QBE Insurance Group Limited (ASX:QBE) Looks Inexpensive But Perhaps Not Attractive Enough

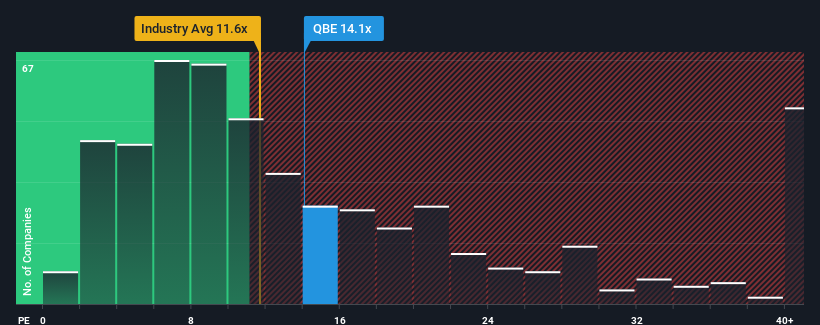

QBE Insurance Group Limited's (ASX:QBE) price-to-earnings (or "P/E") ratio of 14.1x might make it look like a buy right now compared to the market in Australia, where around half of the companies have P/E ratios above 19x and even P/E's above 37x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

QBE Insurance Group certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for QBE Insurance Group

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like QBE Insurance Group's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 247% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 13% each year as estimated by the twelve analysts watching the company. That's shaping up to be materially lower than the 17% per year growth forecast for the broader market.

With this information, we can see why QBE Insurance Group is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On QBE Insurance Group's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of QBE Insurance Group's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for QBE Insurance Group that you should be aware of.

You might be able to find a better investment than QBE Insurance Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if QBE Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:QBE

QBE Insurance Group

Engages in underwriting general insurance and reinsurance risks in the Australia Pacific, North America, and internationally.

Undervalued with solid track record and pays a dividend.