As the Australian market navigates a mixed landscape with sectors like Materials showing strength while Energy struggles, investors are keenly observing potential opportunities. Penny stocks, though an older term, still represent an intriguing area of investment by highlighting smaller or less-established companies that may offer value. By focusing on those with robust financials and clear growth prospects, investors can uncover promising opportunities in this niche segment.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.39 | A$111.77M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.50 | A$70.76M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.775 | A$48.26M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.80 | A$430.33M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.12 | A$230.45M | ✅ 4 ⚠️ 1 View Analysis > |

| West African Resources (ASX:WAF) | A$2.89 | A$3.3B | ✅ 4 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.76 | A$363.6M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.20 | A$1.35B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.90 | A$129.54M | ✅ 4 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.44 | A$639.96M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 432 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Chalice Mining (ASX:CHN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chalice Mining Limited is a mineral exploration and evaluation company with a market capitalization of A$725.68 million.

Operations: Chalice Mining Limited has not reported any distinct revenue segments.

Market Cap: A$725.68M

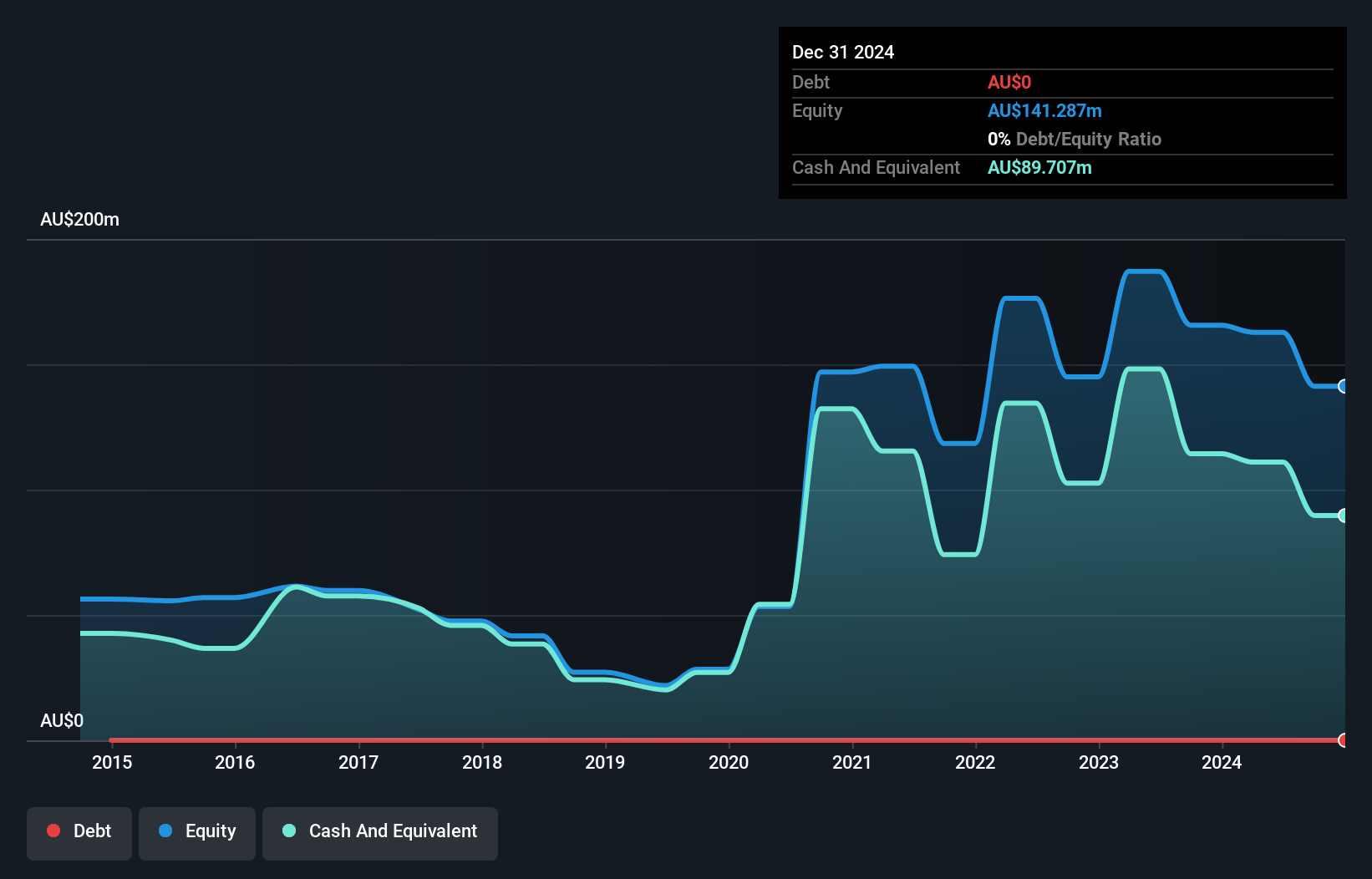

Chalice Mining, with a market cap of A$725.68 million, is currently pre-revenue and unprofitable. The company's cash runway extends over three years based on current free cash flow, providing some financial stability despite the lack of revenue. Recent board changes have improved compliance with ASX governance rules by appointing an independent chair for the Audit Committee. While short-term liabilities are well covered by assets (A$81.2M), significant insider selling has occurred recently, potentially signaling caution among insiders. The management team is relatively new with an average tenure of 1.8 years, indicating potential shifts in strategic direction.

- Click to explore a detailed breakdown of our findings in Chalice Mining's financial health report.

- Explore Chalice Mining's analyst forecasts in our growth report.

Racura Oncology (ASX:RAC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Racura Oncology Ltd, a clinical stage biopharmaceutical company, focuses on addressing the unmet needs of cancer patients for damaging treatments in Australia and has a market cap of A$472.92 million.

Operations: The company generates revenue of A$6.04 million from its operations in Australia.

Market Cap: A$472.92M

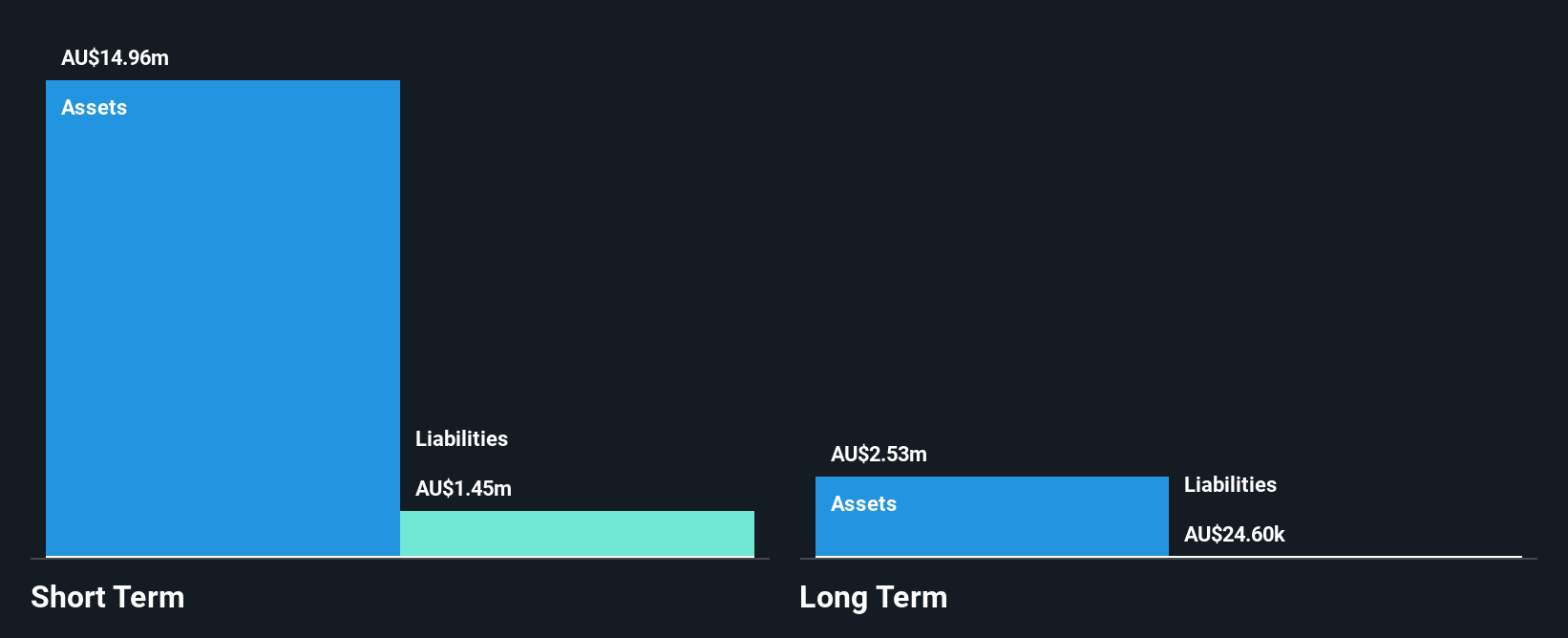

Racura Oncology Ltd, with a market cap of A$472.92 million, is currently unprofitable and has limited revenue (A$6.04 million). Despite this, its short-term assets significantly exceed liabilities, providing some financial cushion. The company recently completed a follow-on equity offering raising A$3.22 million to support ongoing operations and clinical trials for RC220 in cancer treatment. These trials aim to address resistance issues in existing therapies, generating interest due to the potential impact on treatment efficacy. While the management team is relatively inexperienced with an average tenure of 1.6 years, recent strategic appointments may bolster its scientific advisory capabilities.

- Unlock comprehensive insights into our analysis of Racura Oncology stock in this financial health report.

- Gain insights into Racura Oncology's outlook and expected performance with our report on the company's earnings estimates.

United Overseas Australia (ASX:UOS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: United Overseas Australia Ltd, along with its subsidiaries, is involved in the development and resale of land and buildings across Malaysia, Singapore, Vietnam, and Australia, with a market cap of A$1.18 billion.

Operations: The company's revenue primarily comes from its land development and resale segment, which generated A$438.18 million, alongside investment activities contributing A$257.51 million.

Market Cap: A$1.18B

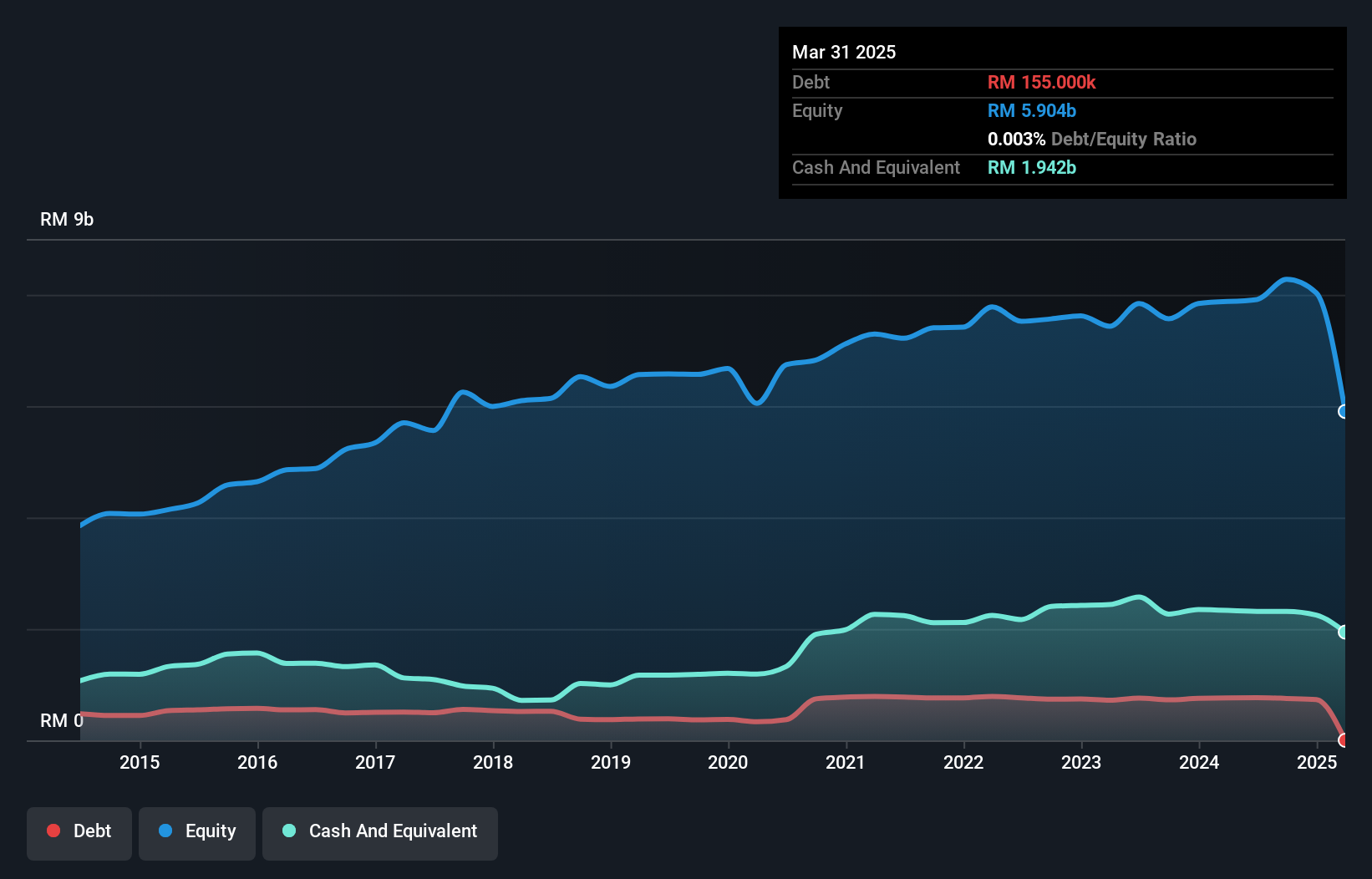

United Overseas Australia Ltd, with a market cap of A$1.18 billion, has demonstrated stable financial health and earnings growth. The company's revenue streams from land development and resale (A$438.18 million) and investment activities (A$257.51 million) highlight its diversified income sources. UOS's robust cash position exceeds its debt, ensuring strong liquidity, while operating cash flow comfortably covers debt obligations. Despite an unstable dividend track record and lower net profit margins compared to last year, the company maintains a solid asset base that surpasses both short-term and long-term liabilities. Its seasoned management team further strengthens its operational stability.

- Jump into the full analysis health report here for a deeper understanding of United Overseas Australia.

- Assess United Overseas Australia's previous results with our detailed historical performance reports.

Make It Happen

- Discover the full array of 432 ASX Penny Stocks right here.

- Searching for a Fresh Perspective? This technology could replace computers: discover the 28 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RAC

Racura Oncology

A clinical stage biopharmaceutical company, focuses on addressing the unmet needs of cancer patients for damaging treatments in Australia.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion