A look at the shareholders of Altura Mining Limited (ASX:AJM) can tell us which group is most powerful. Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

Altura Mining is a smaller company with a market capitalization of AU$119m, so it may still be flying under the radar of many institutional investors. Taking a look at our data on the ownership groups (below), it's seems that institutional investors have not yet purchased much of the company. Let's take a closer look to see what the different types of shareholder can tell us about Altura Mining.

See our latest analysis for Altura Mining

What Does The Institutional Ownership Tell Us About Altura Mining?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

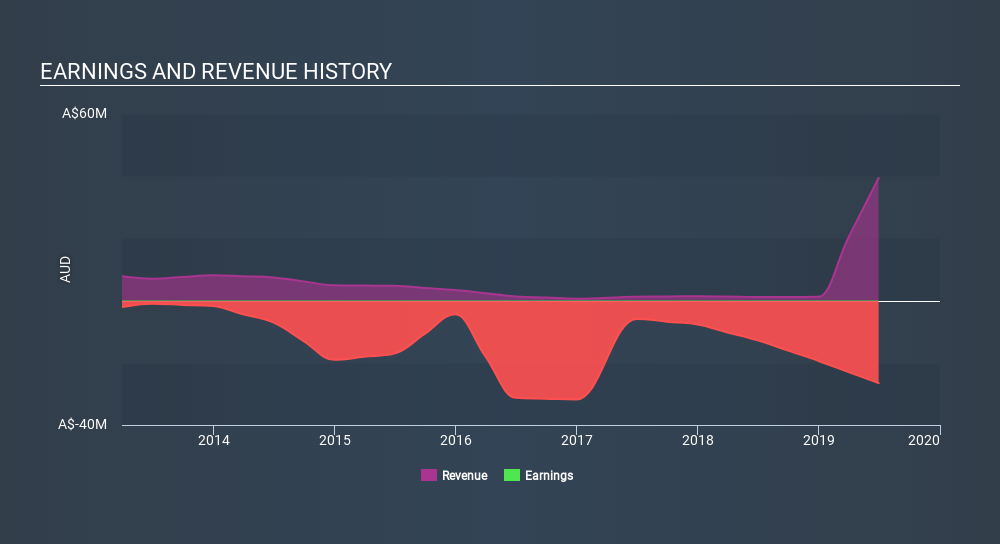

Institutions own less than 5% of Altura Mining. That indicates that the company is on the radar of some funds, but it isn't particularly popular with professional investors at the moment. If the company is growing earnings, that may indicate that it is just beginning to catch the attention of these deep-pocketed investors. When multiple institutional investors want to buy shares, we often see a rising share price. The past revenue trajectory (shown below) can be an indication of future growth, but there are no guarantees.

We note that hedge funds don't have a meaningful investment in Altura Mining. Looking at our data, we can see that the largest shareholder is Ningbo Shanshan Co.,Ltd. with 18% of shares outstanding. The second largest shareholder with 15%, is Allan Buckler, followed by Maxwell Smith, with an ownership of 7.5%.

A closer look at our ownership figures suggests that the top 12 shareholders have a combined ownership of 50% implying that no one share holder has a majority.

While it makes sense to study institutional ownership data for a company, It also makes sense to study analyst sentiments to know which way the wind is blowing. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of Altura Mining

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our information suggests that insiders maintain a significant holding in Altura Mining Limited. Insiders have a AU$34m stake in this AU$119m business. Ownership is clearly an important issue when it comes to investment selection. But ultimately, many risks exist within the business itself, rather than its shareholders. For example, we've discovered 4 warning signs for Altura Mining which any shareholder or potential investor should be aware of.

General Public Ownership

The general public holds a 48% stake in AJM. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Public Company Ownership

It appears to us that public companies own 18% of AJM. It's hard to say for sure, but this suggests they have entwined business interests. This might be a strategic stake, so it's worth watching this space for changes in ownership.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too.

I like to dive deeper into how a company has performed in the past. You can access this interactive graph of past earnings, revenue and cash flow, for free.

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion