The Australian market has shown positive momentum, rising 1.1% over the last week and climbing 11% in the past year, with earnings expected to grow by 13% annually in the coming years. In this favorable environment, identifying strong dividend stocks can be an effective strategy for boosting your income and capitalizing on market growth.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Perenti (ASX:PRN) | 7.92% | ★★★★★☆ |

| Collins Foods (ASX:CKF) | 3.72% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.24% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.73% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.70% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.62% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 3.87% | ★★★★★☆ |

| New Hope (ASX:NHC) | 9.41% | ★★★★☆☆ |

| Grange Resources (ASX:GRR) | 7.27% | ★★★★☆☆ |

| Macquarie Group (ASX:MQG) | 3.00% | ★★★★☆☆ |

Click here to see the full list of 33 stocks from our Top ASX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

MFF Capital Investments (ASX:MFF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MFF Capital Investments Limited is an investment firm manager with a market cap of A$2.19 billion.

Operations: MFF Capital Investments Limited generates revenue primarily from its equity investments, amounting to A$659.96 million.

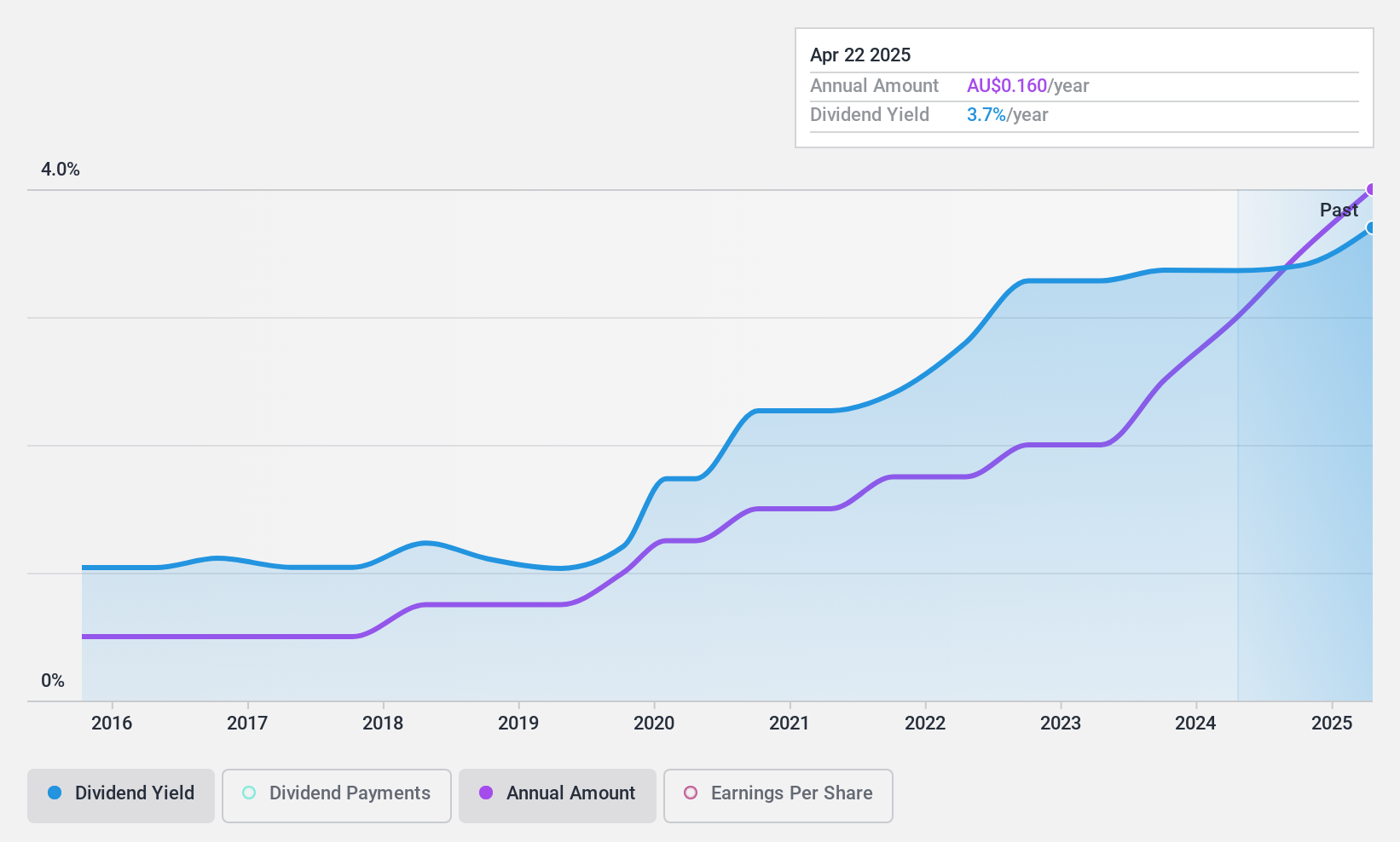

Dividend Yield: 3.7%

MFF Capital Investments offers a reliable dividend yield of 3.7%, with payments well-covered by earnings (payout ratio: 16.8%) and cash flows (cash payout ratio: 24.1%). The company has consistently increased its dividends over the past decade, maintaining stability. Recent earnings show strong growth, with net income rising to A$447.36 million from A$323.58 million year-over-year, supporting the final dividend of 7 cents per share announced for November 2024 payment.

- Take a closer look at MFF Capital Investments' potential here in our dividend report.

- Our expertly prepared valuation report MFF Capital Investments implies its share price may be lower than expected.

QBE Insurance Group (ASX:QBE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: QBE Insurance Group Limited underwrites general insurance and reinsurance risks in the Australia Pacific, North America, and internationally, with a market cap of A$23.74 billion.

Operations: QBE Insurance Group Limited generates revenue from its International segment ($9.56 billion), North America ($7.71 billion), and Australia Pacific ($5.91 billion).

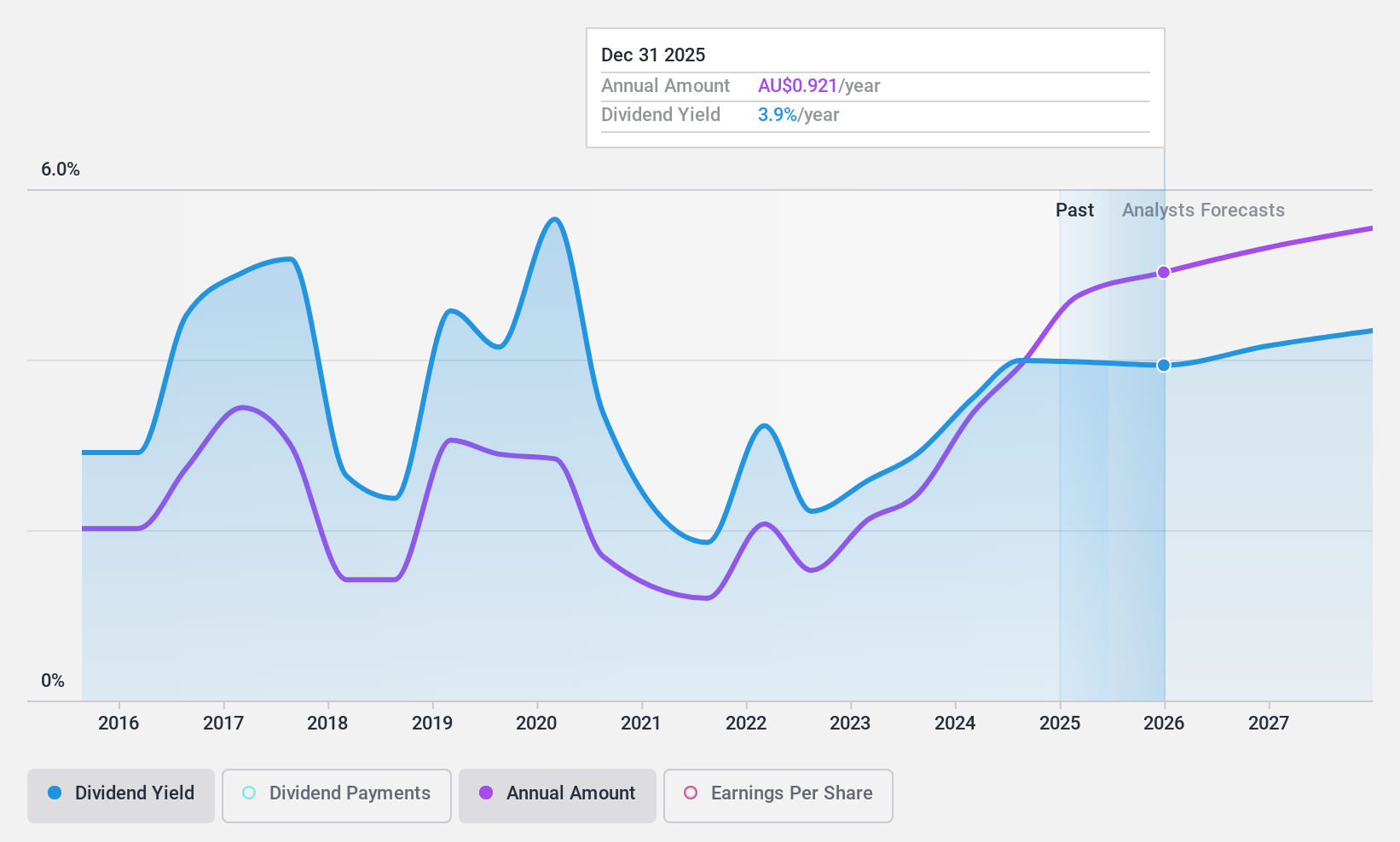

Dividend Yield: 3.7%

QBE Insurance Group's recent interim dividend increase to 24 Australian cents per share, up from 14 cents last year, reflects improved earnings and cash flow coverage. The company's net income for H1 2024 nearly doubled to US$802 million, supporting a payout ratio of 42.9% and a low cash payout ratio of 17.2%. However, QBE's dividend history has been volatile over the past decade despite recent growth in payments.

- Click to explore a detailed breakdown of our findings in QBE Insurance Group's dividend report.

- Our valuation report unveils the possibility QBE Insurance Group's shares may be trading at a discount.

Ridley (ASX:RIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ridley Corporation Limited (ASX:RIC) provides animal nutrition solutions in Australia and has a market cap of A$691.67 million.

Operations: Ridley Corporation Limited generates revenue from two primary segments: Bulk Stockfeeds, which accounts for A$886.59 million, and Packaged/Ingredients, contributing A$376.31 million.

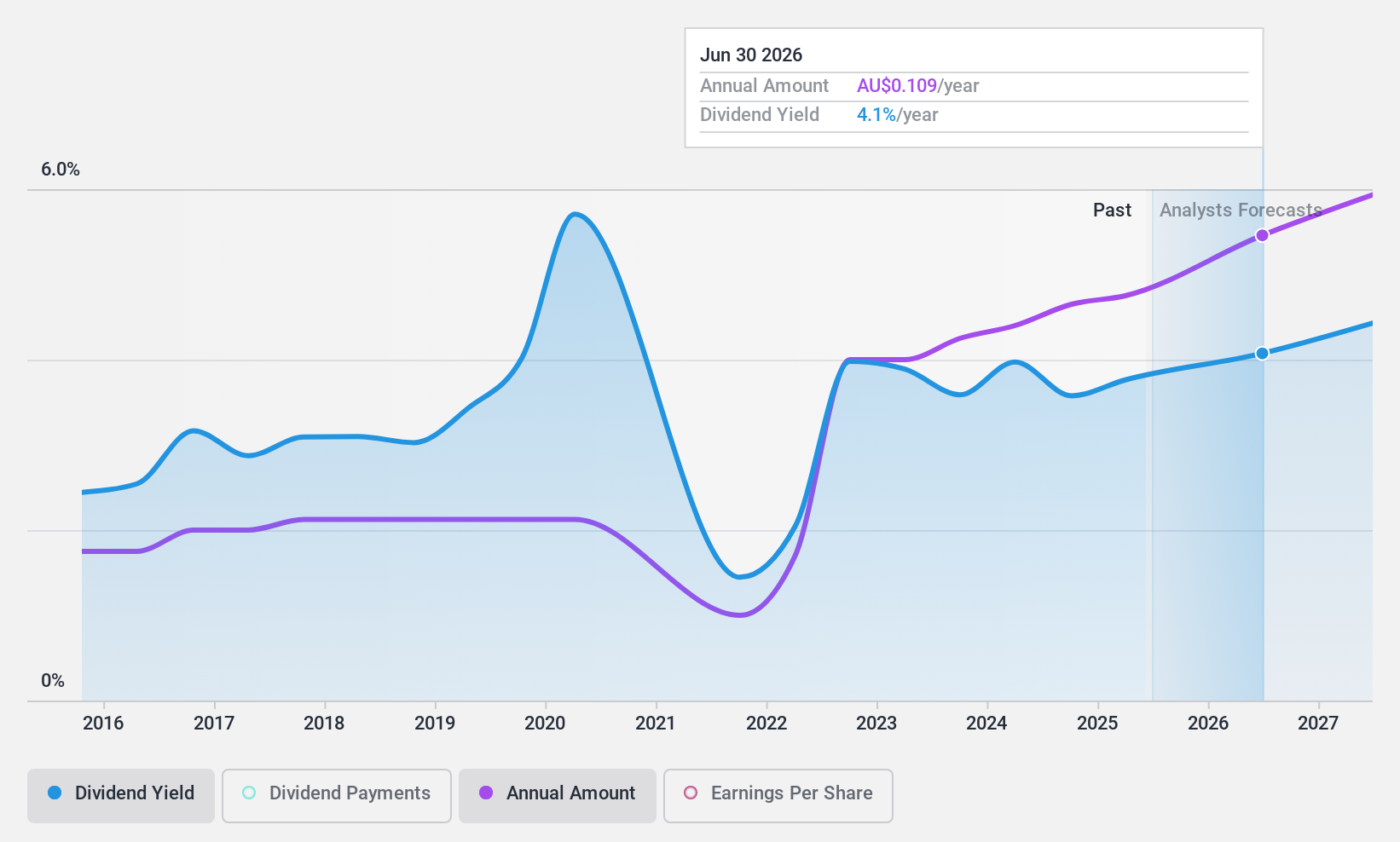

Dividend Yield: 4.2%

Ridley Corporation's recent buyback program aims to repurchase up to 9 million shares for A$20 million, reflecting a strategic move to enhance shareholder value. The company reported full-year sales of A$1.26 billion and net income of A$39.85 million, slightly down from the previous year. Despite this, Ridley increased its dividend to A$0.0465 per share for H2 2024. Dividend payments are well-covered by earnings and cash flows but have been historically volatile over the past decade.

- Dive into the specifics of Ridley here with our thorough dividend report.

- According our valuation report, there's an indication that Ridley's share price might be on the cheaper side.

Key Takeaways

- Take a closer look at our Top ASX Dividend Stocks list of 33 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RIC

Ridley

Engages in the provision of animal nutrition solutions in Australia.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives