- Australia

- /

- Metals and Mining

- /

- ASX:ASM

Can Australian Strategic Materials' (ASX:ASM) Evolving Leadership Sustain Its Operational Momentum?

Reviewed by Sasha Jovanovic

- Australian Strategic Materials Limited has announced a management team restructure following the resignation of Chief Operating Officer Chris Jordaan, who will step down effective 9 November 2025 after overseeing major operational progress in Korea and Australia.

- This leadership transition comes after Jordaan helped launch the first commercial sales of heavy rare earth metals and advanced development of the Dubbo Project, marking a period of operational achievement for the company.

- We'll explore how this pivotal leadership change could influence Australian Strategic Materials' investment narrative, particularly regarding its ongoing project execution and operational momentum.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

What Is Australian Strategic Materials' Investment Narrative?

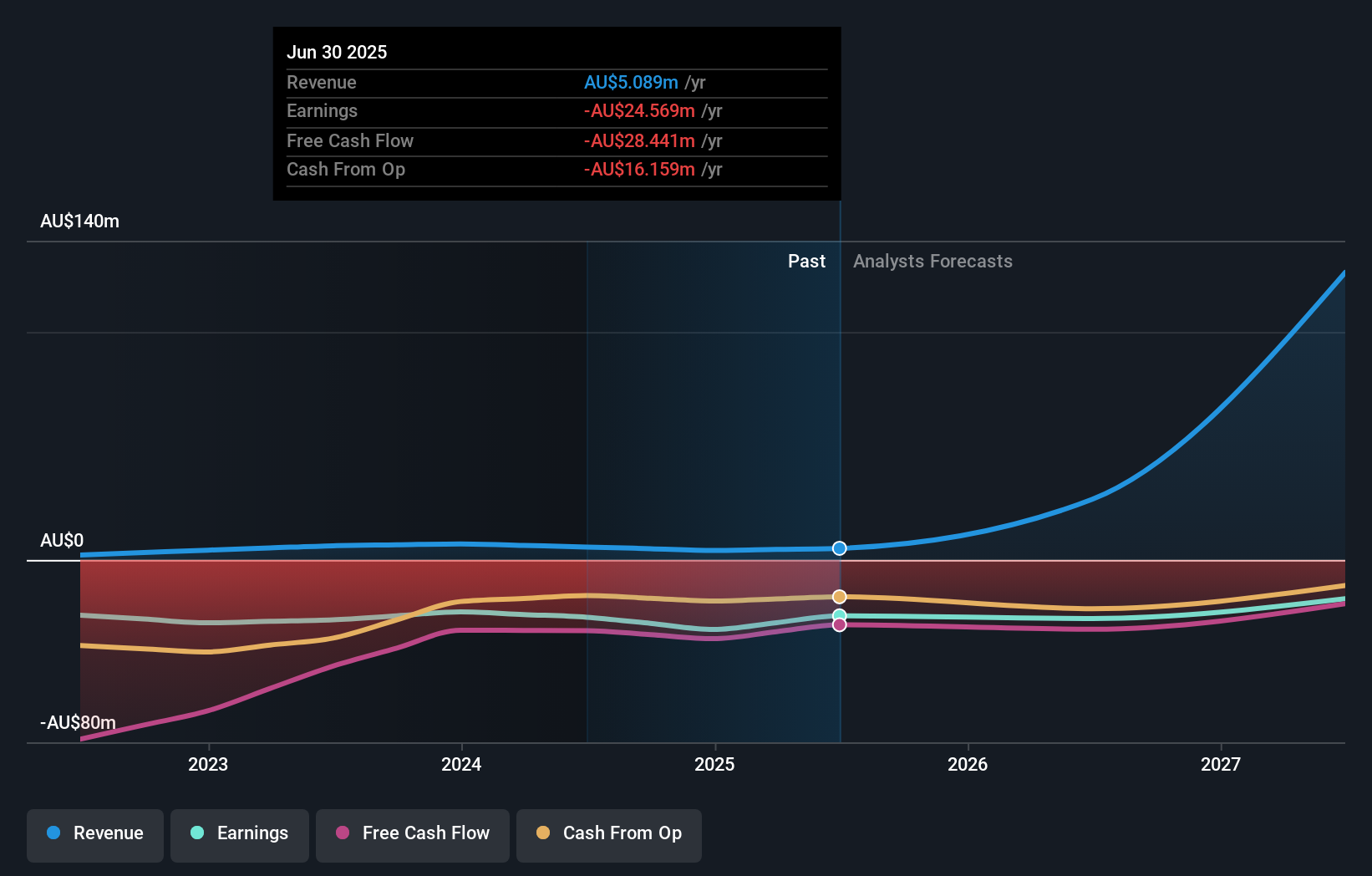

Owning shares in Australian Strategic Materials requires a belief in the company’s ability to turn ambitious growth projections into actual financial traction, despite mounting pressure around sustainability and funding. The recent resignation of COO Chris Jordaan adds a new element of uncertainty, especially as he was closely linked to major operational milestones and progress in Korea and at the Dubbo Project. This leadership transition lands right as the market is watching for short-term catalysts: meaningful sales growth from rare earth metals production, and successful further development at Dubbo. Considering the transition, these catalysts might now come with greater execution risk if new management struggles to maintain momentum. The company still faces substantial risks, highlighted by ongoing going concern warnings from auditors, and persistent unprofitability, which may now be compounded if project timelines or cost control suffer post-Jordaan. If the handover proceeds smoothly, the impact may be limited, but the uncertainty remains front and center.

Contrary to the recent operational progress, the company’s ability to fund its ambitions should not be underestimated. The valuation report we've compiled suggests that Australian Strategic Materials' current price could be inflated.Exploring Other Perspectives

Explore 2 other fair value estimates on Australian Strategic Materials - why the stock might be worth as much as A$2.09!

Build Your Own Australian Strategic Materials Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Australian Strategic Materials research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Australian Strategic Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Australian Strategic Materials' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ASM

Australian Strategic Materials

Operates as an integrated producer of critical metals for technologies in Australia.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives