- Australia

- /

- Specialty Stores

- /

- ASX:TPW

3 ASX Stocks That May Be Trading Below Estimated Value In December 2025

Reviewed by Simply Wall St

As the Australian market experiences a slight retreat, with sectors like Staples, Health Care, and Energy facing declines while Materials show strength, investors are keenly observing potential opportunities amidst fluctuating oil prices and geopolitical developments. In such a climate, identifying stocks that may be trading below their estimated value can offer intriguing prospects for those seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Lynas Rare Earths (ASX:LYC) | A$12.40 | A$23.50 | 47.2% |

| LGI (ASX:LGI) | A$3.88 | A$7.58 | 48.8% |

| IDP Education (ASX:IEL) | A$5.57 | A$10.62 | 47.5% |

| Guzman y Gomez (ASX:GYG) | A$21.23 | A$38.65 | 45.1% |

| Genesis Minerals (ASX:GMD) | A$6.86 | A$13.56 | 49.4% |

| Electro Optic Systems Holdings (ASX:EOS) | A$7.53 | A$13.75 | 45.2% |

| Cromwell Property Group (ASX:CMW) | A$0.475 | A$0.87 | 45.2% |

| Betmakers Technology Group (ASX:BET) | A$0.175 | A$0.34 | 48.5% |

| Alkane Resources (ASX:ALK) | A$1.20 | A$2.39 | 49.7% |

| Airtasker (ASX:ART) | A$0.325 | A$0.63 | 48.7% |

Underneath we present a selection of stocks filtered out by our screen.

Alkane Resources (ASX:ALK)

Overview: Alkane Resources Ltd is an Australian company focused on gold exploration and production, with a market cap of A$1.64 billion.

Operations: Alkane Resources Ltd generates its revenue primarily from gold exploration and production activities in Australia.

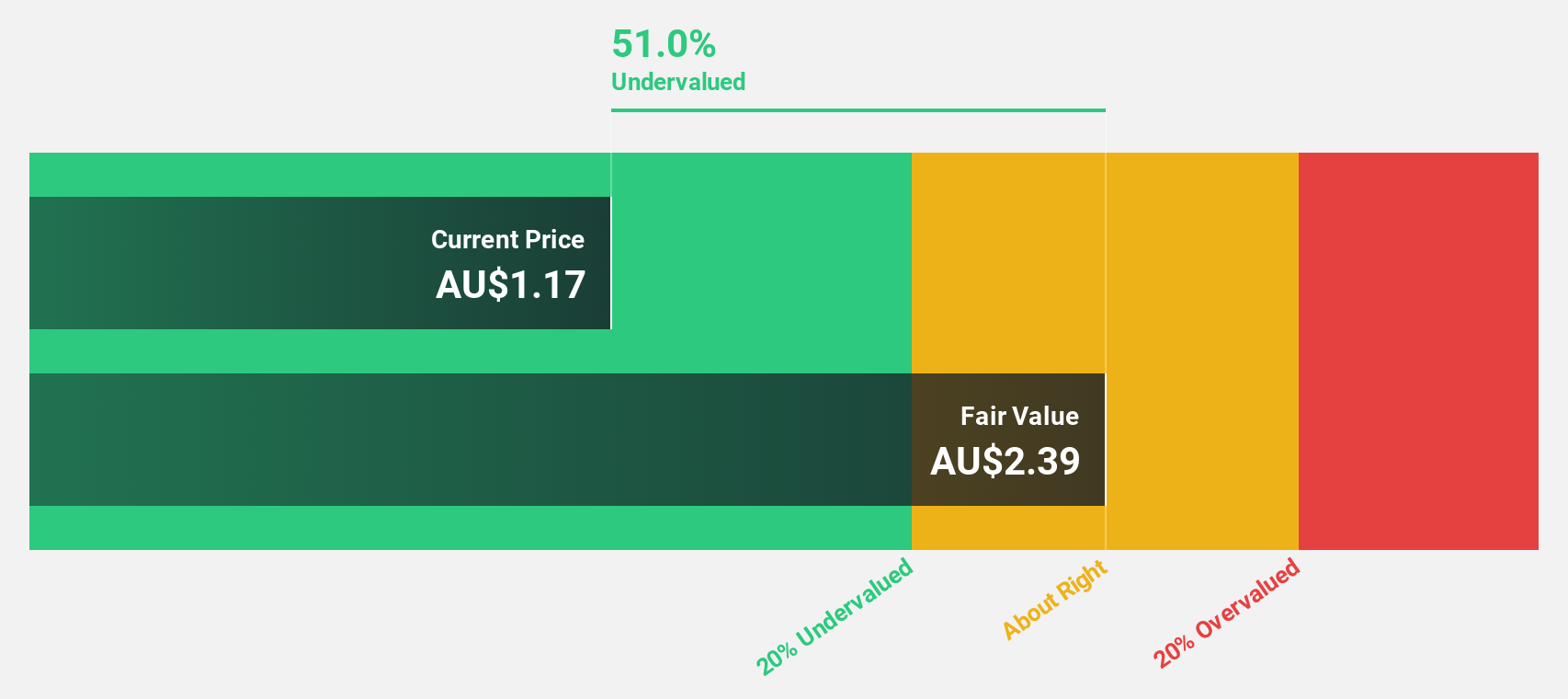

Estimated Discount To Fair Value: 49.7%

Alkane Resources is trading at A$1.20, significantly below its estimated fair value of A$2.39, suggesting it is undervalued based on cash flows. Despite a decline in profit margins and substantial shareholder dilution over the past year, Alkane's earnings are forecast to grow significantly above the market average. Recent board changes include appointing Ms. Denise McComish as an independent Non-Executive Director, potentially strengthening financial oversight and strategic direction amid ongoing production expansions at its Tomingley Gold Operations.

- Our expertly prepared growth report on Alkane Resources implies its future financial outlook may be stronger than recent results.

- Take a closer look at Alkane Resources' balance sheet health here in our report.

Lovisa Holdings (ASX:LOV)

Overview: Lovisa Holdings Limited operates in the retail sector, focusing on the sale of fashion jewelry and accessories, with a market capitalization of A$3.18 billion.

Operations: The company generates revenue of A$798.13 million from its retail sale of fashion jewelry and accessories.

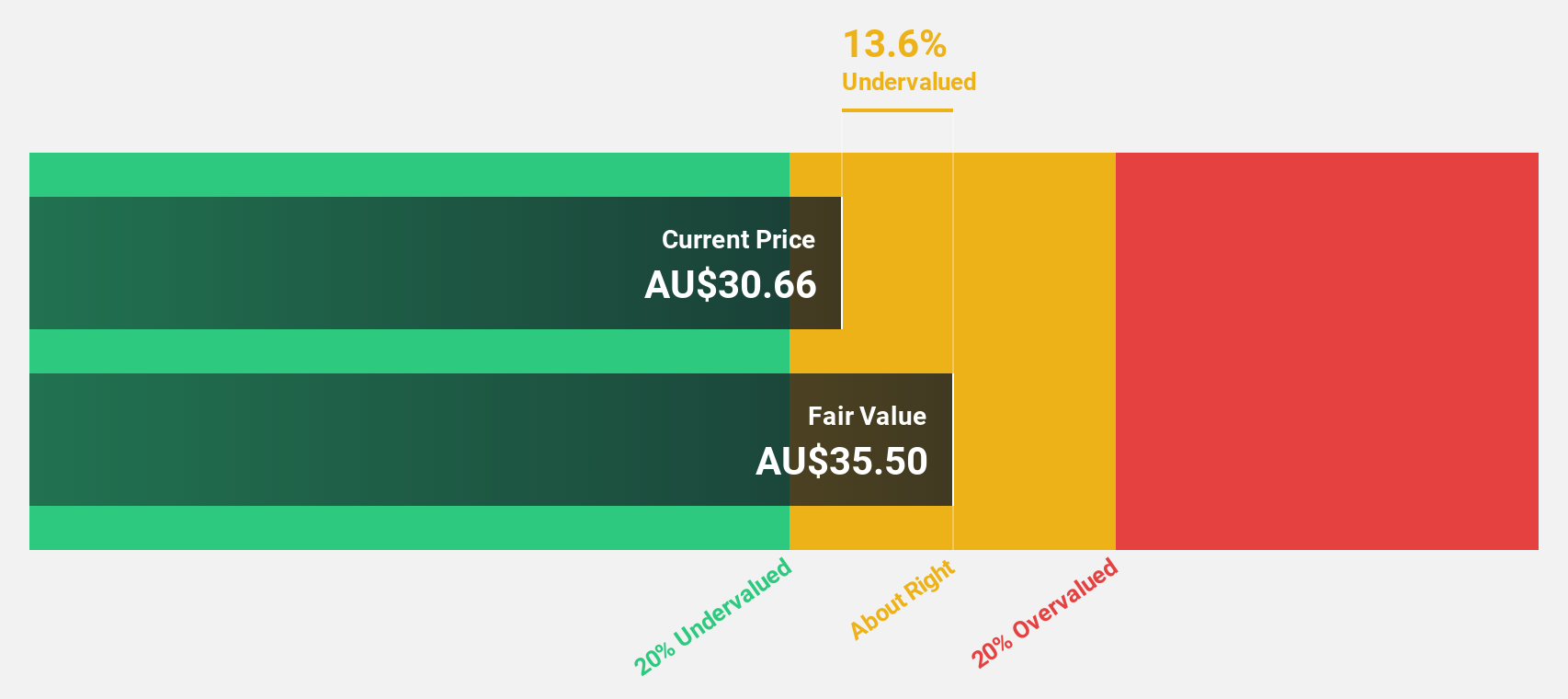

Estimated Discount To Fair Value: 29.9%

Lovisa Holdings is trading at A$28.7, well below its estimated fair value of A$40.97, highlighting its undervaluation based on cash flows. Although the dividend yield of 2.68% isn't fully covered by earnings, Lovisa's earnings and revenue are projected to grow faster than the Australian market average over the next few years. The company's recent Annual General Meeting addressed key governance issues, including director elections and remuneration reports, potentially impacting future strategic decisions.

- The analysis detailed in our Lovisa Holdings growth report hints at robust future financial performance.

- Navigate through the intricacies of Lovisa Holdings with our comprehensive financial health report here.

Temple & Webster Group (ASX:TPW)

Overview: Temple & Webster Group Ltd operates as an online retailer specializing in furniture, homewares, and home improvement products in Australia, with a market capitalization of A$1.50 billion.

Operations: The company's revenue is primarily derived from the sale of furniture, homewares, and home improvement products through its online platform, totaling A$600.72 million.

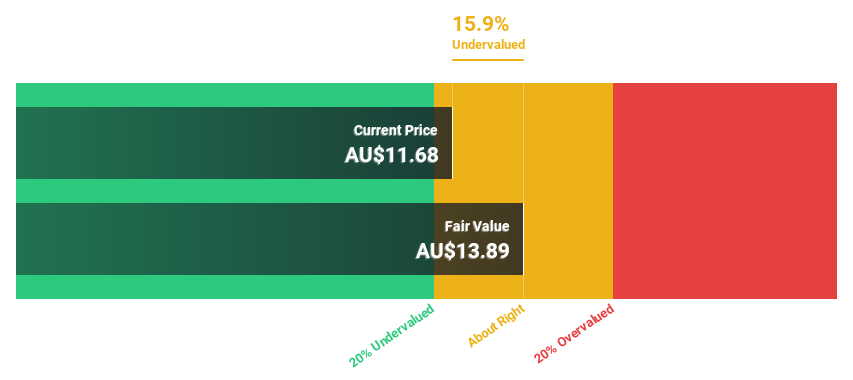

Estimated Discount To Fair Value: 10.3%

Temple & Webster Group is trading at A$12.5, slightly below its estimated fair value of A$13.93, indicating some undervaluation based on cash flows. While revenue growth is expected to be moderate at 15% annually, earnings are projected to increase significantly by 30.18% per year, outpacing the Australian market average. Recent discussions during shareholder meetings focused on governance matters like director elections and remuneration reports, which could influence strategic directions moving forward.

- The growth report we've compiled suggests that Temple & Webster Group's future prospects could be on the up.

- Dive into the specifics of Temple & Webster Group here with our thorough financial health report.

Summing It All Up

- Unlock our comprehensive list of 41 Undervalued ASX Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Temple & Webster Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TPW

Temple & Webster Group

Engages in the online retail of furniture, homewares, and home improvement products through its online platform in Australia.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion