- Australia

- /

- Professional Services

- /

- ASX:C79

Chrysos And 2 Other Promising Penny Stocks On The ASX

Reviewed by Simply Wall St

As the 2025 trading year begins, the Australian market is experiencing a mixed start, with futures indicating a lower opening for the ASX 200. In this context of fluctuating market conditions, investors might consider exploring opportunities beyond well-known stocks. Penny stocks, while an older term, still represent smaller or emerging companies that can offer unique value propositions. This article will explore three such penny stocks on the ASX that demonstrate financial resilience and potential growth opportunities.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.56 | A$65.64M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.88 | A$238.78M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.955 | A$318.31M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.51 | A$316.27M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$842.94M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$103.99M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$205.65M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$2.00 | A$112.19M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.90 | A$483.46M | ★★★★☆☆ |

Click here to see the full list of 1,052 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Chrysos (ASX:C79)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chrysos Corporation Limited develops and supplies mining technology, with a market capitalization of A$568.86 million.

Operations: Chrysos generates revenue from its mining services segment, amounting to A$45.36 million.

Market Cap: A$568.86M

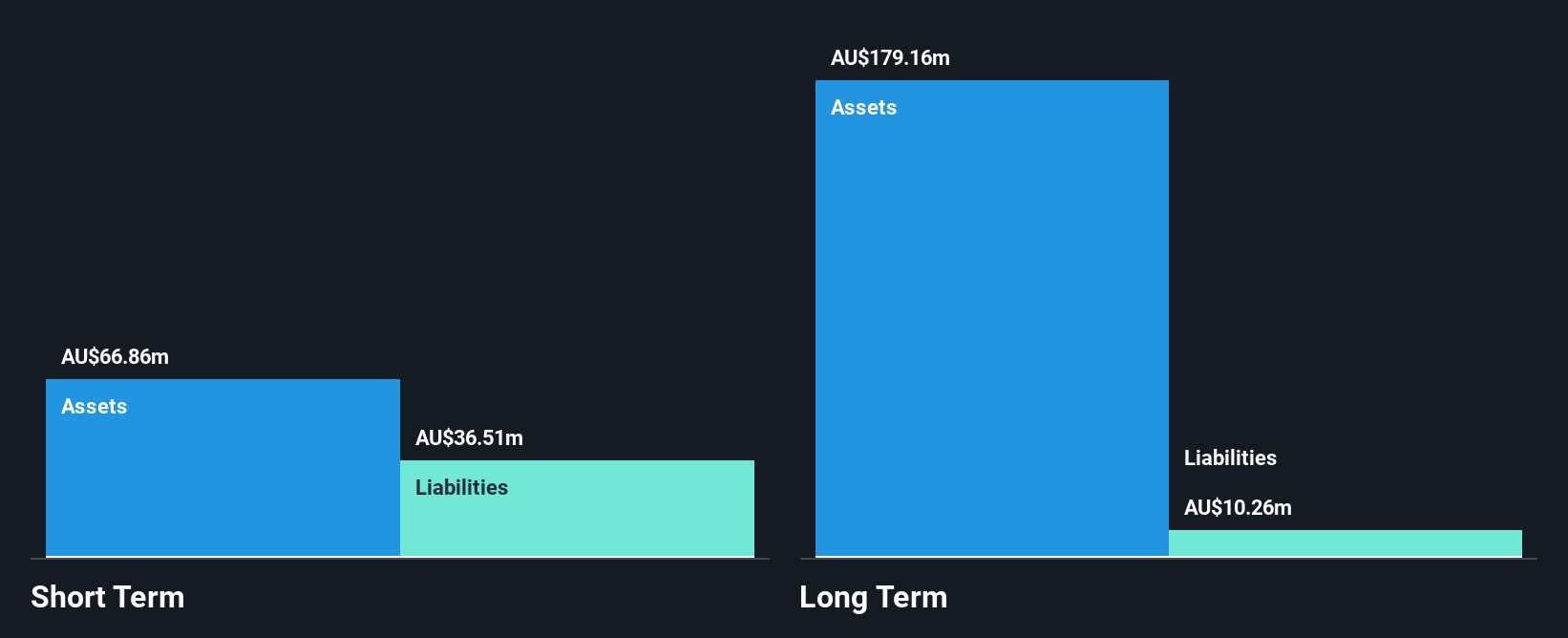

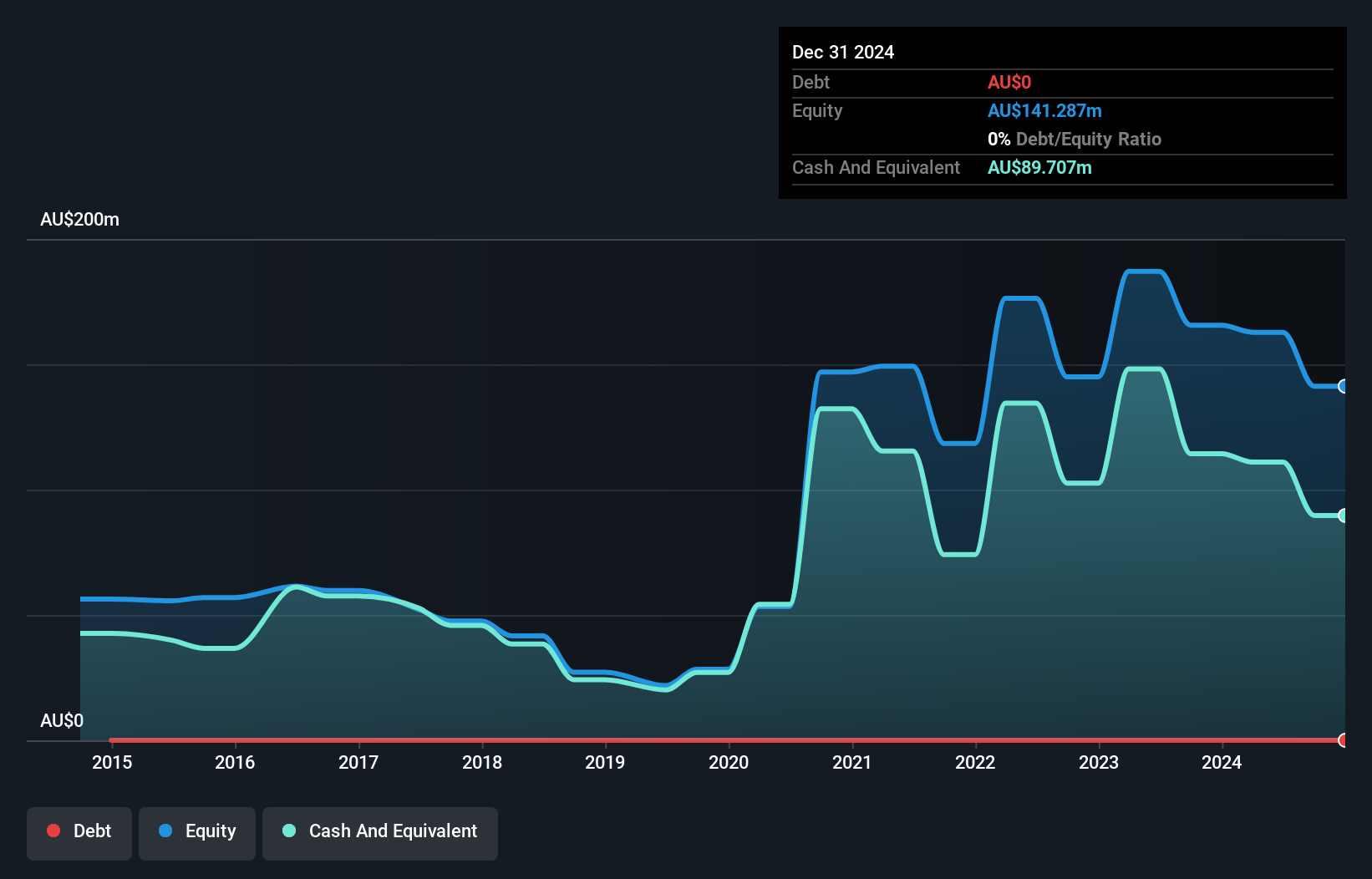

Chrysos Corporation Limited, with a market capitalization of A$568.86 million, is navigating the penny stock landscape with some promising aspects despite its challenges. The company reported revenue of A$45.36 million from its mining services segment and reaffirmed earnings guidance for fiscal 2025, projecting revenues between $60 million to $70 million. While currently unprofitable and experiencing increased losses over the past five years, Chrysos benefits from a strong cash position with short-term assets significantly exceeding liabilities and no debt burden. Management's experience and stable volatility add some stability to this speculative investment environment.

- Take a closer look at Chrysos' potential here in our financial health report.

- Gain insights into Chrysos' future direction by reviewing our growth report.

Chalice Mining (ASX:CHN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chalice Mining Limited is a mineral exploration and evaluation company with a market cap of A$429.87 million.

Operations: Chalice Mining Limited does not have any reported revenue segments.

Market Cap: A$429.87M

Chalice Mining Limited, with a market cap of A$429.87 million, operates as a pre-revenue entity in the mineral exploration sector, lacking significant revenue streams. Despite its unprofitability and negative return on equity, the company maintains financial stability through its debt-free status and sufficient cash runway exceeding three years. Its short-term assets significantly surpass both short- and long-term liabilities, providing a solid liquidity position. The management team and board have considerable experience averaging around four years tenure each. However, profitability is not anticipated in the near term despite projected revenue growth of 23.76% annually.

- Navigate through the intricacies of Chalice Mining with our comprehensive balance sheet health report here.

- Examine Chalice Mining's earnings growth report to understand how analysts expect it to perform.

Clover (ASX:CLV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Clover Corporation Limited produces, refines, and sells natural oils and encapsulated powders across various regions including Australia, New Zealand, Asia, Europe, the Middle East, and the Americas with a market cap of A$74.73 million.

Operations: The company generates revenue of A$62.21 million from its Nutritional Oil and Microencapsulated Powders segment.

Market Cap: A$74.73M

Clover Corporation Limited, with a market cap of A$74.73 million, generates revenue from its Nutritional Oil and Microencapsulated Powders segment amounting to A$62.21 million. The company's financial health is supported by a significant reduction in debt over five years and more cash than total debt, while short-term assets comfortably cover both short- and long-term liabilities. Despite these strengths, Clover faces challenges with declining profit margins—currently at 2.4% compared to last year's 7.8%—and negative earnings growth over the past year (-75.6%). However, earnings are forecasted to grow significantly at 35.74% annually.

- Click here and access our complete financial health analysis report to understand the dynamics of Clover.

- Learn about Clover's future growth trajectory here.

Turning Ideas Into Actions

- Unlock our comprehensive list of 1,052 ASX Penny Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:C79

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives