- Australia

- /

- Construction

- /

- ASX:TEA

Discovering Hidden Gems in Australia This October 2024

Reviewed by Simply Wall St

In October 2024, the Australian market has been experiencing volatility, with the ASX200 closing 0.67% lower at 8,150 points amid investor concerns over Middle Eastern conflicts and sector-specific fluctuations. In this climate of uncertainty, identifying hidden gems in the small-cap space requires a keen eye for companies that demonstrate resilience and potential for growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Bisalloy Steel Group | 0.95% | 10.27% | 24.14% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| SKS Technologies Group | NA | 34.65% | 47.39% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Qualitas (ASX:QAL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Qualitas is a real estate investment firm specializing in direct investments across various real estate classes and geographies, as well as acquisitions, distressed debt restructuring, capital raisings, and consulting services, with a market cap of A$749.45 million.

Operations: Qualitas generates revenue primarily through direct lending, contributing A$26.79 million, and funds management, which adds A$13.61 million.

Qualitas, a financial firm with high-quality earnings, saw its net income rise to A$26.18 million from A$22.34 million last year, reflecting a 17.2% growth in earnings over the past year. The company's net debt to equity ratio stands at 26.1%, which is considered satisfactory and significantly reduced from 931.3% five years ago to 79.6%. Recent leadership changes include the appointment of Darren Steinberg as an independent non-executive director, enhancing their board expertise in commercial property and funds management.

Redox (ASX:RDX)

Simply Wall St Value Rating: ★★★★★★

Overview: Redox Limited is a company that supplies and distributes chemicals, ingredients, and raw materials across Australia, New Zealand, the United States, and internationally with a market capitalization of A$1.79 billion.

Operations: Redox generates revenue primarily from its wholesale drugs segment, amounting to A$1.14 billion.

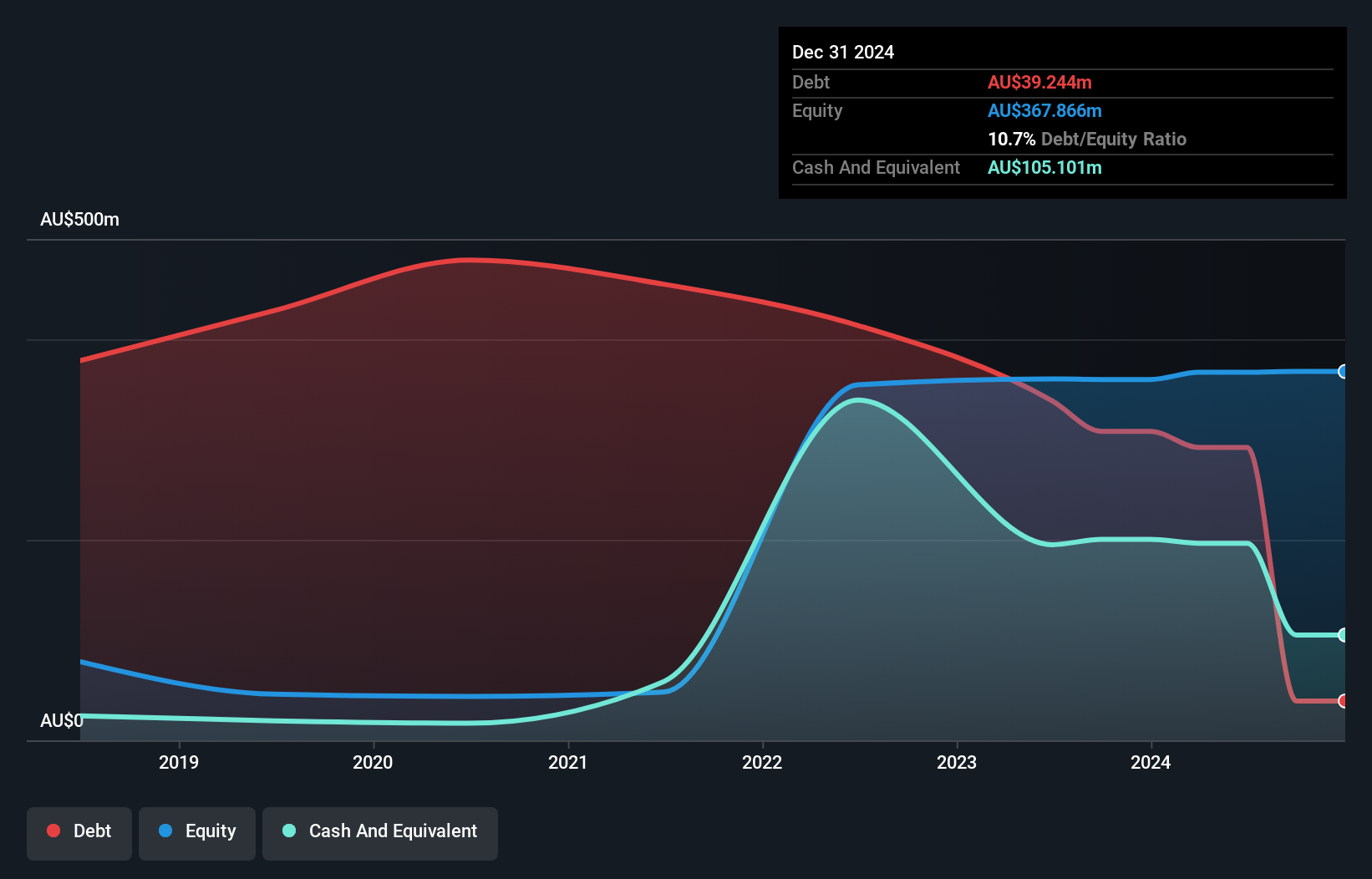

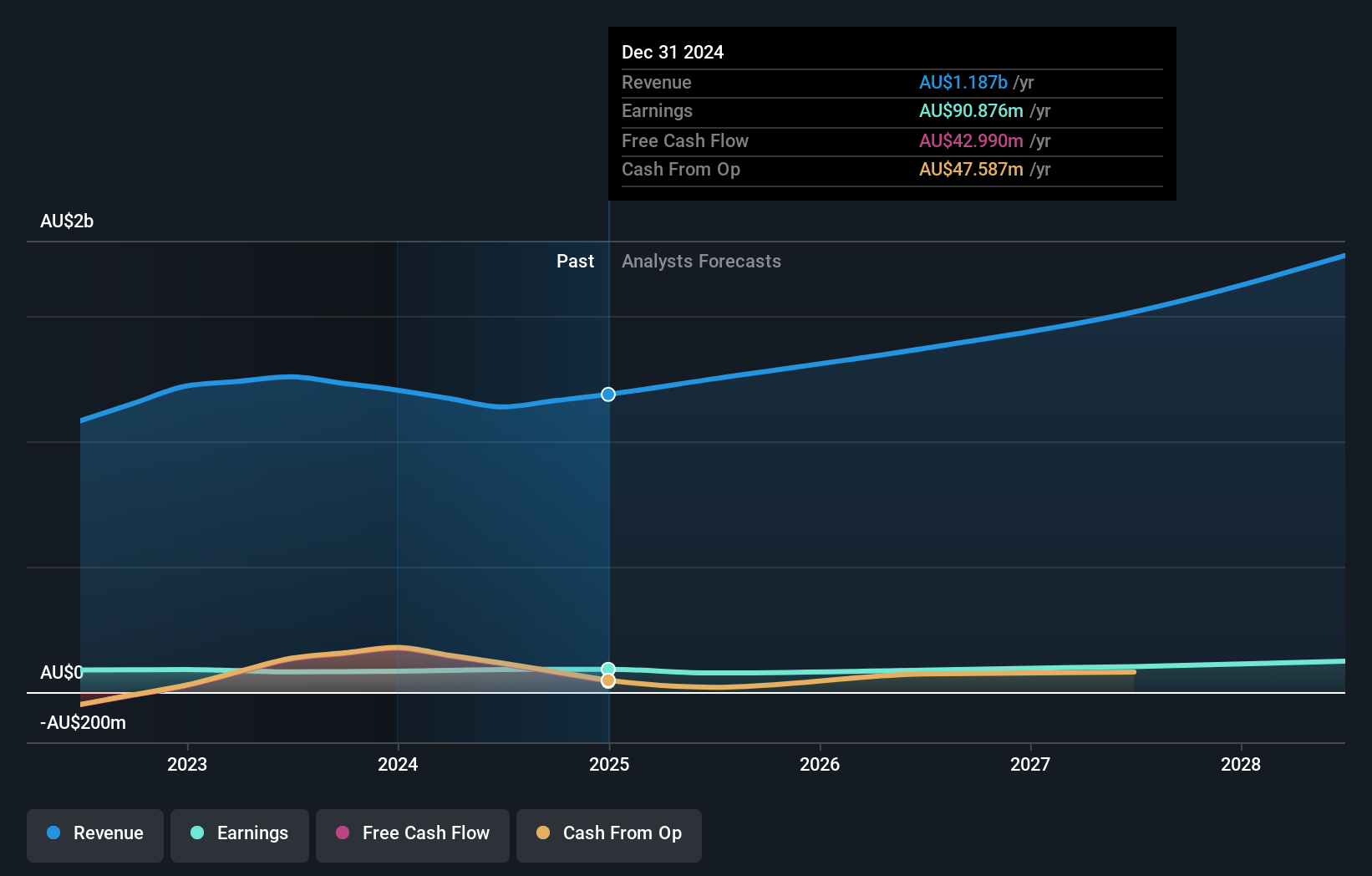

Redox, a promising player in the Australian market, has shown impressive financial health with its debt to equity ratio dropping from 69.6% to 2.6% over five years and more cash than total debt. The company reported a net income of A$90.24 million for the year ending June 2024, up from A$80.73 million previously, despite sales dipping slightly to A$1.14 billion from A$1.26 billion last year. Trading at 6.7% below estimated fair value and maintaining high-quality earnings, Redox remains profitable with positive free cash flow and forecasts earnings growth of 7.63% annually.

- Dive into the specifics of Redox here with our thorough health report.

Gain insights into Redox's historical performance by reviewing our past performance report.

Tasmea (ASX:TEA)

Simply Wall St Value Rating: ★★★★★★

Overview: Tasmea Limited specializes in providing shutdown, maintenance, emergency breakdown, and capital upgrade services across Australia with a market capitalization of approximately A$519.87 million.

Operations: Tasmea generates revenue primarily from Mechanical Services (A$141.42 million) and Electrical Services (A$129.44 million), with additional contributions from Water & Fluid and Civil Services.

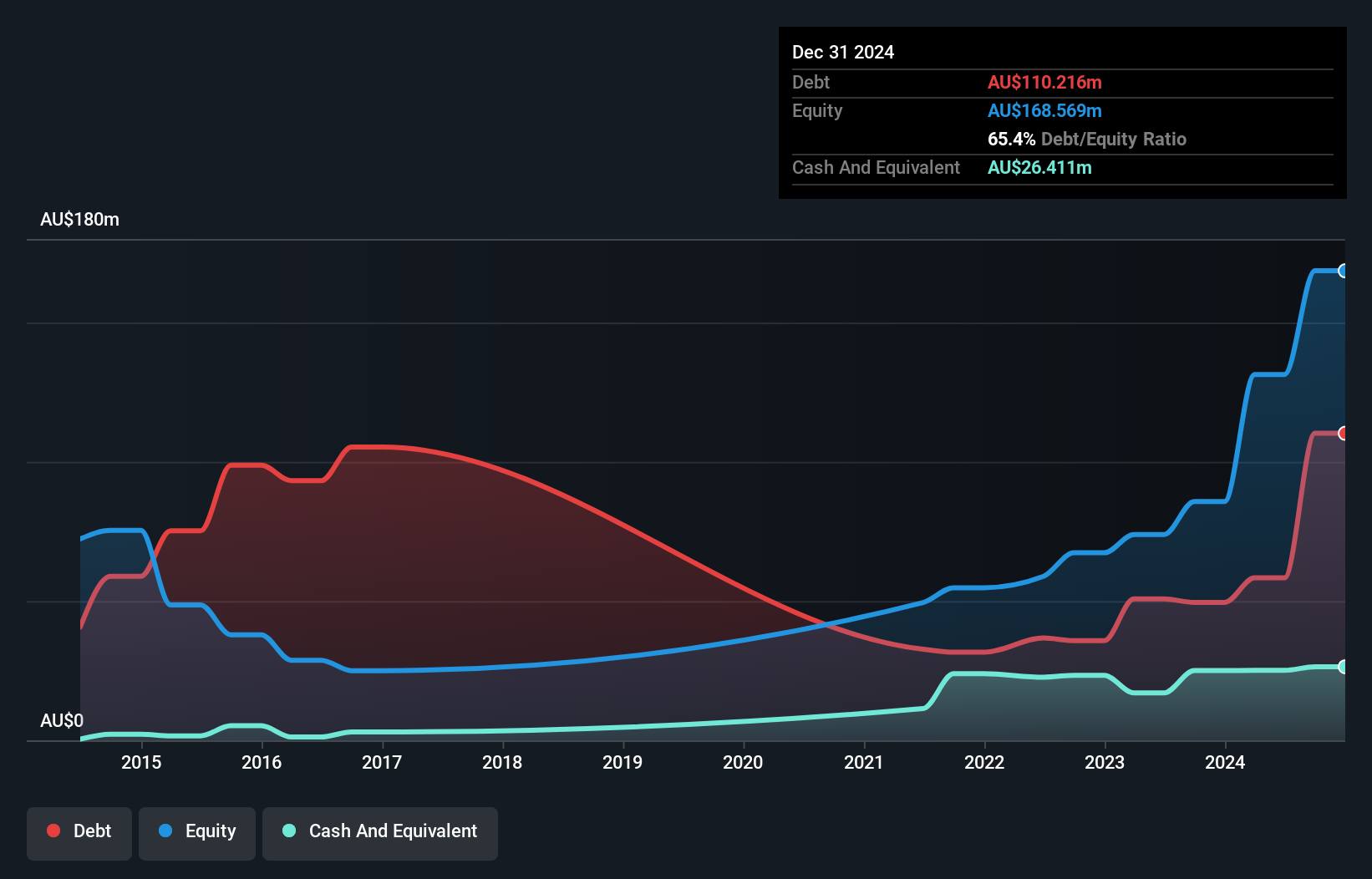

Tasmea seems to be making waves with its recent inclusion in the S&P/ASX Emerging Companies Index, highlighting its growth potential. The company reported a notable earnings increase of A$30.35 million from A$19.32 million last year, showcasing robust performance. Its net debt to equity ratio stands at a satisfactory 25.3%, and interest payments are well covered by EBIT at 12 times coverage, indicating financial stability and efficient debt management in the current landscape.

- Navigate through the intricacies of Tasmea with our comprehensive health report here.

Assess Tasmea's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Delve into our full catalog of 57 ASX Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tasmea might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TEA

Tasmea

Provides shutdown, maintenance, emergency breakdown, and capital upgrade services in Australia.

Exceptional growth potential with outstanding track record.

Market Insights

Community Narratives