Here's Why We Think nib holdings (ASX:NHF) Is Well Worth Watching

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like nib holdings (ASX:NHF). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for nib holdings

How Fast Is nib holdings Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. As a tree reaches steadily for the sky, nib holdings's EPS has grown 19% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

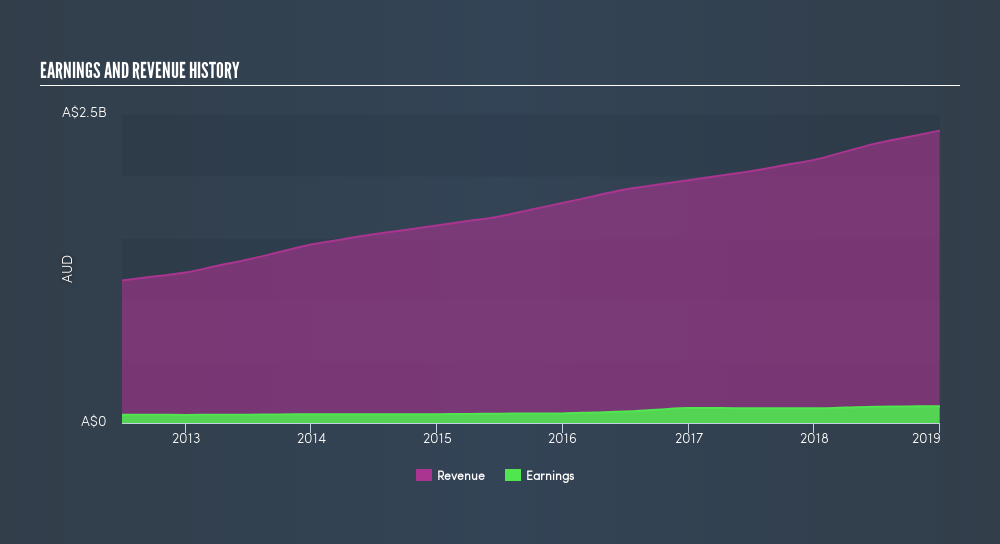

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that nib holdings's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. nib holdings maintained stable EBIT margins over the last year, all while growing revenue 11% to AU$2.4b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this freeinteractive visualization of nib holdings's forecast profits?.

Are nib holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Over the last 12 months nib holdings insiders spent AU$232k more buying shares than they received from selling them. On balance, that's a good sign. We also note that it was the MD, CEO & Executive Director, Mark Fitzgibbon, who made the biggest single acquisition, paying AU$591k for shares at about AU$6.45 each.

The good news, alongside the insider buying, for nib holdings bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have AU$29m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 1.1% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Is nib holdings Worth Keeping An Eye On?

You can't deny that nib holdings has grown its earnings per share at a very impressive rate. That's attractive. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So I do think this is one stock worth watching. If you think nib holdings might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

As a growth investor I do like to see insider buying. But nib holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdictionWe aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:NHF

nib holdings

Engages in the underwriting and distribution of private health, life, and living insurance to residents, international students, and visitors in Australia and New Zealand.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives