Revenue Beat: Steadfast Group Limited Exceeded Revenue Forecasts By 5.6% And Analysts Are Updating Their Estimates

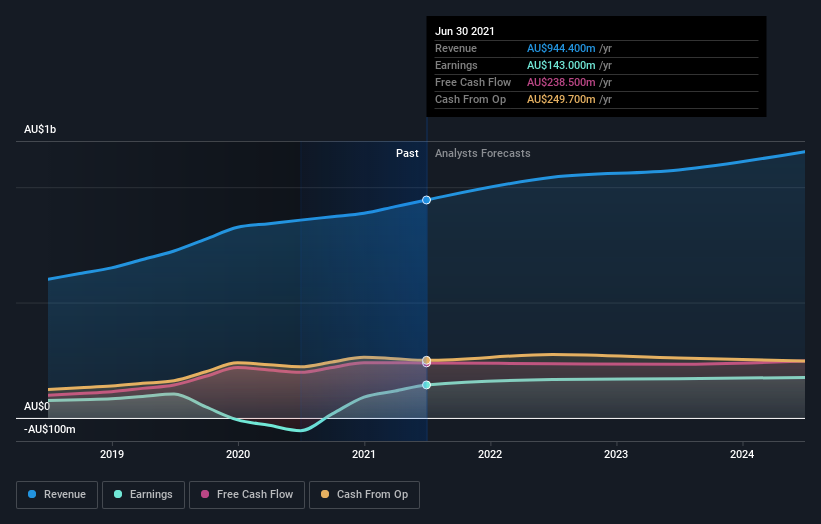

Steadfast Group Limited (ASX:SDF) investors will be delighted, with the company turning in some strong numbers with its latest results. Results were good overall, with revenues beating analyst predictions by 5.6% to hit AU$944m. Statutory earnings per share (EPS) came in at AU$0.17, some 2.1% above whatthe analysts had expected. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

View our latest analysis for Steadfast Group

After the latest results, the six analysts covering Steadfast Group are now predicting revenues of AU$1.04b in 2022. If met, this would reflect a decent 10% improvement in sales compared to the last 12 months. Per-share earnings are expected to increase 4.7% to AU$0.17. In the lead-up to this report, the analysts had been modelling revenues of AU$946.4m and earnings per share (EPS) of AU$0.17 in 2022. It seems sentiment has certainly become more bullish on revenues, even though they haven't changed their view on earnings per share.

The analysts increased their price target 5.2% to AU$4.74, perhaps signalling that higher revenues are a strong leading indicator for Steadfast Group's valuation. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on Steadfast Group, with the most bullish analyst valuing it at AU$5.30 and the most bearish at AU$4.00 per share. With such a narrow range of valuations, the analysts apparently share similar views on what they think the business is worth.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We would highlight that Steadfast Group's revenue growth is expected to slow, with the forecast 10% annualised growth rate until the end of 2022 being well below the historical 14% p.a. growth over the last five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 2.9% annually. So it's pretty clear that, while Steadfast Group's revenue growth is expected to slow, it's still expected to grow faster than the industry itself.

The Bottom Line

The most obvious conclusion is that there's been no major change in the business' prospects in recent times, with the analysts holding their earnings forecasts steady, in line with previous estimates. Pleasantly, they also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have forecasts for Steadfast Group going out to 2024, and you can see them free on our platform here.

You should always think about risks though. Case in point, we've spotted 2 warning signs for Steadfast Group you should be aware of.

If you decide to trade Steadfast Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:SDF

Steadfast Group

Provides general insurance brokerage services Australasia, Asia, and Europe.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026