- Australia

- /

- Medical Equipment

- /

- ASX:PNV

3 ASX Stocks That May Be Trading Below Estimated Value In October 2025

Reviewed by Simply Wall St

As the Australian market experiences fluctuations driven by profit-taking and shifts in global economic sentiment, investors are closely watching sectors like Materials and Energy for opportunities. In this environment, identifying stocks that may be trading below their estimated value can be crucial for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Superloop (ASX:SLC) | A$3.22 | A$5.66 | 43.1% |

| Resimac Group (ASX:RMC) | A$1.15 | A$2.17 | 47% |

| NRW Holdings (ASX:NWH) | A$4.82 | A$9.20 | 47.6% |

| MAAS Group Holdings (ASX:MGH) | A$4.62 | A$9.15 | 49.5% |

| Liontown Resources (ASX:LTR) | A$1.06 | A$2.08 | 49.1% |

| James Hardie Industries (ASX:JHX) | A$33.42 | A$61.40 | 45.6% |

| DroneShield (ASX:DRO) | A$4.79 | A$9.30 | 48.5% |

| Cynata Therapeutics (ASX:CYP) | A$0.265 | A$0.43 | 38.9% |

| Betmakers Technology Group (ASX:BET) | A$0.19 | A$0.32 | 40.1% |

| Airtasker (ASX:ART) | A$0.36 | A$0.71 | 49.5% |

Let's take a closer look at a couple of our picks from the screened companies.

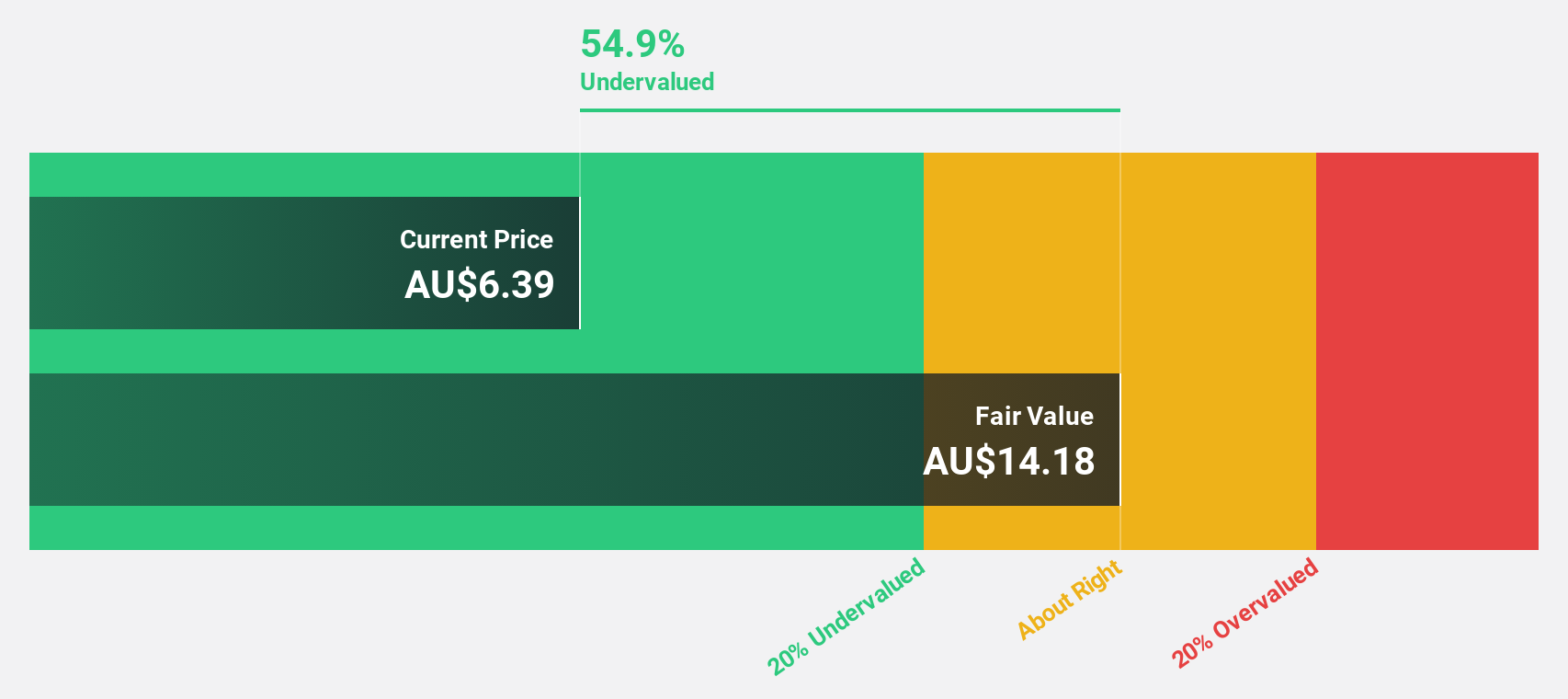

Elders (ASX:ELD)

Overview: Elders Limited operates as a provider of agricultural products and services to rural and regional customers primarily in Australia, with a market cap of A$1.41 billion.

Operations: The company's revenue segments include A$2.70 billion from the Branch Network, A$362.96 million from Wholesale Products, and A$142.30 million from Feed and Processing Services.

Estimated Discount To Fair Value: 35.3%

Elders is trading at A$7.39, significantly below its estimated fair value of A$11.41, indicating it may be undervalued based on cash flows. While earnings are projected to grow at 25.8% annually, surpassing the Australian market's growth rate, revenue growth remains moderate at 12.2%. However, recent leadership changes could impact strategic direction and operational performance. Despite a dividend yield of 2.44%, coverage by earnings or free cash flows is inadequate and shareholder dilution occurred last year.

- Insights from our recent growth report point to a promising forecast for Elders' business outlook.

- Dive into the specifics of Elders here with our thorough financial health report.

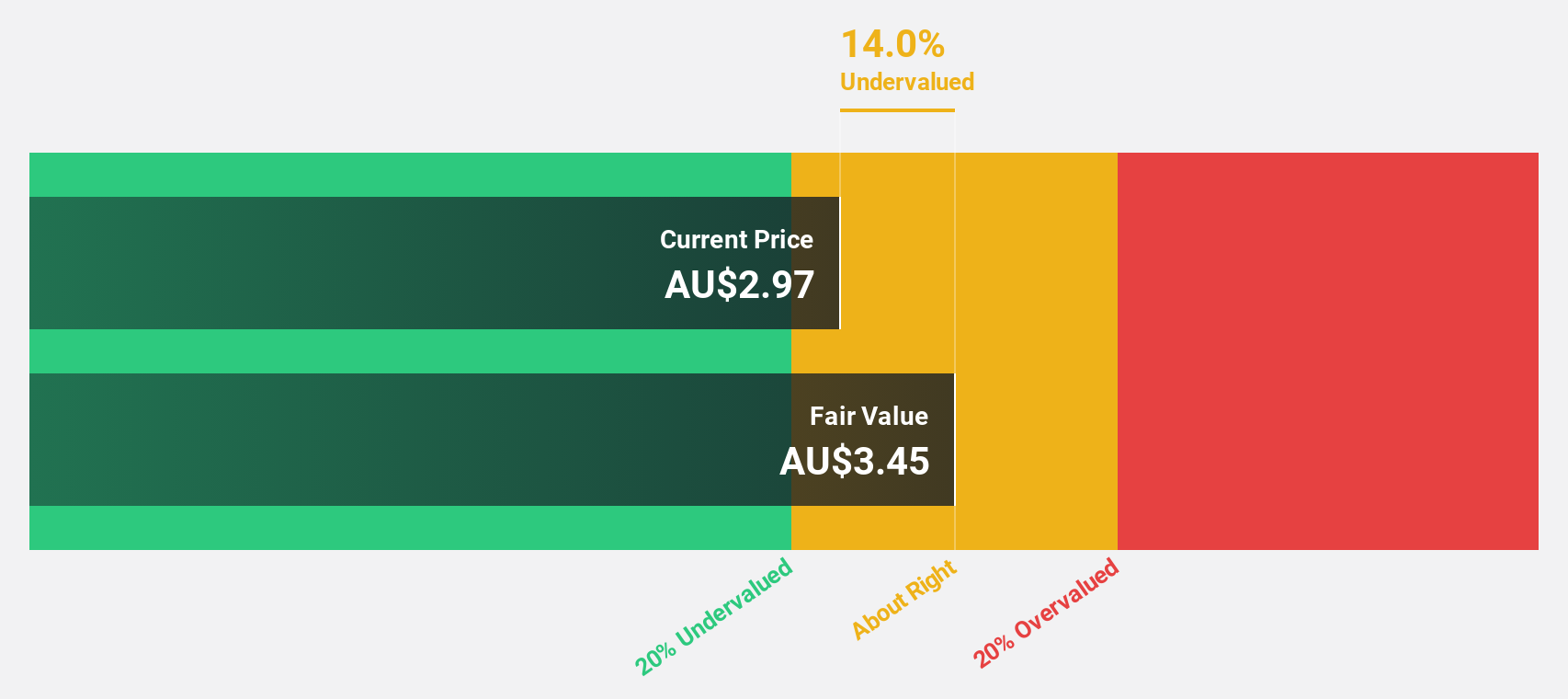

FINEOS Corporation Holdings (ASX:FCL)

Overview: FINEOS Corporation Holdings plc develops and sells enterprise claims and policy management software for life, accident, and health insurers, as well as employee benefits providers across North America, the Asia Pacific, the Middle East, and Africa, with a market cap of A$1.01 billion.

Operations: The company's revenue segment consists of €135.90 million from software and programming for the insurance and employee benefits sectors across multiple regions.

Estimated Discount To Fair Value: 14.0%

FINEOS Corporation Holdings is trading at A$2.97, slightly below its estimated fair value of A$3.45, suggesting it could be undervalued based on cash flows. The company forecasts revenue growth of 9.2% annually, outpacing the Australian market's 7.7%. Recent guidance indicates revenue at the lower end due to currency impacts and economic concerns; however, profitability is expected within three years with increased recurring revenues and gross margins by 2029.

- In light of our recent growth report, it seems possible that FINEOS Corporation Holdings' financial performance will exceed current levels.

- Take a closer look at FINEOS Corporation Holdings' balance sheet health here in our report.

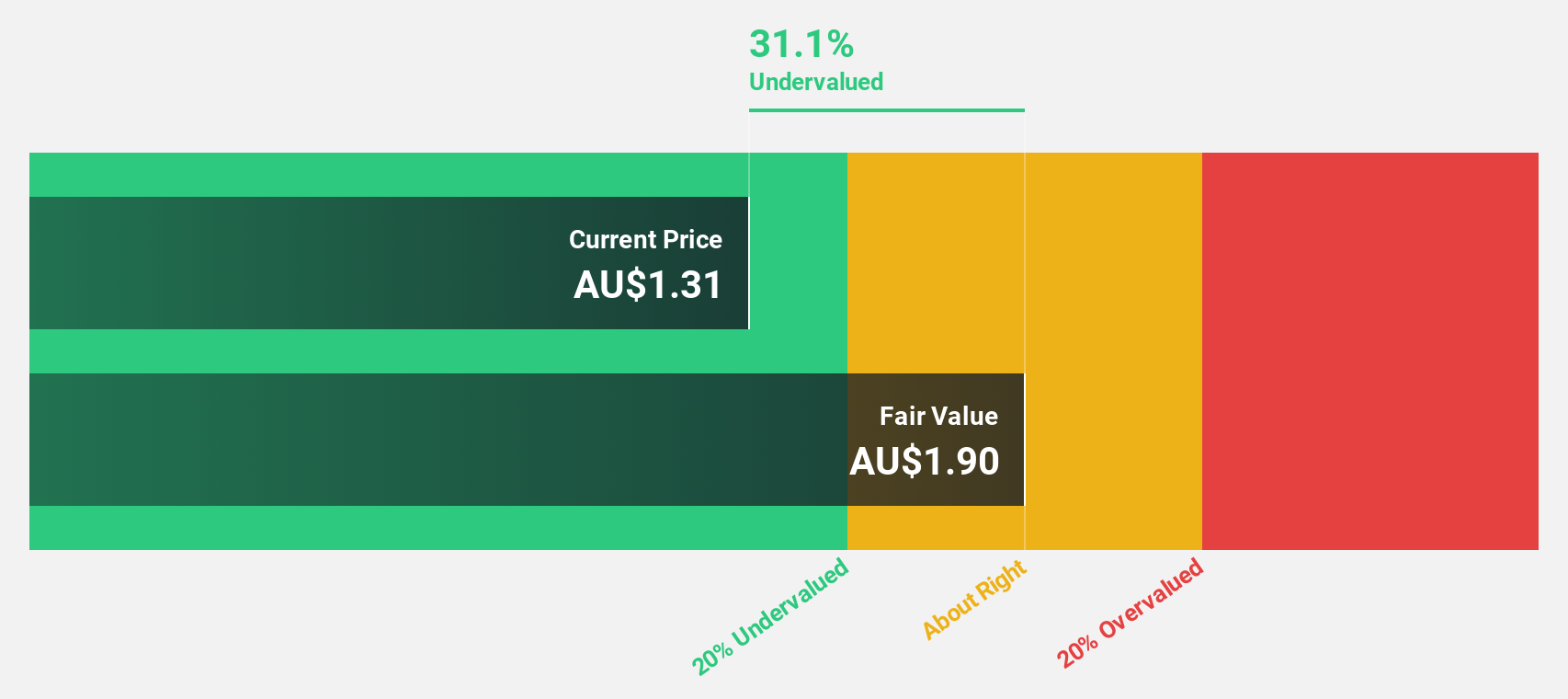

PolyNovo (ASX:PNV)

Overview: PolyNovo Limited designs, manufactures, and sells biodegradable medical devices across several countries including Australia, New Zealand, the United States, and others with a market cap of A$901.55 million.

Operations: The company's revenue primarily comes from the development, manufacturing, and commercialization of the NovoSorb technology, amounting to A$128.70 million.

Estimated Discount To Fair Value: 22.6%

PolyNovo is trading at A$1.31, below its fair value of A$1.69, indicating it may be undervalued based on cash flows. The company's earnings are forecast to grow significantly at 27.4% annually, outpacing the Australian market's 14.5%. Recent results showed a revenue increase to A$129.19 million and net income growth to A$13.21 million from the previous year, despite being dropped from the S&P/ASX 200 Index recently and undergoing board changes with Robert Douglas joining as a director.

- The analysis detailed in our PolyNovo growth report hints at robust future financial performance.

- Click here to discover the nuances of PolyNovo with our detailed financial health report.

Key Takeaways

- Click through to start exploring the rest of the 26 Undervalued ASX Stocks Based On Cash Flows now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PNV

PolyNovo

Designs, manufactures, and sells biodegradable medical devices in Australia, New Zealand, the United States, the United Kingdom, Ireland, Singapore, India, and Hong Kong.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives