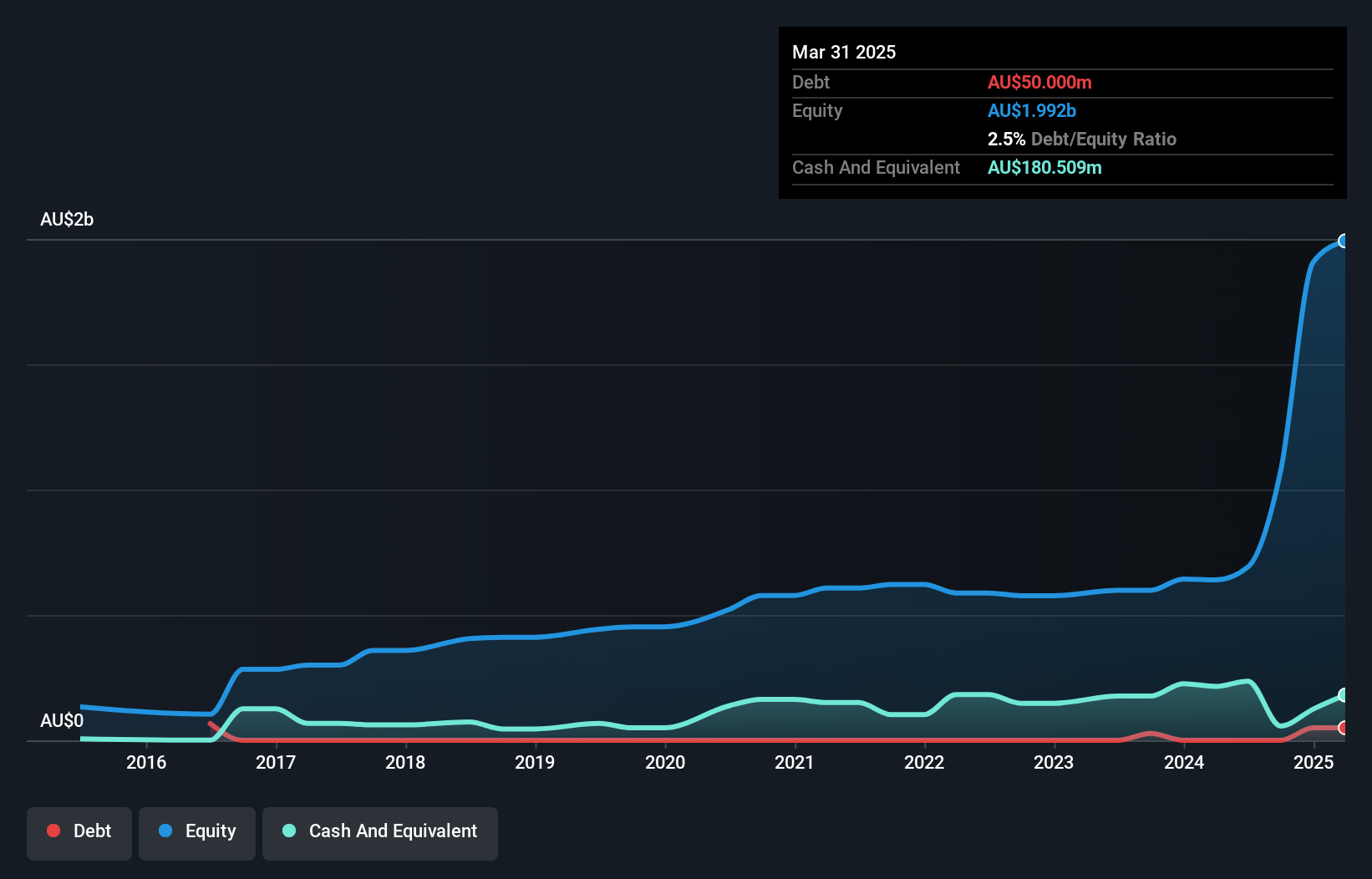

Westgold Resources, a promising player in the Australian mining sector, has seen significant developments recently. The company reported earnings of A$44.07 million for the nine months ending March 2024, a notable turnaround from the previous year's net loss of A$7.05 million. Additionally, Westgold's Beta Hunt mine has shown impressive drill results with intersections such as 4m at 22.45g/t Au and 15m at 3.07g/t Au, indicating substantial gold potential. The merger with Karora Resources and subsequent board appointments further strengthen its strategic position in the industry.

- Unlock comprehensive insights into our analysis of Westgold Resources stock in this health report.

Evaluate Westgold Resources' historical performance by accessing our past performance report.

Summing It All Up

- Click here to access our complete index of 52 ASX Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emerald Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EMR

Emerald Resources

Engages in the exploration and development of mineral reserves in Cambodia and Australia.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives