- Australia

- /

- Metals and Mining

- /

- ASX:ALK

Spotlight On ASX: 3 Penny Stocks With Market Caps Over A$100M

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has risen 1.5%, and over the past year, it is up 17%, with earnings forecasted to grow by 12% annually. In light of these positive conditions, investors may find value in exploring penny stocks—an outdated term that still signifies smaller or less-established companies with potential for growth. By focusing on those with strong financials and clear growth trajectories, investors can uncover opportunities that offer both stability and upside potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.59 | A$69.16M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.81 | A$148.62M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$2.00 | A$325.64M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.88 | A$238.78M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.54 | A$334.88M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.89 | A$104.55M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.65 | A$808.63M | ★★★★★☆ |

| GTN (ASX:GTN) | A$0.4475 | A$87.7M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.15 | A$65.35M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.80 | A$473.59M | ★★★★☆☆ |

Click here to see the full list of 1,046 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Alkane Resources (ASX:ALK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alkane Resources Ltd is an Australian company focused on gold exploration and production, with a market cap of A$302.53 million.

Operations: The company generates revenue primarily from its Gold Operations segment, which accounts for A$173.58 million.

Market Cap: A$302.53M

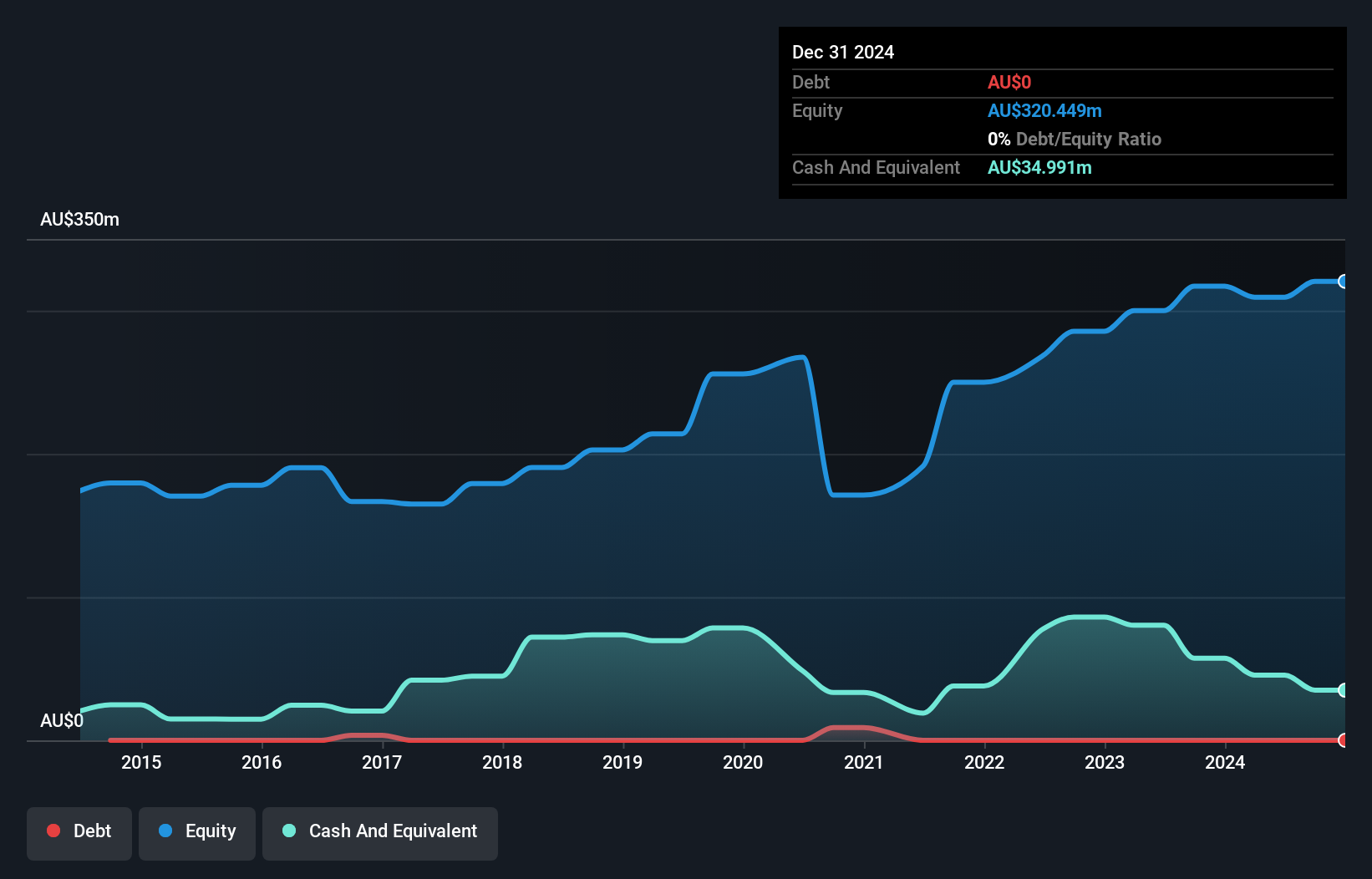

Alkane Resources, with a market cap of A$302.53 million, primarily generates revenue from its Gold Operations segment, reporting A$173.58 million in sales for the last fiscal year. Despite seasoned management and board members, Alkane faces challenges with declining earnings growth of -58.4% over the past year and reduced profit margins from 22.3% to 10.2%. However, it remains debt-free, alleviating concerns about interest coverage and long-term liabilities despite short-term assets not fully covering long-term obligations. The company's stock trades significantly below estimated fair value but exhibits stable weekly volatility at 7%.

- Click here and access our complete financial health analysis report to understand the dynamics of Alkane Resources.

- Examine Alkane Resources' earnings growth report to understand how analysts expect it to perform.

Emerald Resources (ASX:EMR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.41 billion.

Operations: The company generates revenue primarily from its Mine Operations segment, which accounts for A$366.04 million.

Market Cap: A$2.41B

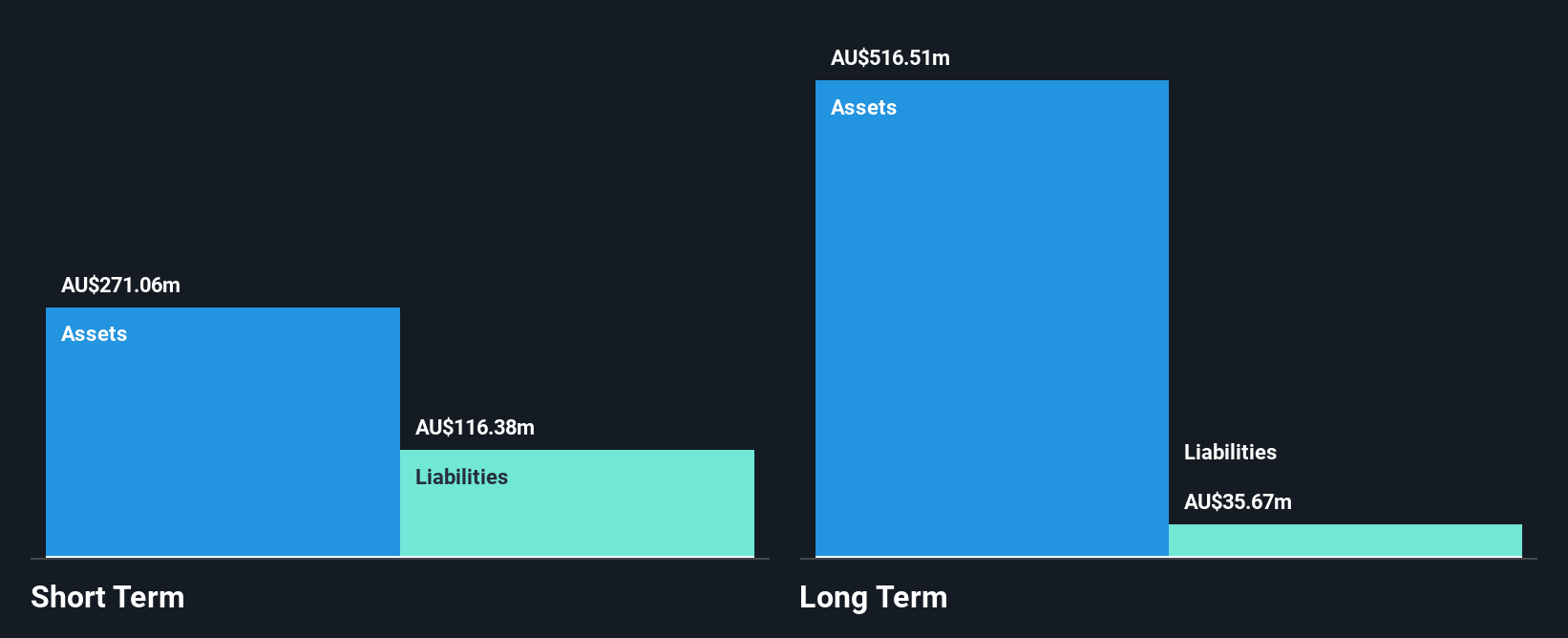

Emerald Resources, with a market cap of A$2.41 billion, has shown strong earnings growth, increasing by 41.9% over the past year and surpassing industry averages. The company maintains high-quality earnings and robust profit margins at 22.6%, up from the previous year. Its financial health is solid with short-term assets exceeding liabilities and debt well-covered by operating cash flow. However, shareholder dilution occurred recently with shares outstanding growing by 5.5%. Recent board changes include the retirement of Simon Lee AO, a key figure in Emerald's development into a gold producer in Cambodia and Australia.

- Dive into the specifics of Emerald Resources here with our thorough balance sheet health report.

- Gain insights into Emerald Resources' outlook and expected performance with our report on the company's earnings estimates.

Image Resources (ASX:IMA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Image Resources NL is a mineral sands mining company based in Western Australia with a market capitalization of A$105.48 million.

Operations: Image Resources NL has not reported any specific revenue segments.

Market Cap: A$105.48M

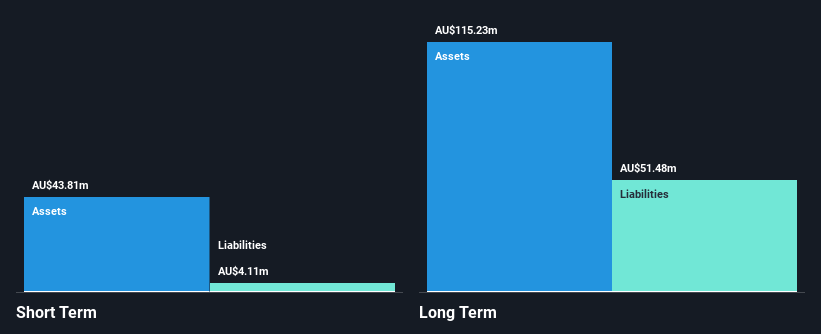

Image Resources, with a market cap of A$105.48 million, is currently pre-revenue and unprofitable, facing increasing losses over the past five years at an annual rate of 33.2%. Despite this, the company benefits from being debt-free and having a seasoned management team with an average tenure of 9.3 years. Short-term assets (A$43.8M) exceed short-term liabilities (A$4.1M), but long-term liabilities remain uncovered by these assets (A$51.5M). Recent financial results show a net loss of A$5.16 million for the half-year ending June 2024, marking a decline from net income in the previous year.

- Jump into the full analysis health report here for a deeper understanding of Image Resources.

- Explore historical data to track Image Resources' performance over time in our past results report.

Where To Now?

- Click this link to deep-dive into the 1,046 companies within our ASX Penny Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Alkane Resources, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ALK

Alkane Resources

Operates as a gold exploration and production company in Australia.

Good value with reasonable growth potential.