- Australia

- /

- Metals and Mining

- /

- ASX:BGL

Does Bellevue Gold (ASX:BGL) Deacon North Re‑Start Clarify Its High‑Grade Production Roadmap?

Reviewed by Sasha Jovanovic

- Bellevue Gold Limited recently confirmed it remains on track to lift ore grades after resuming development in the high-grade Deacon North area, following the completion of work at the Armand mining zone.

- By reallocating a dedicated development jumbo and establishing independent firing to accelerate underground progress, Bellevue is aiming to de-risk future high-grade production from its largest ore source within the Bellevue Gold Project.

- Against this backdrop, we’ll consider how the renewed development push at Deacon North shapes Bellevue Gold’s investment narrative in the near term.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Bellevue Gold's Investment Narrative?

To own Bellevue Gold, you need to believe the market is undervaluing a growing, but still unprofitable, producer that is in the middle of a complicated ramp-up. The big near term catalysts remain grade performance, cost control and any progress or stall in the ongoing M&A interest. The latest Deacon North update matters here: confirming development is back on track in the largest high grade area helps support the thesis that higher ore grades and stronger cash generation are still achievable, even after guidance cuts and a withdrawn five year plan. At the same time, the recent share price surge toward analyst targets suggests that execution risk, funding needs after past equity raises, and any hiccups in underground development could weigh more heavily on sentiment from here.

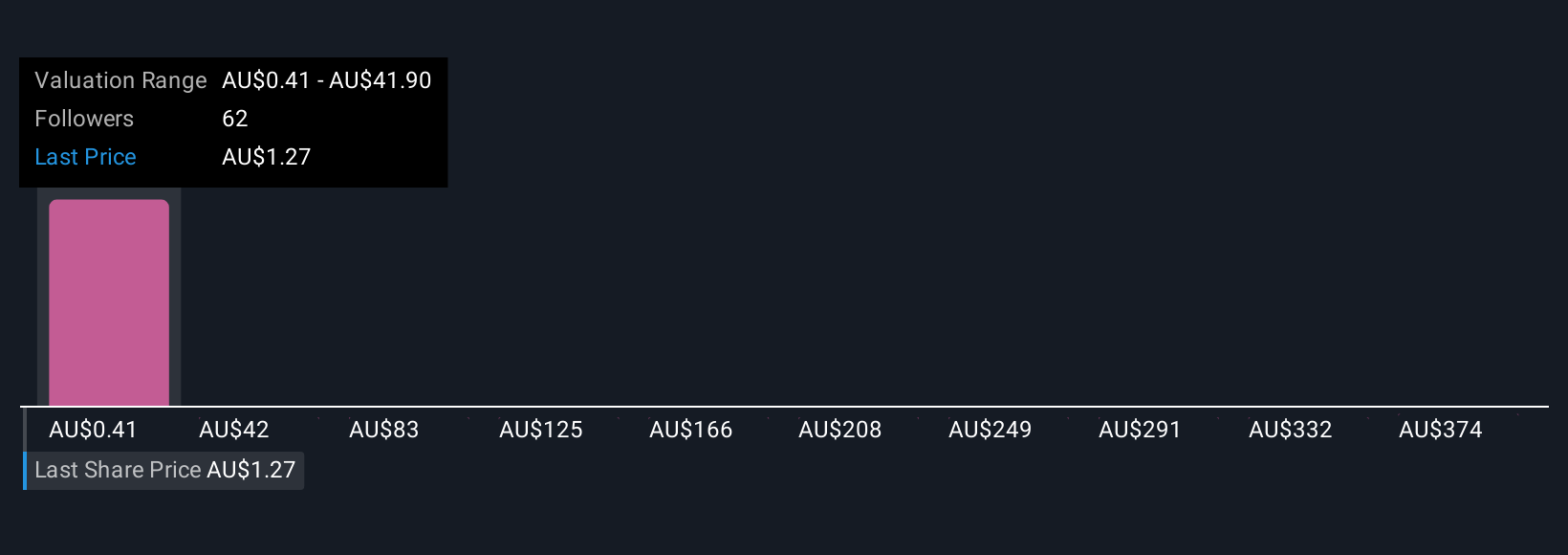

But there is a key operational risk here that investors should not overlook. Bellevue Gold's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 11 other fair value estimates on Bellevue Gold - why the stock might be a potential multi-bagger!

Build Your Own Bellevue Gold Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bellevue Gold research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bellevue Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bellevue Gold's overall financial health at a glance.

No Opportunity In Bellevue Gold?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bellevue Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BGL

Bellevue Gold

Engages in the exploration, development, mining, and processing of gold properties in Australia.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026