For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Allkem (ASX:AKE). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Allkem

How Fast Is Allkem Growing Its Earnings Per Share?

In the last three years Allkem's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Allkem's EPS skyrocketed from US$0.51 to US$0.70, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 36%.

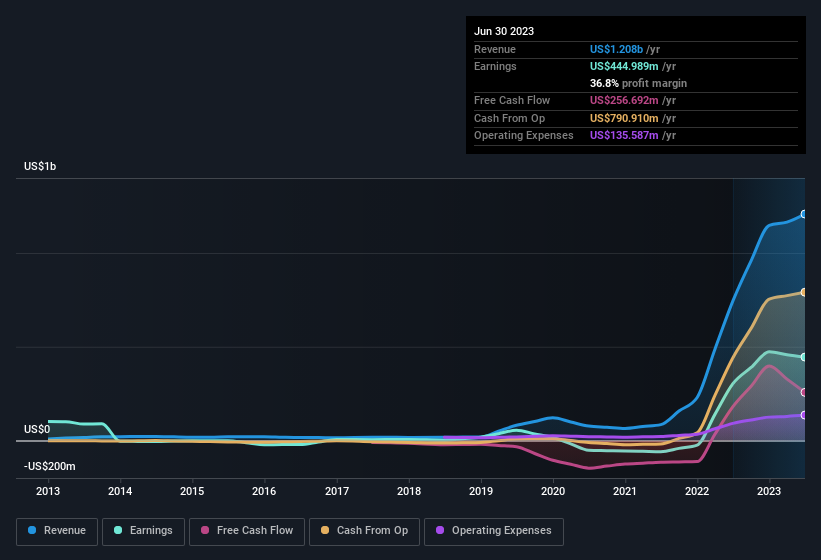

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Allkem shareholders can take confidence from the fact that EBIT margins are up from 59% to 67%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Allkem's future profits.

Are Allkem Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Shareholders in Allkem will be more than happy to see insiders committing themselves to the company, spending US$706k on shares in just twelve months. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. It is also worth noting that it was Chair Peter Coleman who made the biggest single purchase, worth AU$251k, paying AU$15.71 per share.

Along with the insider buying, another encouraging sign for Allkem is that insiders, as a group, have a considerable shareholding. With a whopping US$96m worth of shares as a group, insiders have plenty riding on the company's success. That's certainly enough to let shareholders know that management will be very focussed on long term growth.

Should You Add Allkem To Your Watchlist?

You can't deny that Allkem has grown its earnings per share at a very impressive rate. That's attractive. Furthermore, company insiders have been adding to their significant stake in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of Allkem.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Allkem, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Allkem, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AKE

Allkem

Allkem Limited engages in the production and sale of lithium and boron in Argentina.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives