- Australia

- /

- Metals and Mining

- /

- ASX:EMR

Undiscovered Gems in Australia to Explore in May 2025

Reviewed by Simply Wall St

As the ASX200 opens slightly lower despite strong performances on Wall Street, the focus turns to smaller companies that may offer unique opportunities in Australia's dynamic market. In this environment, identifying promising small-cap stocks with solid fundamentals and growth potential can be key for investors looking to uncover hidden gems amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| MFF Capital Investments | 0.69% | 28.52% | 31.31% | ★★★★★☆ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| Carlton Investments | 0.02% | 4.45% | 3.97% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Emerald Resources (ASX:EMR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emerald Resources NL focuses on the exploration and development of mineral reserves in Cambodia and Australia, with a market capitalization of A$2.71 billion.

Operations: Emerald Resources generates revenue primarily from mine operations, totaling A$427.32 million. The company does not include "Other" segments in its primary revenue stream analysis.

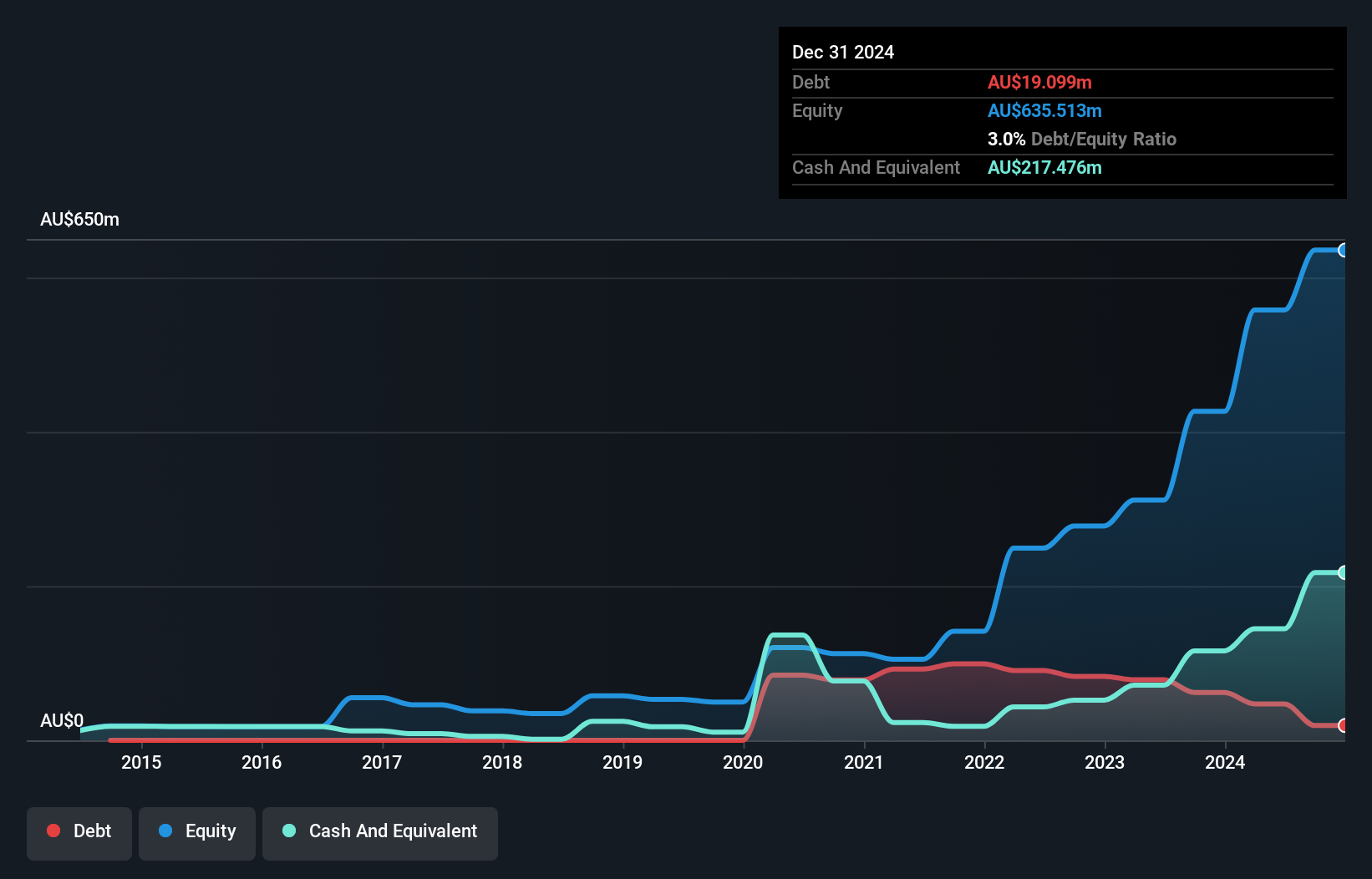

Emerald Resources, an emerging player in the mining sector, showcases impressive financial health with earnings surging 32.2% last year, outpacing the industry average of 2%. The company reported A$239.73 million in sales for the half-year ending December 2024, up from A$176.75 million a year prior. Net income climbed to A$59.67 million from A$43.31 million previously, reflecting high-quality earnings and strong operational performance. With interest payments well covered by EBIT at a ratio of 29.7 times and trading significantly below estimated fair value (90%), Emerald Resources appears poised for continued growth in its field.

- Unlock comprehensive insights into our analysis of Emerald Resources stock in this health report.

Evaluate Emerald Resources' historical performance by accessing our past performance report.

K&S (ASX:KSC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: K&S Corporation Limited operates in the transportation and logistics, warehousing, and fuel distribution sectors across Australia and New Zealand with a market capitalization of A$481.71 million.

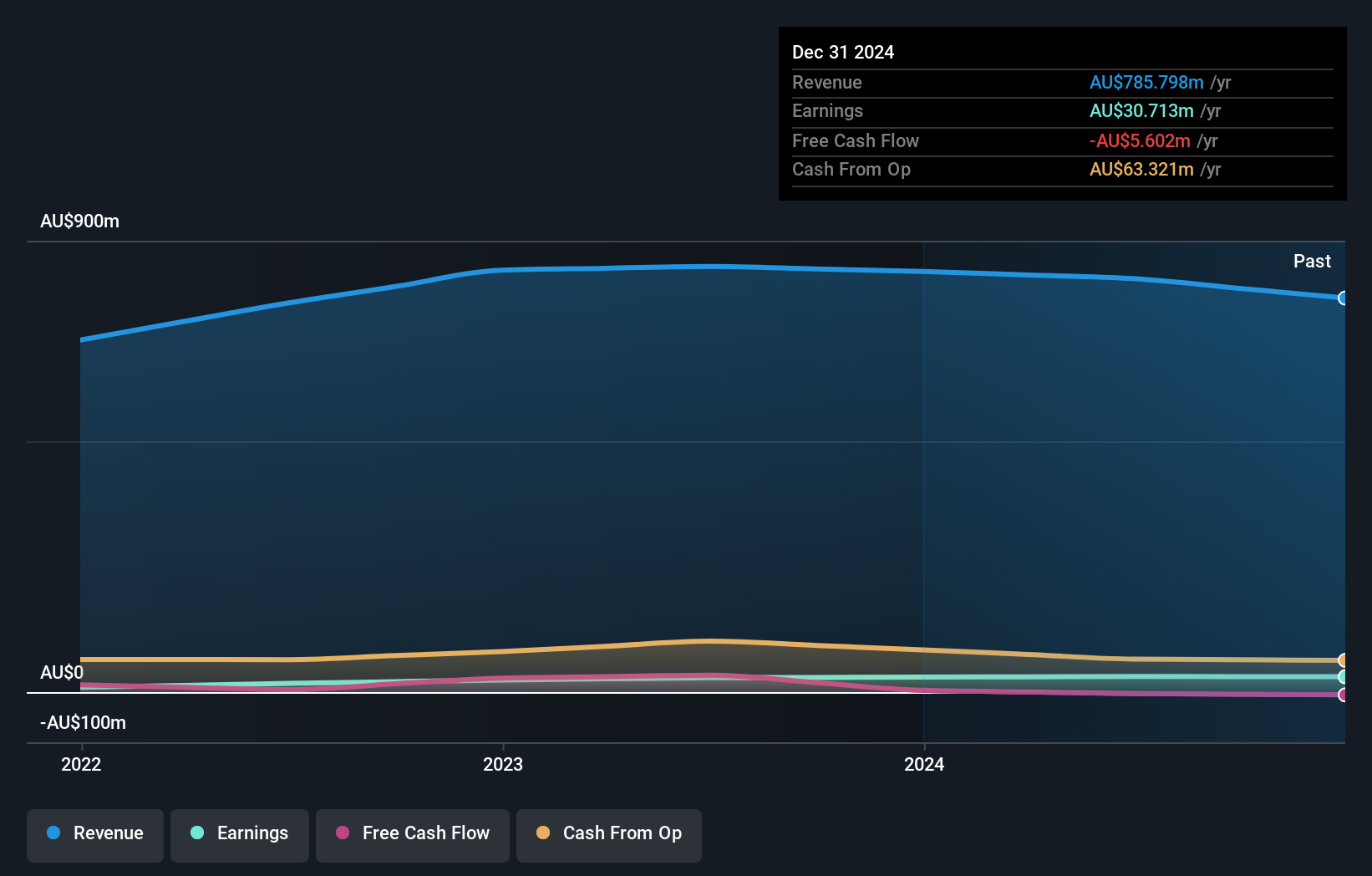

Operations: K&S Corporation Limited generates revenue primarily from its Australian Transport segment, contributing A$553.12 million, followed by Fuel at A$213.29 million and New Zealand Transport at A$74.99 million.

K&S Corporation, a smaller player in the logistics sector, has shown resilience with earnings growing 25.5% annually over the past five years. Despite a rise in its debt to equity ratio from 9.9% to 20.2%, it remains satisfactory at 12.7%. The company's interest payments are well covered by EBIT at 9.5 times, indicating strong financial health despite not being free cash flow positive recently. Trading slightly below fair value and having initiated a share repurchase program at A$3.60 per share, K&S seems focused on enhancing shareholder value amidst fluctuating sales and revenue figures in recent reports.

- Click here to discover the nuances of K&S with our detailed analytical health report.

Examine K&S' past performance report to understand how it has performed in the past.

Servcorp (ASX:SRV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Servcorp Limited offers executive serviced and virtual offices, coworking spaces, and various IT, communications, and secretarial services with a market capitalization of A$496.40 million.

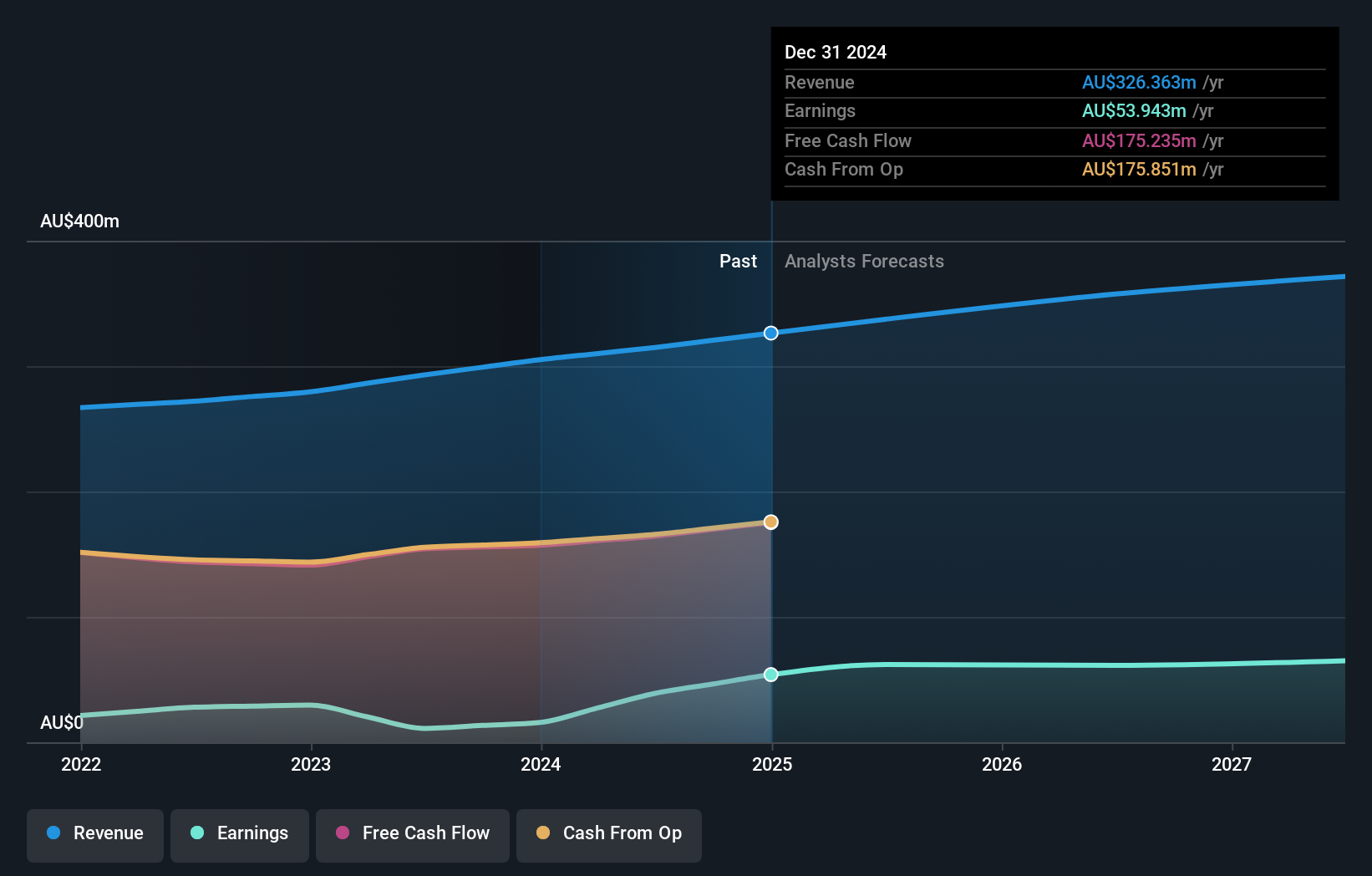

Operations: Revenue primarily stems from real estate rental, amounting to A$326.36 million.

Servcorp, a nimble player in the Australian market, showcases impressive earnings growth of 241.2% over the past year, outpacing its real estate peers. With net income jumping to A$34.55 million from A$19.6 million and basic EPS rising to A$0.351 from A$0.202, it's clear that this company is on a strong trajectory. Trading at 84.9% below estimated fair value and being debt-free further enhances its appeal as an investment opportunity with high-quality earnings and positive free cash flow supporting its financial health and future prospects in a competitive industry landscape.

- Delve into the full analysis health report here for a deeper understanding of Servcorp.

Understand Servcorp's track record by examining our Past report.

Key Takeaways

- Explore the 51 names from our ASX Undiscovered Gems With Strong Fundamentals screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emerald Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EMR

Emerald Resources

Engages in the exploration and development of mineral reserves in Cambodia and Australia.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives