Do Institutions Own Medibank Private Limited (ASX:MPL) Shares?

Every investor in Medibank Private Limited (ASX:MPL) should be aware of the most powerful shareholder groups. Generally speaking, as a company grows, institutions will increase their ownership. Conversely, insiders often decrease their ownership over time. We also tend to see lower insider ownership in companies that were previously publicly owned.

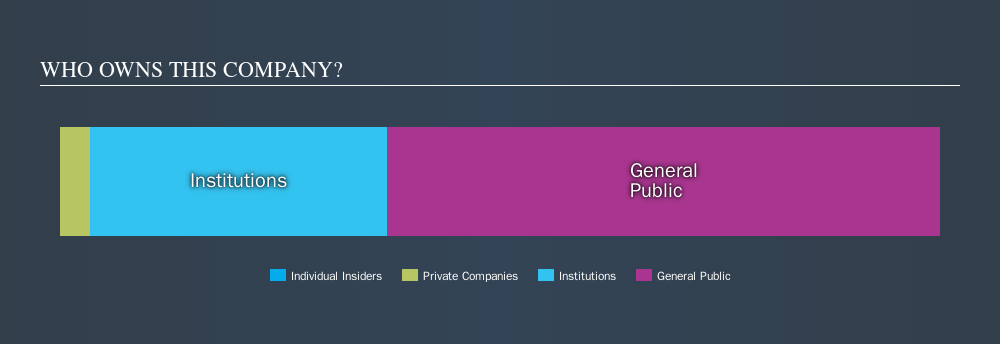

Medibank Private has a market capitalization of AU$8.9b, so it's too big to fly under the radar. We'd expect to see both institutions and retail investors owning a portion of the company. In the chart below below, we can see that institutional investors have bought into the company. Let's delve deeper into each type of owner, to discover more about MPL.

See our latest analysis for Medibank Private

What Does The Institutional Ownership Tell Us About Medibank Private?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

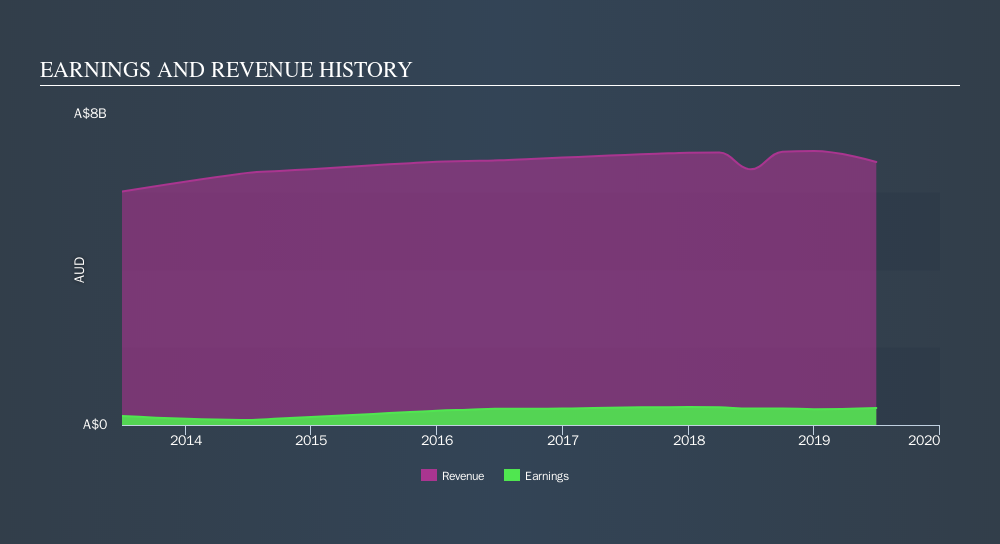

Medibank Private already has institutions on the share registry. Indeed, they own 34% of the company. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Medibank Private's historic earnings and revenue, below, but keep in mind there's always more to the story.

Hedge funds don't have many shares in Medibank Private. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of Medibank Private

The definition of company insiders can be subjective, and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. The company management answer to the board; and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board, themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our information suggests that Medibank Private Limited insiders own under 1% of the company. But they may have an indirect interest through a corporate structure that we haven't picked up on. It is a pretty big company, so it would be possible for board members to own a meaningful interest in the company, without owning much of a proportional interest. In this case, they own around AU$8.8m worth of shares (at current prices). It is good to see board members owning shares, but it might be worth checking if those insiders have been buying.

General Public Ownership

The general public, mostly retail investors, hold a substantial 63% stake in MPL, suggesting it is a fairly popular stock. With this size of ownership, retail investors can collectively play a role in decisions that affect shareholder returns, such as dividend policies and the appointment of directors. They can also exercise the power to decline an acquisition or merger that may not improve profitability.

Private Company Ownership

Our data indicates that Private Companies hold 3.4%, of the company's shares. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it's hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important.

I always like to check for a history of revenue growth. You can too, by accessing this free chart of historic revenue and earnings in this detailed graph.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:MPL

Medibank Private

Provides private health insurance and health services in Australia.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives