- Australia

- /

- Metals and Mining

- /

- ASX:AMI

Aurelia Metals Leads Our ASX Penny Stock Highlights

Reviewed by Simply Wall St

As Australian markets brace for a cautious opening, reflecting the skittish mood of global indices after the Federal Reserve's recent announcements, investors are seeking opportunities that balance risk and reward. Penny stocks, though often considered a niche investment area, continue to offer potential growth opportunities in smaller or newer companies. When these stocks are supported by strong financials and solid fundamentals, they can provide an attractive avenue for those looking to uncover hidden gems in the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.4M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.92 | A$106.21M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.52 | A$102.12M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.97 | A$320.75M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.99 | A$247.9M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.18 | A$337.66M | ★★★★☆☆ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$229.74M | ★★★★★★ |

| Nickel Industries (ASX:NIC) | A$0.80 | A$3.43B | ★★★★★☆ |

Click here to see the full list of 1,027 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Aurelia Metals (ASX:AMI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aurelia Metals Limited is an Australian company involved in the exploration and production of mineral properties, with a market capitalization of approximately A$312.94 million.

Operations: The company's revenue is derived from its operations at the Peak Mine generating A$207.34 million, the Dargues Mine contributing A$102.36 million, and the Hera Mine with A$0.20 million.

Market Cap: A$312.94M

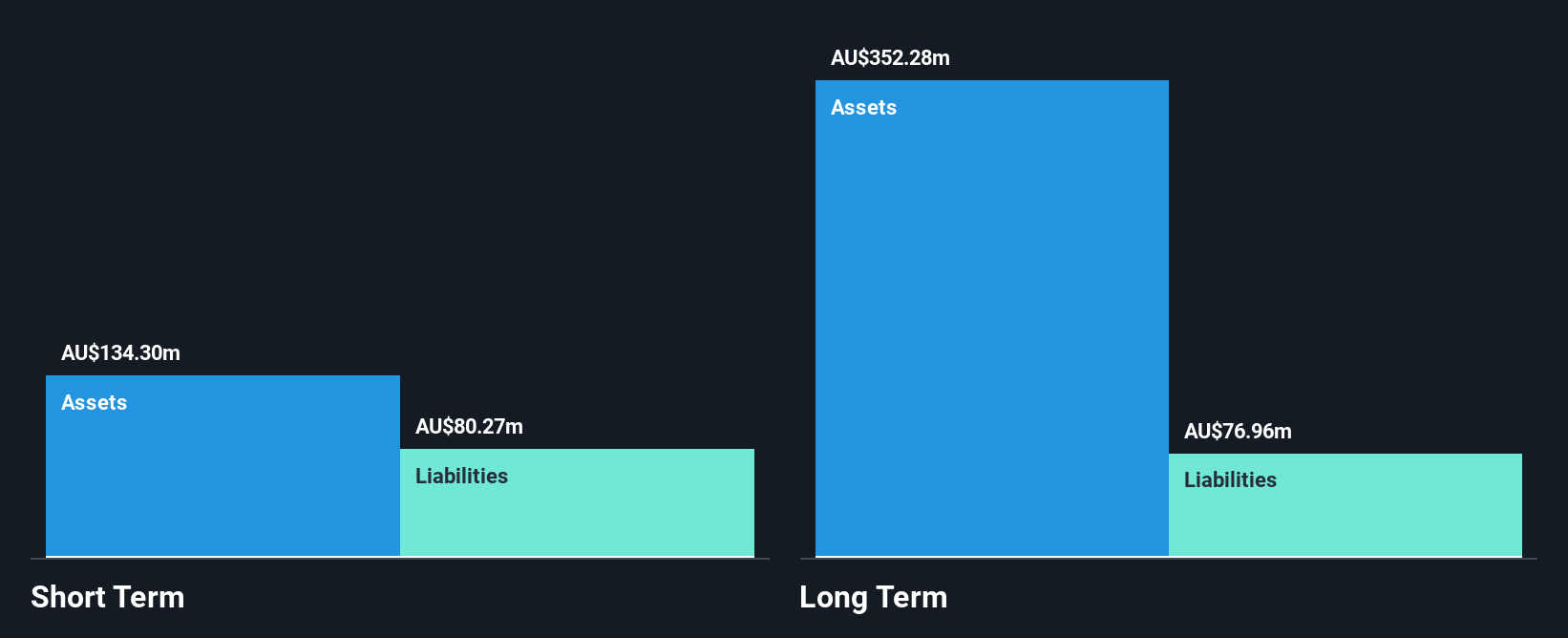

Aurelia Metals Limited, with a market cap of A$312.94 million, derives significant revenue from its Peak and Dargues Mines. Despite being unprofitable with increasing losses over the past five years, the company maintains a strong cash runway exceeding three years and positive free cash flow. Analysts forecast earnings growth at 47.19% annually, indicating potential for future profitability. The stock is trading significantly below estimated fair value, suggesting possible upside according to analysts' consensus price targets. However, both the management team and board are relatively inexperienced, which may impact strategic execution moving forward.

- Dive into the specifics of Aurelia Metals here with our thorough balance sheet health report.

- Assess Aurelia Metals' future earnings estimates with our detailed growth reports.

Perenti (ASX:PRN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Perenti Limited is a global mining services company with a market capitalization of A$1.24 billion.

Operations: The company's revenue is primarily derived from its Contract Mining Services segment, which generated A$2.54 billion, followed by Drilling Services with A$598.10 million and Mining Services and Idoba contributing A$239.06 million.

Market Cap: A$1.24B

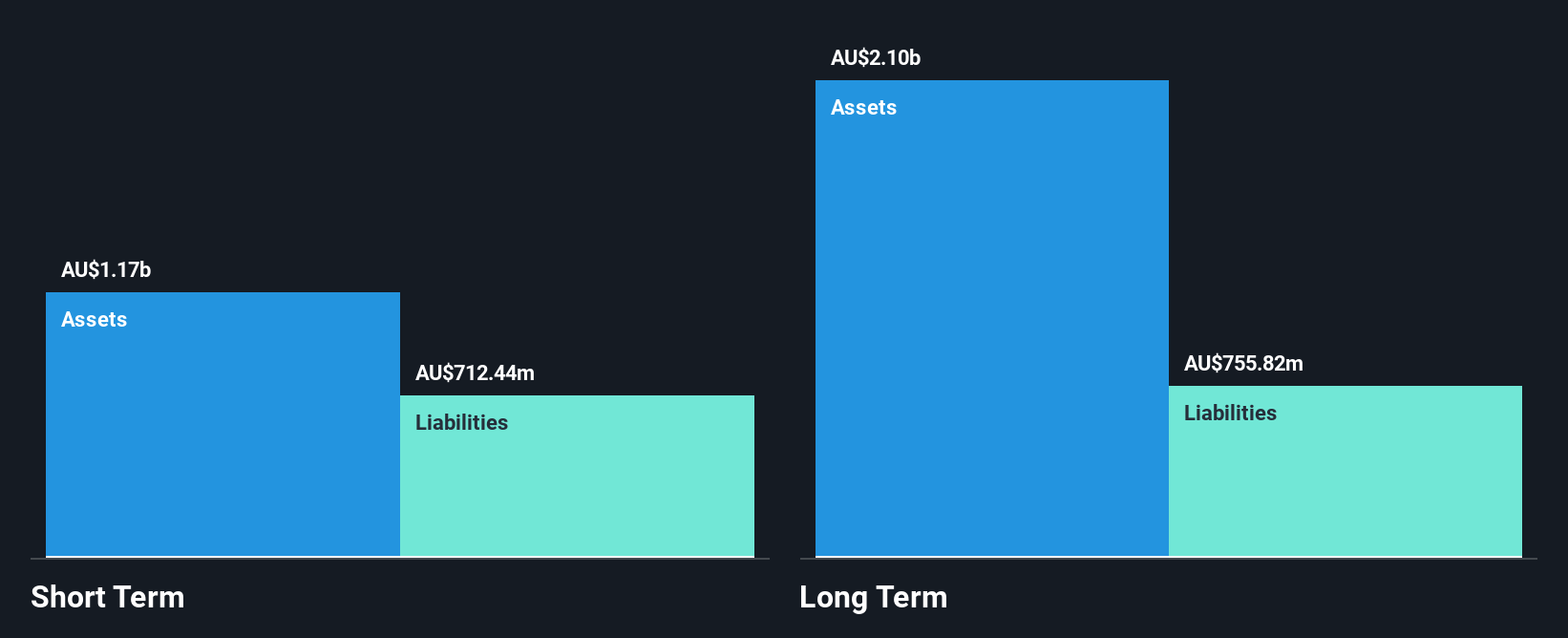

Perenti Limited, with a market cap of A$1.24 billion, primarily generates revenue from its Contract Mining Services segment. The company has demonstrated high-quality earnings and stable weekly volatility. Its short-term assets exceed both short- and long-term liabilities, indicating solid liquidity management. Perenti's net debt to equity ratio is satisfactory at 23.6%, with interest payments well covered by EBIT (3.1x coverage). Despite negative earnings growth over the past year and low return on equity at 6%, forecasts suggest a robust annual earnings growth of 22.07%. The stock trades significantly below estimated fair value, suggesting potential undervaluation opportunities.

- Unlock comprehensive insights into our analysis of Perenti stock in this financial health report.

- Examine Perenti's earnings growth report to understand how analysts expect it to perform.

Star Entertainment Group (ASX:SGR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: The Star Entertainment Group Limited operates and manages integrated resorts in Australia, with a market cap of A$372.65 million.

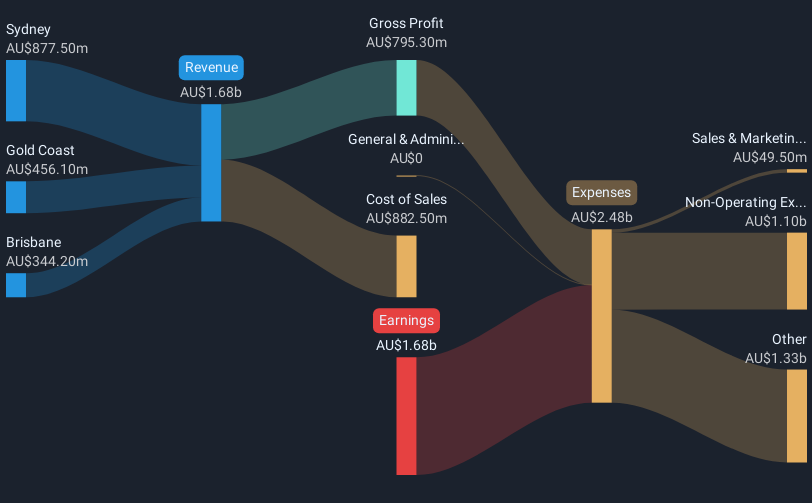

Operations: The company's revenue is derived from its operations in Sydney (A$877.5 million), Brisbane (A$344.2 million), and the Gold Coast (A$456.1 million).

Market Cap: A$372.65M

Star Entertainment Group, with a market cap of A$372.65 million, faces challenges as it remains unprofitable and has seen increasing losses over the past five years. Despite having more cash than total debt and a sufficient cash runway for over three years, its short-term liabilities exceed short-term assets by A$263.8 million, raising liquidity concerns. Recent executive changes include the appointment of Steve McCann as CEO and Frank Krile as CFO, potentially signaling strategic shifts. The stock is considered to be trading at a good value compared to peers but exhibits high volatility relative to most Australian stocks.

- Click here to discover the nuances of Star Entertainment Group with our detailed analytical financial health report.

- Explore Star Entertainment Group's analyst forecasts in our growth report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1,027 ASX Penny Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AMI

Aurelia Metals

Engages in the exploration and production of mineral properties in Australia.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives