This article will reflect on the compensation paid to Robert Kelly who has served as CEO of Steadfast Group Limited (ASX:SDF) since 1996. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Steadfast Group.

View our latest analysis for Steadfast Group

How Does Total Compensation For Robert Kelly Compare With Other Companies In The Industry?

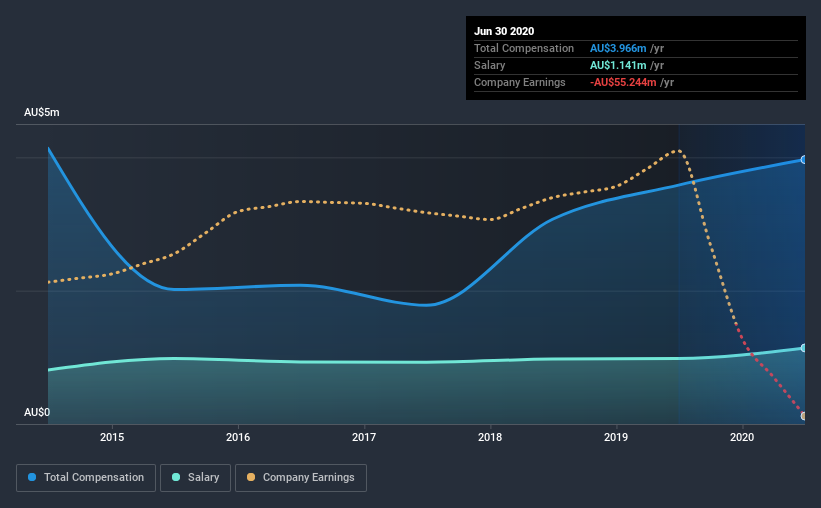

According to our data, Steadfast Group Limited has a market capitalization of AU$3.1b, and paid its CEO total annual compensation worth AU$4.0m over the year to June 2020. We note that's an increase of 11% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at AU$1.1m.

For comparison, other companies in the same industry with market capitalizations ranging between AU$1.4b and AU$4.5b had a median total CEO compensation of AU$3.0m. Hence, we can conclude that Robert Kelly is remunerated higher than the industry median. What's more, Robert Kelly holds AU$13m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$1.1m | AU$982k | 29% |

| Other | AU$2.8m | AU$2.6m | 71% |

| Total Compensation | AU$4.0m | AU$3.6m | 100% |

On an industry level, around 41% of total compensation represents salary and 59% is other remuneration. In Steadfast Group's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Steadfast Group Limited's Growth

Steadfast Group Limited has reduced its earnings per share by 51% a year over the last three years. It achieved revenue growth of 18% over the last year.

The decrease in EPS could be a concern for some investors. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Steadfast Group Limited Been A Good Investment?

Boasting a total shareholder return of 34% over three years, Steadfast Group Limited has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

As we noted earlier, Steadfast Group pays its CEO higher than the norm for similar-sized companies belonging to the same industry. But Steadfast Group is growing its revenue, and total shareholder returns have also been pleasing for the last three years. Sadly, EPS growth did not follow suit, remaining during this time. Although we would have liked to see EPS growth, positive shareholder returns, and growing revenues make us believe CEO compensation is reasonable.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 4 warning signs for Steadfast Group (of which 1 can't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Steadfast Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:SDF

Steadfast Group

Provides general insurance brokerage services Australasia, Asia, and Europe.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026