- Australia

- /

- Metals and Mining

- /

- ASX:CMM

ASX Growth Stocks With High Insider Ownership For October 2024

Reviewed by Simply Wall St

As the ASX200 edges past its previous record high, buoyed by positive movements on Wall Street and stable economic indicators, investors are keenly observing the market dynamics. In this context of growth and optimism, companies with substantial insider ownership often stand out as they may reflect confidence from those closest to the business in its potential trajectory.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Genmin (ASX:GEN) | 12% | 117.7% |

| Catalyst Metals (ASX:CYL) | 17% | 45.4% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Liontown Resources (ASX:LTR) | 14.7% | 59.8% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 70.2% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Pointerra (ASX:3DP) | 20.1% | 126.4% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

We're going to check out a few of the best picks from our screener tool.

Capricorn Metals (ASX:CMM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capricorn Metals Ltd is involved in the evaluation, exploration, development, and production of gold properties in Australia with a market cap of A$2.43 billion.

Operations: The company's revenue is primarily generated from its Karlawinda gold project, amounting to A$359.73 million.

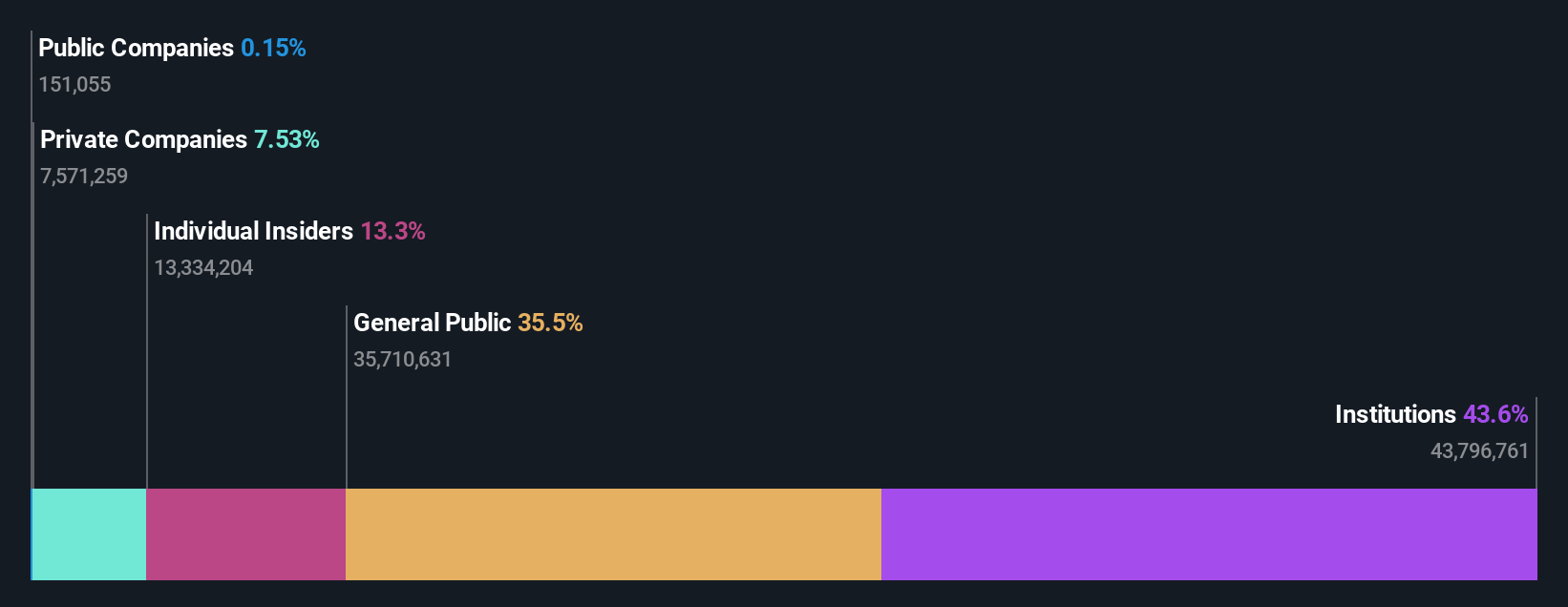

Insider Ownership: 11.9%

Capricorn Metals has demonstrated substantial growth, with earnings increasing to A$87.14 million from A$4.4 million year-over-year, and revenue reaching A$359.83 million. The company is advancing a significant expansion at its Karlawinda Gold Project, potentially increasing throughput by up to 55%. With forecasted revenue growth of 18.8% annually and a high projected return on equity of 31.8%, Capricorn stands out in the Australian market despite no recent insider trading activity reported.

- Click here and access our complete growth analysis report to understand the dynamics of Capricorn Metals.

- The analysis detailed in our Capricorn Metals valuation report hints at an inflated share price compared to its estimated value.

PWR Holdings (ASX:PWH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PWR Holdings Limited designs, prototypes, produces, tests, validates, and sells cooling products and solutions globally with a market cap of A$897.03 million.

Operations: The company's revenue segments consist of A$41.98 million from PWR C&R and A$111.26 million from PWR Performance Products.

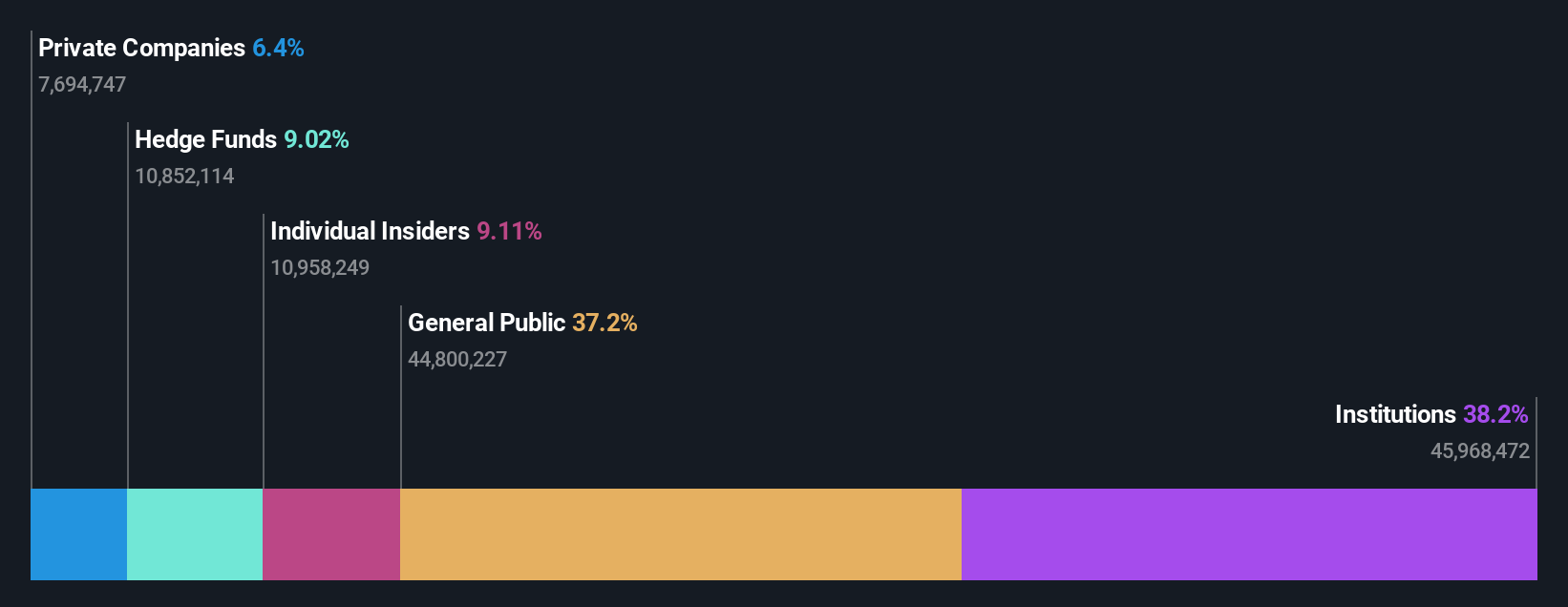

Insider Ownership: 13.2%

PWR Holdings has shown consistent growth, with earnings increasing to A$20.99 million from A$17.4 million year-over-year and sales rising to A$97.53 million. The company's revenue is forecasted to grow at 13% annually, outpacing the broader Australian market's 5.6%. Trading at 18% below its estimated fair value, PWR's return on equity is projected to reach a high of 27.9%. Recent executive changes include appointing Sharyn Williams as CFO in early 2025.

- Take a closer look at PWR Holdings' potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that PWR Holdings is priced higher than what may be justified by its financials.

Temple & Webster Group (ASX:TPW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Temple & Webster Group Ltd operates as an online retailer specializing in furniture, homewares, and home improvement products in Australia, with a market capitalization of A$1.60 billion.

Operations: The company's revenue is primarily generated from the sale of furniture, homewares, and home improvement products, totaling A$497.84 million.

Insider Ownership: 13.8%

Temple & Webster Group is experiencing significant earnings growth, forecasted at 40.1% annually, surpassing the Australian market average. Despite a decline in net profit margin from 2.1% to 0.4%, revenue increased to A$497.8 million for the year ending June 2024. Insider activity shows more buying than selling recently, though not substantially so. The appointment of Cameron Barnsley as CFO may bolster strategic financial management given his extensive experience in technology and ecommerce sectors globally.

- Navigate through the intricacies of Temple & Webster Group with our comprehensive analyst estimates report here.

- Our valuation report here indicates Temple & Webster Group may be overvalued.

Seize The Opportunity

- Get an in-depth perspective on all 98 Fast Growing ASX Companies With High Insider Ownership by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CMM

Capricorn Metals

Engages in the evaluation, exploration, development, and production of gold properties in Australia.

Outstanding track record with reasonable growth potential.