As Australian markets anticipate a modest 0.17% gain, investors are keeping a close eye on global developments and local economic indicators, such as the RBA's recent decisions and their implications for trade with China. In this context, penny stocks—though an older term—remain relevant as they offer potential growth opportunities in smaller or newer companies. With strong financial foundations, these stocks can present surprising value and stability; we'll explore several that stand out for their financial strength.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lindsay Australia (ASX:LAU) | A$0.69 | A$218.85M | ✅ 4 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.80 | A$144.98M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.905 | A$1.15B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.56 | A$73.59M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.57 | A$396.25M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.605 | A$115.6M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.57 | A$169.4M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.16 | A$726.11M | ✅ 4 ⚠️ 4 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.725 | A$845.39M | ✅ 5 ⚠️ 3 View Analysis > |

| Tasmea (ASX:TEA) | A$2.90 | A$673.74M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 998 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Centaurus Metals (ASX:CTM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Centaurus Metals Limited is an exploration and evaluation company focused on mineral resource properties in Brazil, with a market cap of A$191.23 million.

Operations: Centaurus Metals Limited has not reported any specific revenue segments.

Market Cap: A$191.23M

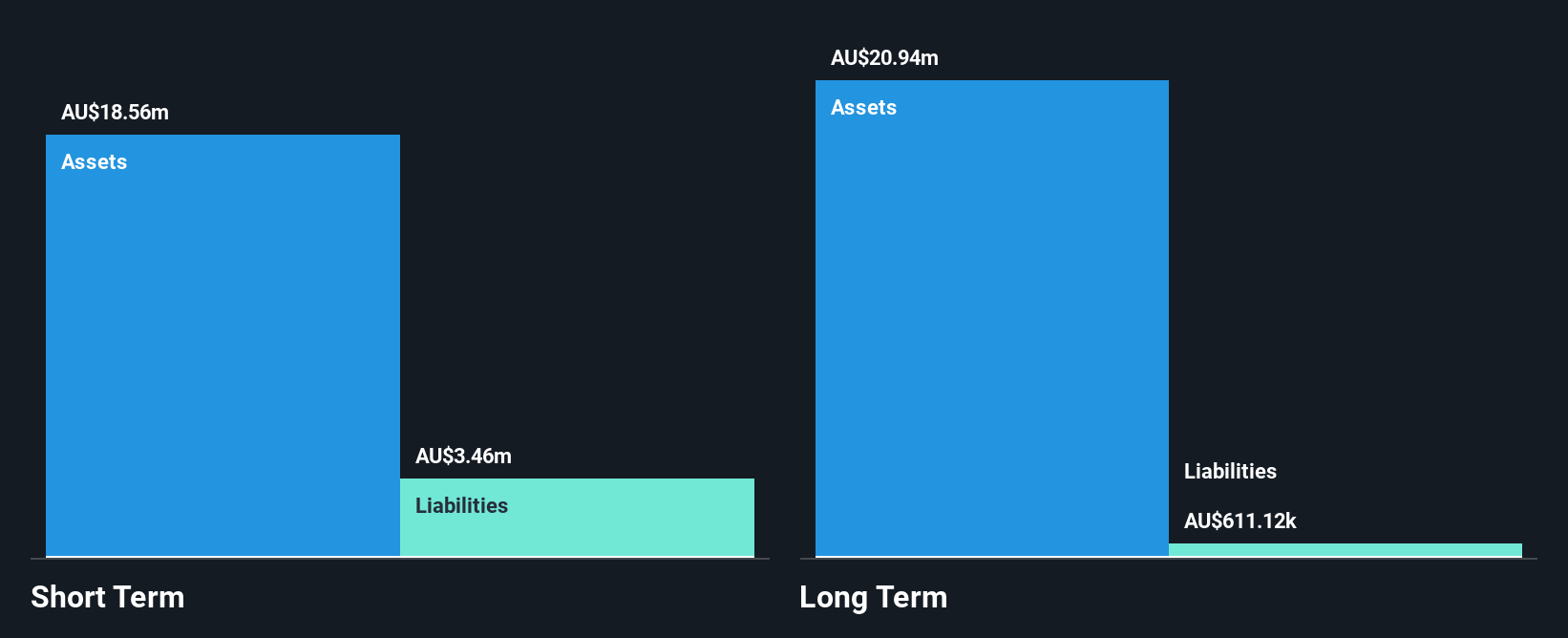

Centaurus Metals Limited, with a market cap of A$191.23 million, is a pre-revenue exploration company focused on mineral resources in Brazil. Despite being unprofitable and not expected to achieve profitability within the next three years, the company has shown some improvement by reducing its net loss from A$40.74 million to A$18.45 million over the past year. It boasts a seasoned management team and board, with short-term assets of A$18.6 million comfortably covering both short-term and long-term liabilities. The company remains debt-free but has only 1.1 years of cash runway if current cash flow trends persist.

- Take a closer look at Centaurus Metals' potential here in our financial health report.

- Gain insights into Centaurus Metals' future direction by reviewing our growth report.

Nuix (ASX:NXL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nuix Limited offers investigative analytics and intelligence software solutions across various regions including Asia Pacific, the Americas, Europe, the Middle East, and Africa, with a market cap of A$806.99 million.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to A$227.37 million.

Market Cap: A$806.99M

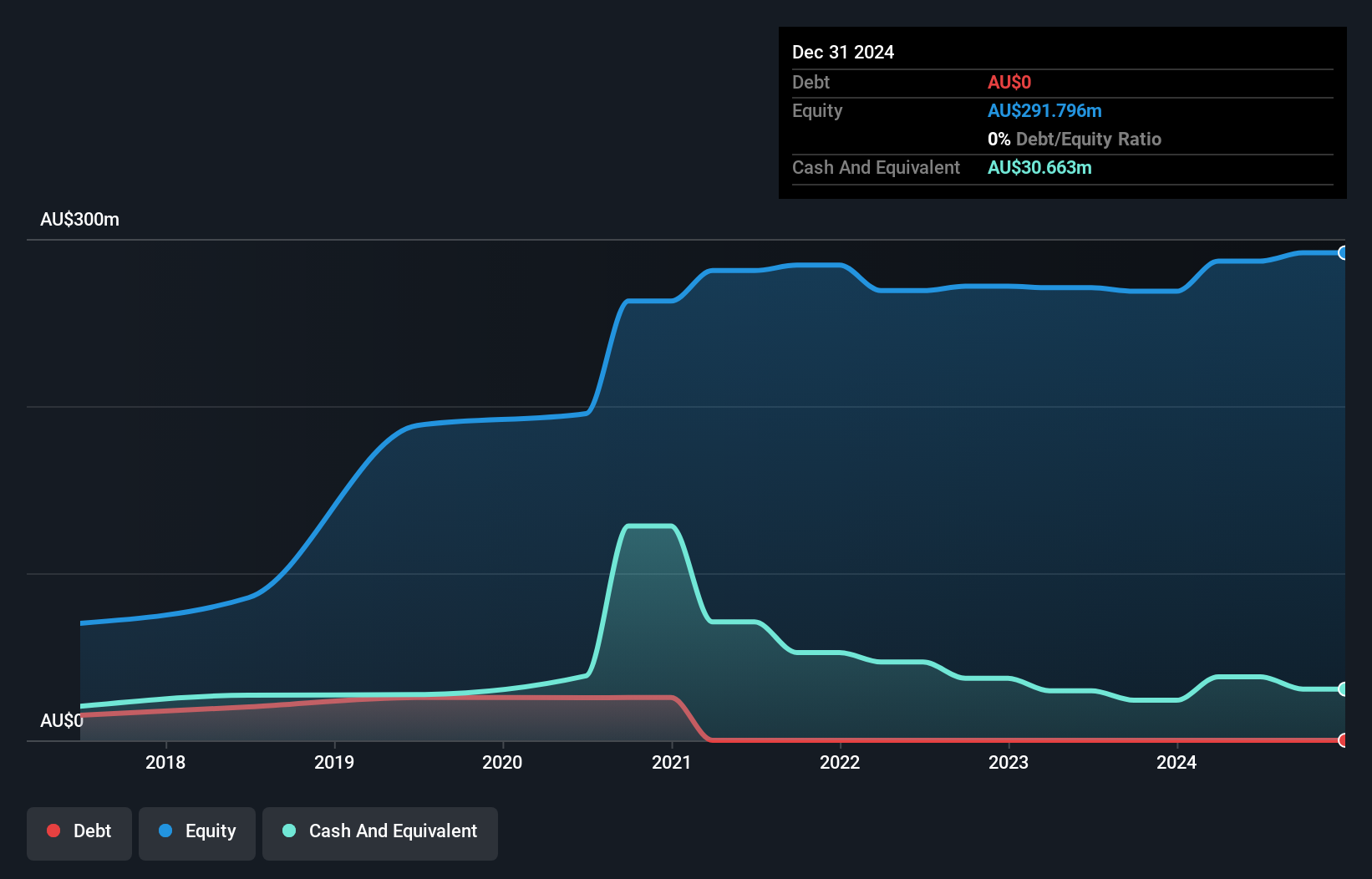

Nuix Limited, with a market cap of A$806.99 million, operates in investigative analytics and intelligence software solutions across multiple regions. Despite being unprofitable, it maintains a positive free cash flow and has no debt, offering a cash runway exceeding three years if this trend continues. The company's short-term assets of A$119.4 million comfortably cover both short-term and long-term liabilities. It trades at 40.1% below its estimated fair value and recently joined the S&P/ASX 200 Index, indicating increased visibility in the market. However, its net loss widened to A$10.4 million for the half year ending December 2024 compared to the previous year.

- Get an in-depth perspective on Nuix's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Nuix's future.

Spenda (ASX:SPX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Spenda Limited focuses on developing and commercializing technology solutions that modernize business IT systems by converting, migrating, and managing server-based legacy data to the cloud in Australia, with a market cap of A$36.92 million.

Operations: Spenda Limited generates revenue through its Lending segment, which accounts for A$3.71 million, and its SaaS & Payments segment, contributing A$3.93 million.

Market Cap: A$36.92M

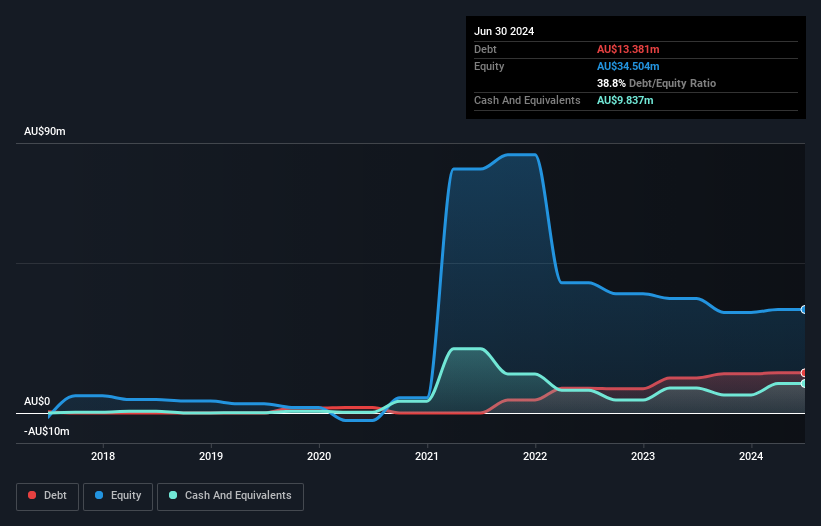

Spenda Limited, with a market cap of A$36.92 million, is focused on cloud-based IT solutions and faces challenges typical of penny stocks. Despite generating revenue from its Lending (A$3.71 million) and SaaS & Payments (A$3.93 million) segments, it remains unprofitable with increasing losses over the past five years at a rate of 12.2% annually. The company has less than a year of cash runway but maintains more cash than debt and recently secured a A$3 million loan for capital expenditure and working capital needs. Its short-term assets cover both short-term and long-term liabilities, though share price volatility remains high.

- Click here and access our complete financial health analysis report to understand the dynamics of Spenda.

- Gain insights into Spenda's past trends and performance with our report on the company's historical track record.

Where To Now?

- Take a closer look at our ASX Penny Stocks list of 998 companies by clicking here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NXL

Nuix

Provides investigative analytics and intelligence software solutions in the Asia Pacific, the Americas, Europe, the Middle East, and Africa.

Flawless balance sheet and good value.

Market Insights

Community Narratives