Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Accent Resources N.L. (ASX:ACS) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Accent Resources

What Is Accent Resources's Net Debt?

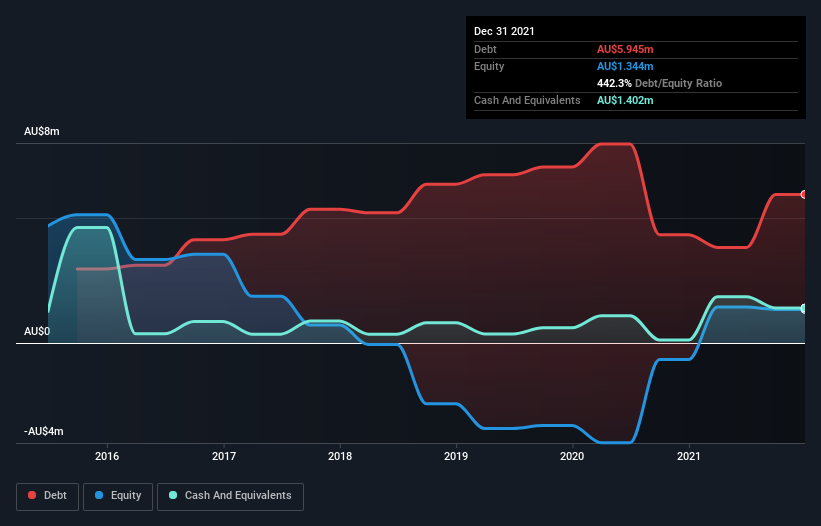

The image below, which you can click on for greater detail, shows that at December 2021 Accent Resources had debt of AU$5.94m, up from AU$4.33m in one year. However, because it has a cash reserve of AU$1.40m, its net debt is less, at about AU$4.54m.

How Strong Is Accent Resources' Balance Sheet?

According to the last reported balance sheet, Accent Resources had liabilities of AU$559.2k due within 12 months, and liabilities of AU$6.06m due beyond 12 months. Offsetting this, it had AU$1.40m in cash and AU$109.2k in receivables that were due within 12 months. So it has liabilities totalling AU$5.11m more than its cash and near-term receivables, combined.

Of course, Accent Resources has a market capitalization of AU$28.0m, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Accent Resources's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Given its lack of meaningful operating revenue, investors are probably hoping that Accent Resources finds some valuable resources, before it runs out of money.

Caveat Emptor

Importantly, Accent Resources had an earnings before interest and tax (EBIT) loss over the last year. To be specific the EBIT loss came in at AU$1.3m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. Another cause for caution is that is bled AU$3.6m in negative free cash flow over the last twelve months. So in short it's a really risky stock. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Accent Resources (of which 2 are a bit concerning!) you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ACS

Accent Resources

Engages in the exploration and evaluation of mineral deposits in Western Australia.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success