- Australia

- /

- Oil and Gas

- /

- ASX:VEA

3 ASX Stocks Including Medibank Private That May Be Priced Below Estimated Value

Reviewed by Simply Wall St

In recent trading sessions, the Australian market has faced downward pressure, with the ASX200 closing 0.67% lower at 8,150 points amid investor concerns over Middle Eastern conflicts. Despite this volatility, sectors like Energy and Health Care have shown resilience, suggesting opportunities may exist for discerning investors seeking stocks potentially priced below their estimated value. In such an environment, identifying undervalued stocks can be crucial for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Duratec (ASX:DUR) | A$1.395 | A$2.59 | 46.1% |

| Charter Hall Group (ASX:CHC) | A$15.92 | A$31.44 | 49.4% |

| Genesis Minerals (ASX:GMD) | A$2.04 | A$3.92 | 48% |

| Ingenia Communities Group (ASX:INA) | A$4.97 | A$9.41 | 47.2% |

| IperionX (ASX:IPX) | A$3.40 | A$6.70 | 49.2% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| IDP Education (ASX:IEL) | A$15.19 | A$27.80 | 45.4% |

| Megaport (ASX:MP1) | A$7.36 | A$13.44 | 45.2% |

| Superloop (ASX:SLC) | A$1.71 | A$3.31 | 48.4% |

| Mineral Resources (ASX:MIN) | A$50.99 | A$95.63 | 46.7% |

Let's uncover some gems from our specialized screener.

Medibank Private (ASX:MPL)

Overview: Medibank Private Limited offers private health insurance and health services in Australia, with a market cap of A$10.08 billion.

Operations: The company's revenue is primarily derived from Health Insurance, contributing A$7.90 billion, and Medibank Health services, which add A$360.10 million.

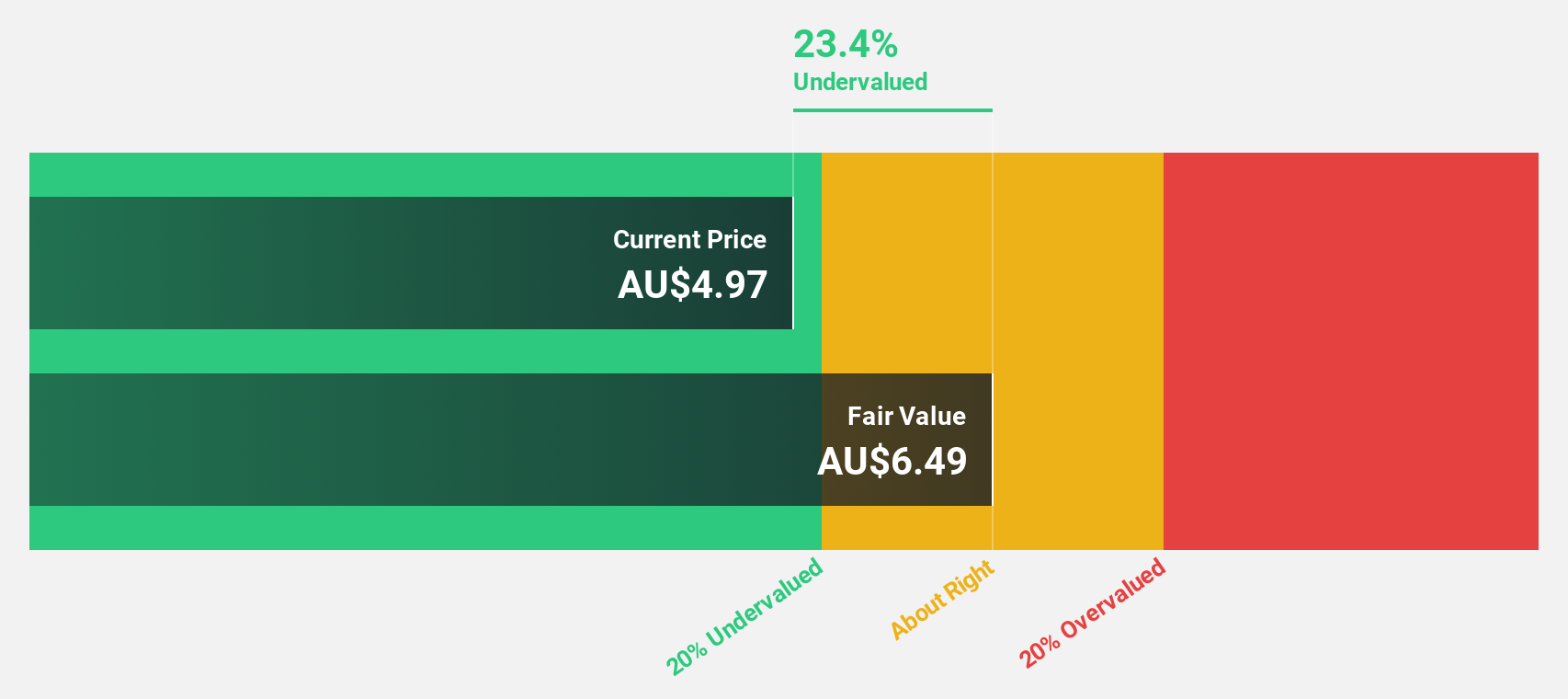

Estimated Discount To Fair Value: 43.5%

Medibank Private is trading at A$3.66, significantly below its estimated fair value of A$6.48, suggesting it may be undervalued based on cash flows. Despite a recent net income of A$3.9 million, the company's earnings are forecast to grow 28.1% annually, outpacing the Australian market's growth rate of 12.2%. However, its dividend yield of 4.54% is not well covered by earnings, posing potential sustainability concerns.

- Our growth report here indicates Medibank Private may be poised for an improving outlook.

- Take a closer look at Medibank Private's balance sheet health here in our report.

National Storage REIT (ASX:NSR)

Overview: National Storage REIT is the largest self-storage provider in Australia and New Zealand, operating over 225 centers that offer tailored storage solutions to more than 90,000 residential and commercial customers, with a market cap of A$3.50 billion.

Operations: The company's revenue segment includes A$354.69 million from the operation and management of storage centers.

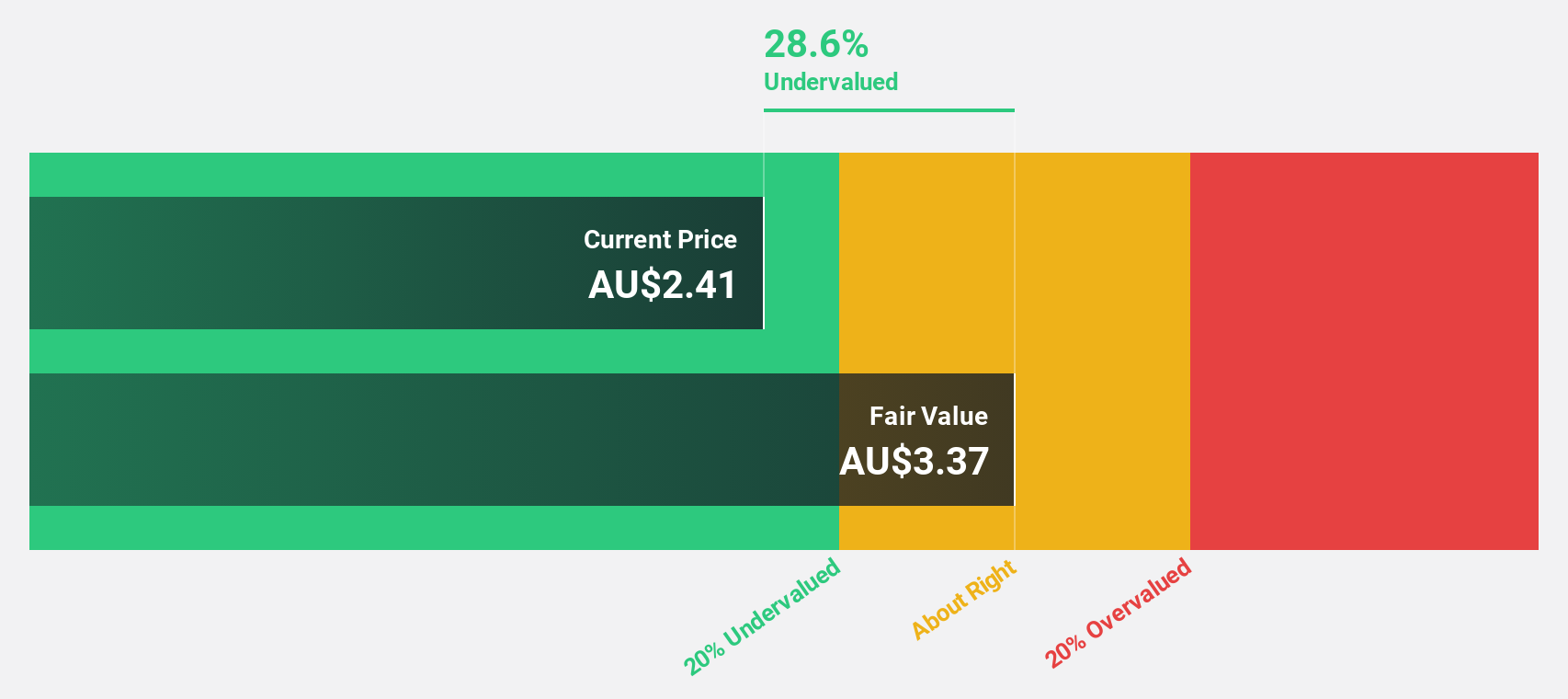

Estimated Discount To Fair Value: 37.1%

National Storage REIT, trading at A$2.53, is valued below its estimated fair value of A$4.02, highlighting potential undervaluation based on cash flows. Despite a drop in net income to A$28.93 million for the year ended June 30, 2024, earnings are projected to grow significantly at 20% annually over the next three years. The company maintains a reliable dividend yield of 4.35%, though its return on equity is forecasted to remain low at 4.6%.

- The growth report we've compiled suggests that National Storage REIT's future prospects could be on the up.

- Navigate through the intricacies of National Storage REIT with our comprehensive financial health report here.

Viva Energy Group (ASX:VEA)

Overview: Viva Energy Group Limited is an energy company operating in Australia, Singapore, and Papua New Guinea with a market cap of A$4.80 billion.

Operations: The company generates revenue from three main segments: Convenience & Mobility (A$11.43 billion), Commercial & Industrial (A$16.97 billion), and Energy & Infrastructure (A$7.92 billion).

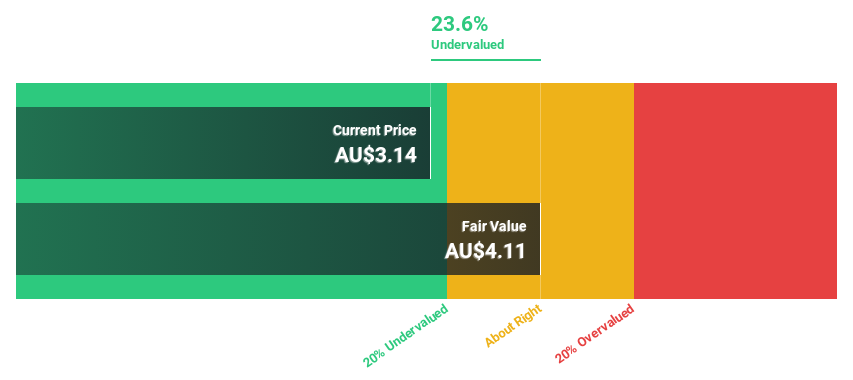

Estimated Discount To Fair Value: 16.8%

Viva Energy Group, currently trading at A$3.02, is below its fair value estimate of A$3.63, suggesting some undervaluation based on cash flows. The company recently turned profitable with a net income of A$80 million for the half-year ending June 2024, contrasting a net loss previously. Despite high earnings growth forecasts of 26.43% annually over three years, dividends have decreased and are not well-covered by earnings due to significant insider selling and shareholder dilution concerns.

- The analysis detailed in our Viva Energy Group growth report hints at robust future financial performance.

- Dive into the specifics of Viva Energy Group here with our thorough financial health report.

Key Takeaways

- Discover the full array of 46 Undervalued ASX Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:VEA

Viva Energy Group

Operates as an energy company in Australia, Singapore, and Papua New Guinea.

Moderate with reasonable growth potential.