- Australia

- /

- Metals and Mining

- /

- ASX:DEG

ASX Stocks That May Be Priced Below Their Value In October 2024

Reviewed by Simply Wall St

The Australian market has experienced a steady climb, with a 1.1% increase in the last week and a notable 17% rise over the past year, while earnings are projected to grow by 12% annually in the coming years. In this environment, identifying stocks that may be priced below their intrinsic value can offer potential opportunities for investors looking to capitalize on future growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Data#3 (ASX:DTL) | A$7.51 | A$13.46 | 44.2% |

| Mader Group (ASX:MAD) | A$5.56 | A$10.41 | 46.6% |

| Accent Group (ASX:AX1) | A$2.46 | A$4.80 | 48.7% |

| Ansell (ASX:ANN) | A$31.06 | A$57.89 | 46.3% |

| Charter Hall Group (ASX:CHC) | A$16.56 | A$31.28 | 47.1% |

| Ingenia Communities Group (ASX:INA) | A$5.06 | A$9.39 | 46.1% |

| Aussie Broadband (ASX:ABB) | A$3.80 | A$6.74 | 43.6% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Megaport (ASX:MP1) | A$7.42 | A$13.46 | 44.9% |

| Ai-Media Technologies (ASX:AIM) | A$0.795 | A$1.41 | 43.8% |

Let's explore several standout options from the results in the screener.

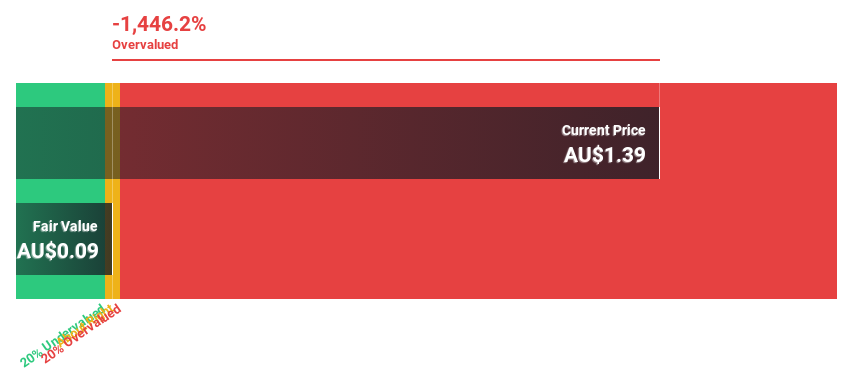

De Grey Mining (ASX:DEG)

Overview: De Grey Mining Limited is an Australian company focused on the exploration of mineral properties, with a market cap of A$3.34 billion.

Operations: The company's revenue is primarily derived from exploration activities, amounting to A$0.04 million.

Estimated Discount To Fair Value: 41.5%

De Grey Mining is trading at A$1.37, significantly below its estimated fair value of A$2.34, indicating it may be undervalued based on cash flows. Despite making less than US$1 million in revenue, De Grey's earnings are forecast to grow nearly 60% annually and become profitable within three years. Recent developments include completing key exploration activities at the Egina Gold Project and ongoing negotiations for access agreements, which could enhance future exploration potential and cash flow prospects.

- In light of our recent growth report, it seems possible that De Grey Mining's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of De Grey Mining.

Hansen Technologies (ASX:HSN)

Overview: Hansen Technologies Limited develops, integrates, and supports billing systems software for the energy, utilities, communications, and media sectors with a market cap of A$991.81 million.

Operations: The company generates revenue primarily from its billing segment, amounting to A$347.61 million.

Estimated Discount To Fair Value: 39.3%

Hansen Technologies is trading at A$4.94, well below its estimated fair value of A$8.14, suggesting undervaluation based on cash flows. Despite a decline in net profit margin from 13.7% to 6%, earnings are projected to grow significantly at 20.9% annually, outpacing the broader Australian market's growth rate of 12.2%. Recent client wins with Area Nett AS and leadership changes could further impact future performance and operational efficiency positively.

- Upon reviewing our latest growth report, Hansen Technologies' projected financial performance appears quite optimistic.

- Navigate through the intricacies of Hansen Technologies with our comprehensive financial health report here.

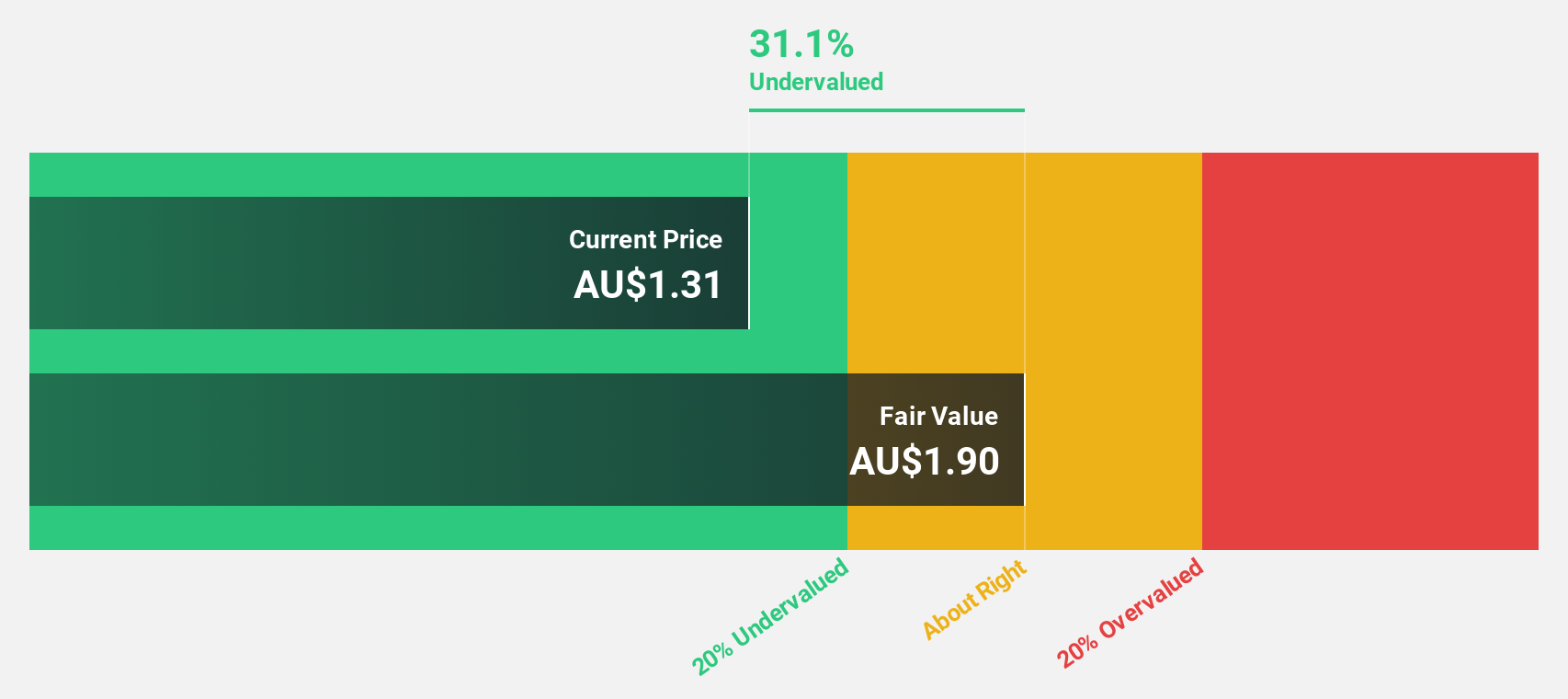

PolyNovo (ASX:PNV)

Overview: PolyNovo Limited designs, manufactures, and sells biodegradable medical devices in the United States, Australia, New Zealand, and internationally with a market cap of A$1.62 billion.

Operations: The company's revenue is primarily derived from the development, manufacturing, and commercialization of the NovoSorb technology, amounting to A$103.23 million.

Estimated Discount To Fair Value: 24.1%

PolyNovo is trading at A$2.34, significantly below its estimated fair value of A$3.08, indicating undervaluation based on cash flows. The company recently turned profitable with a net income of A$5.26 million for the fiscal year ending June 2024, compared to a loss previously. Earnings are forecast to grow substantially at 38.3% annually, surpassing market averages, although insider selling has been noted recently which may warrant caution among investors.

- Our comprehensive growth report raises the possibility that PolyNovo is poised for substantial financial growth.

- Click here to discover the nuances of PolyNovo with our detailed financial health report.

Make It Happen

- Unlock more gems! Our Undervalued ASX Stocks Based On Cash Flows screener has unearthed 40 more companies for you to explore.Click here to unveil our expertly curated list of 43 Undervalued ASX Stocks Based On Cash Flows.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DEG

De Grey Mining

Engages in the exploration of mineral properties in Australia.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives