- Australia

- /

- Medical Equipment

- /

- ASX:UBI

We Think Universal Biosensors (ASX:UBI) Needs To Drive Business Growth Carefully

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So, the natural question for Universal Biosensors (ASX:UBI) shareholders is whether they should be concerned by its rate of cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

See our latest analysis for Universal Biosensors

Does Universal Biosensors Have A Long Cash Runway?

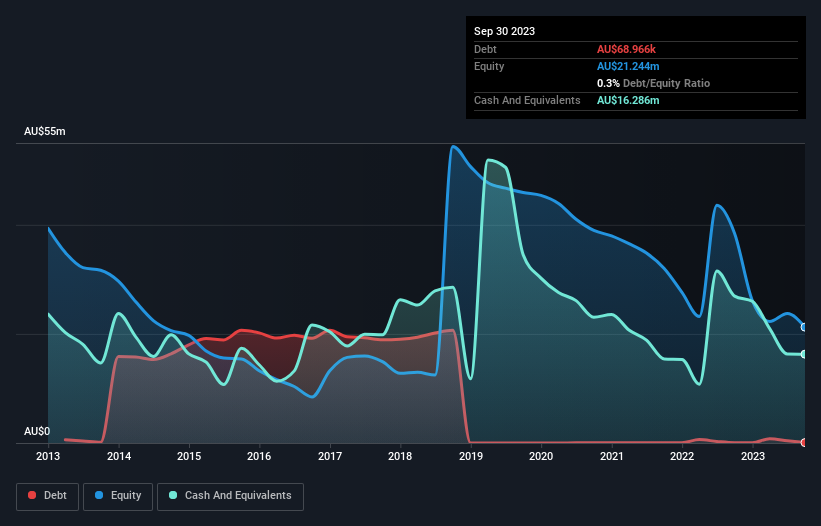

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. Universal Biosensors has such a small amount of debt that we'll set it aside, and focus on the AU$16m in cash it held at September 2023. Looking at the last year, the company burnt through AU$11m. So it had a cash runway of approximately 17 months from September 2023. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. The image below shows how its cash balance has been changing over the last few years.

How Well Is Universal Biosensors Growing?

We reckon the fact that Universal Biosensors managed to shrink its cash burn by 27% over the last year is rather encouraging. Revenue also improved during the period, increasing by 5.7%. On balance, we'd say the company is improving over time. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how Universal Biosensors has developed its business over time by checking this visualization of its revenue and earnings history.

How Easily Can Universal Biosensors Raise Cash?

Universal Biosensors seems to be in a fairly good position, in terms of cash burn, but we still think it's worthwhile considering how easily it could raise more money if it wanted to. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of AU$46m, Universal Biosensors' AU$11m in cash burn equates to about 25% of its market value. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

Is Universal Biosensors' Cash Burn A Worry?

Even though its cash burn relative to its market cap makes us a little nervous, we are compelled to mention that we thought Universal Biosensors' cash burn reduction was relatively promising. We don't think its cash burn is particularly problematic, but after considering the range of factors in this article, we do think shareholders should be monitoring how it changes over time. Separately, we looked at different risks affecting the company and spotted 3 warning signs for Universal Biosensors (of which 1 is concerning!) you should know about.

Of course Universal Biosensors may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:UBI

Universal Biosensors

Through its subsidiaries, designs and develops electrochemical cells (strips) used in conjunction with point-of-use devices in Australia, the Americas, Europe, and internationally.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026