- Australia

- /

- Healthcare Services

- /

- ASX:REG

Unveiling Three ASX Stocks Estimated To Trade Below Their Fair Value

Reviewed by Simply Wall St

The Australian stock market has shown robust performance, with a 3.0% increase over the last week and a 10% rise over the past year, coupled with an anticipated annual earnings growth of 14%. In this context, identifying stocks that trade below their fair value can offer investors potential opportunities for growth in a flourishing market environment.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Fenix Resources (ASX:FEX) | A$0.40 | A$0.77 | 47.8% |

| MaxiPARTS (ASX:MXI) | A$2.04 | A$3.96 | 48.5% |

| GTN (ASX:GTN) | A$0.435 | A$0.85 | 48.8% |

| hipages Group Holdings (ASX:HPG) | A$1.04 | A$2.06 | 49.5% |

| VEEM (ASX:VEE) | A$1.82 | A$3.54 | 48.6% |

| Strike Energy (ASX:STX) | A$0.21 | A$0.41 | 48.5% |

| Australian Clinical Labs (ASX:ACL) | A$2.42 | A$4.67 | 48.2% |

| ReadyTech Holdings (ASX:RDY) | A$3.25 | A$6.20 | 47.6% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| MedAdvisor (ASX:MDR) | A$0.55 | A$1.07 | 48.5% |

Underneath we present a selection of stocks filtered out by our screen.

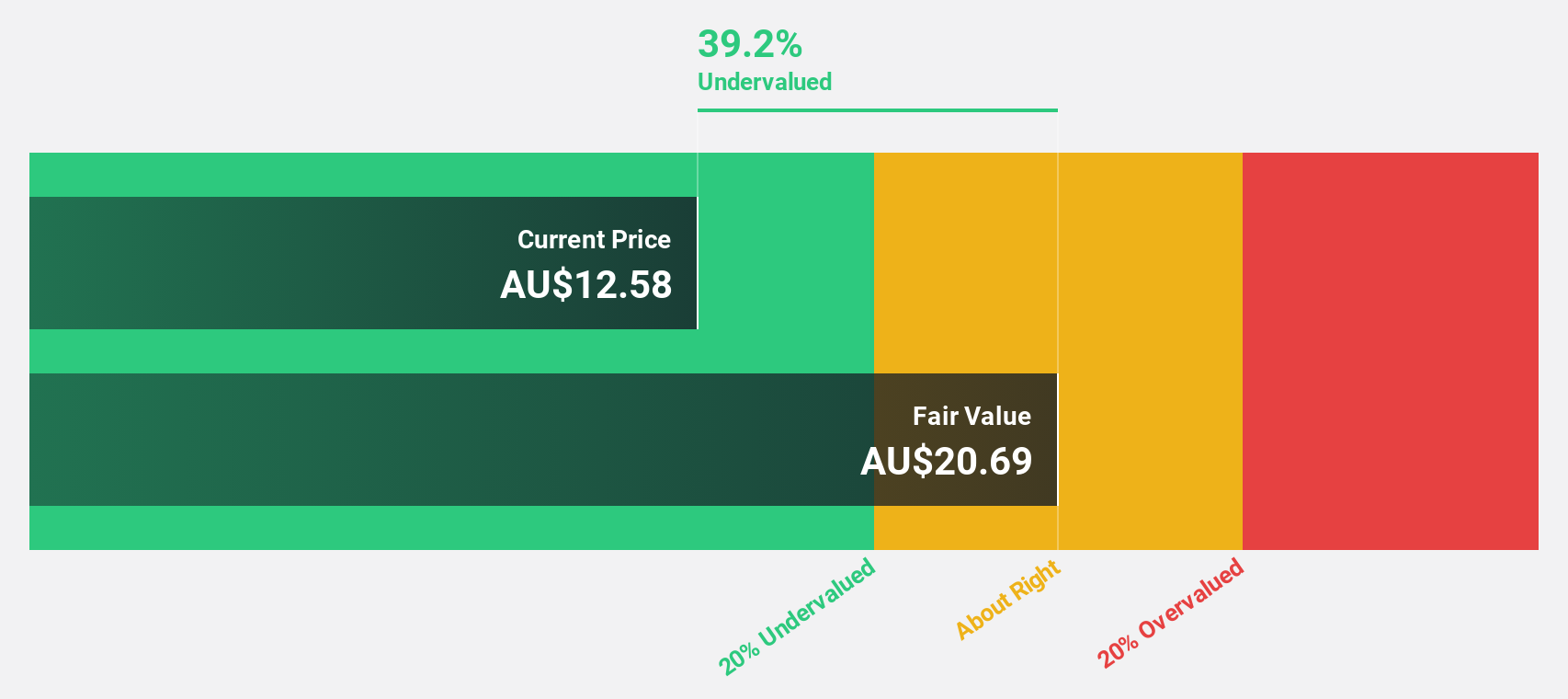

Flight Centre Travel Group (ASX:FLT)

Overview: Flight Centre Travel Group Limited operates as a travel retailer serving both leisure and corporate sectors across Australia, New Zealand, the Americas, Europe, the Middle East, Africa, Asia, and internationally with a market cap of A$4.88 billion.

Operations: The company's revenue is primarily derived from its leisure and corporate travel services, generating A$1.28 billion and A$1.06 billion respectively.

Estimated Discount To Fair Value: 28.1%

Flight Centre Travel Group, priced at A$22.19, is significantly undervalued based on discounted cash flow analysis, with an estimated fair value of A$30.87. This year marked a return to profitability for the company, enhancing its investment appeal. Additionally, Flight Centre's revenue and earnings growth are projected to outpace the Australian market average at 9.7% and 19.1% per year respectively, supported by a robust forecasted Return on Equity of 21.9% in three years' time.

- In light of our recent growth report, it seems possible that Flight Centre Travel Group's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Flight Centre Travel Group.

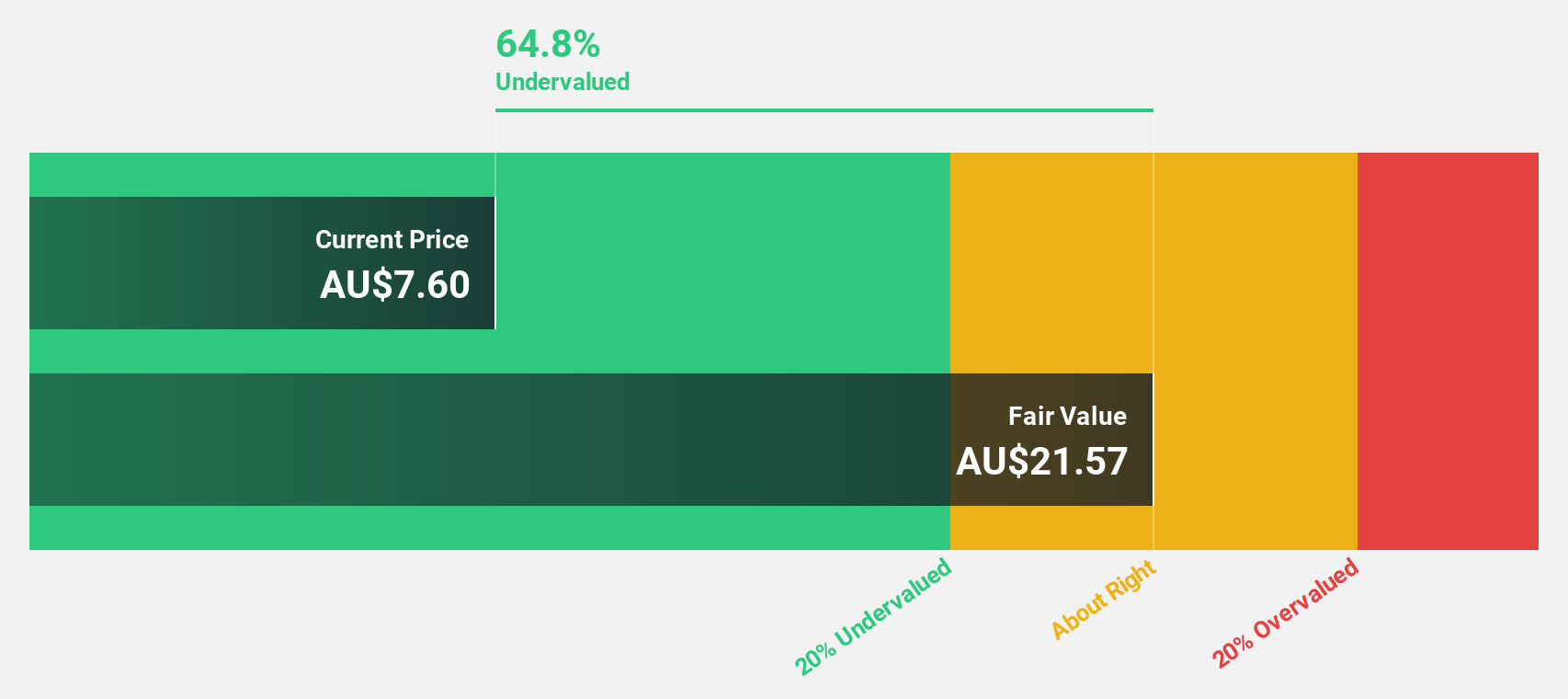

Regis Healthcare (ASX:REG)

Overview: Regis Healthcare Limited operates in Australia, providing residential aged care services with a market capitalization of approximately A$1.29 billion.

Operations: The company generates its revenue primarily from residential aged care services, totaling approximately A$882.29 million.

Estimated Discount To Fair Value: 36.2%

Regis Healthcare, currently priced at A$4.28, is trading 36.2% below its estimated fair value of A$6.7, indicating significant undervaluation based on discounted cash flow analysis. Despite recent insider selling, the company's projected earnings growth is substantial at 96.27% annually. Additionally, its Return on Equity is expected to be very high at 184% in three years, surpassing market averages significantly with forecasted revenue growth also outpacing the Australian market average of 5.3% per year at 8.5%.

- Insights from our recent growth report point to a promising forecast for Regis Healthcare's business outlook.

- Take a closer look at Regis Healthcare's balance sheet health here in our report.

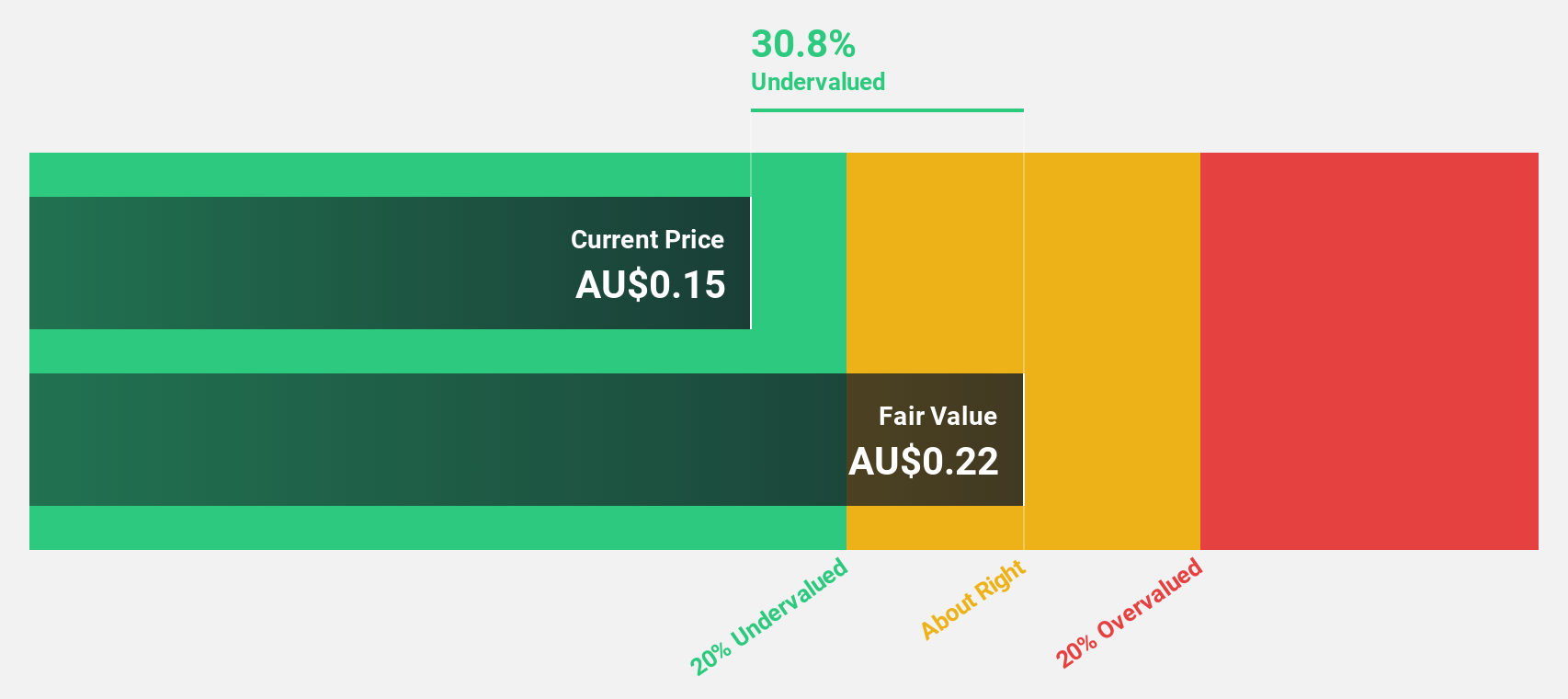

Strike Energy (ASX:STX)

Overview: Strike Energy Limited is an Australian company focused on the exploration and development of oil and gas resources, with a market capitalization of approximately A$600.76 million.

Operations: The company generates its revenue through the exploration and development of oil and gas resources in Australia.

Estimated Discount To Fair Value: 48.5%

Strike Energy, valued at A$0.21, is significantly undervalued by over 20% compared to its fair value of A$0.41 based on discounted cash flow analysis. The company's earnings are expected to grow by 36.11% annually, outpacing the Australian market's average growth rate of 13.9%. Recent developments include nearing completion of preparatory works for the Booth-1 well in partnership with Triangle Energy and New Zealand Oil and Gas, targeting multiple oil and gas reservoirs in the North Perth Basin.

- The analysis detailed in our Strike Energy growth report hints at robust future financial performance.

- Dive into the specifics of Strike Energy here with our thorough financial health report.

Next Steps

- Unlock more gems! Our Undervalued ASX Stocks Based On Cash Flows screener has unearthed 45 more companies for you to explore.Click here to unveil our expertly curated list of 48 Undervalued ASX Stocks Based On Cash Flows.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:REG

Regis Healthcare

Engages in the provision of residential aged care services in Australia.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives