3 ASX Stocks Estimated To Be 31.3% To 41.2% Below Intrinsic Value

Reviewed by Simply Wall St

The Australian market is currently navigating a complex landscape, with the Reserve Bank of Australia's recent interest rate cut and mixed sector performances highlighting the challenges and opportunities for investors. In this environment, identifying undervalued stocks can be particularly rewarding, as they may offer potential growth when their intrinsic value is recognized by the market.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Mader Group (ASX:MAD) | A$6.17 | A$11.19 | 44.9% |

| Whitehaven Coal (ASX:WHC) | A$5.34 | A$9.65 | 44.6% |

| IDP Education (ASX:IEL) | A$12.12 | A$24.11 | 49.7% |

| Symal Group (ASX:SYL) | A$1.99 | A$3.64 | 45.3% |

| MLG Oz (ASX:MLG) | A$0.625 | A$1.13 | 44.8% |

| Atlas Arteria (ASX:ALX) | A$5.07 | A$9.15 | 44.6% |

| Mesoblast (ASX:MSB) | A$2.88 | A$5.61 | 48.6% |

| Alcidion Group (ASX:ALC) | A$0.091 | A$0.16 | 43.5% |

| Integral Diagnostics (ASX:IDX) | A$2.97 | A$5.76 | 48.4% |

| Sandfire Resources (ASX:SFR) | A$10.85 | A$19.19 | 43.5% |

Let's take a closer look at a couple of our picks from the screened companies.

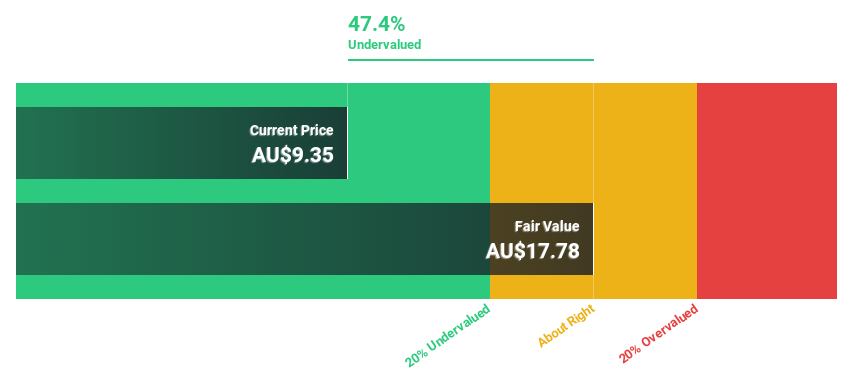

Audinate Group (ASX:AD8)

Overview: Audinate Group Limited develops and sells digital audio visual networking solutions in Australia and internationally, with a market cap of A$799.25 million.

Operations: The company generates revenue of A$73.60 million from its Contract Electronics Manufacturing Services segment.

Estimated Discount To Fair Value: 35.1%

Audinate Group is trading at A$10.41, significantly undervalued compared to its estimated fair value of A$16.03, suggesting potential upside based on discounted cash flow analysis. Despite a challenging financial period with a net loss of A$2.21 million and reduced profit margins, earnings are forecast to grow substantially at 51% annually, outpacing the Australian market's growth rate. However, return on equity remains low at 6.8%, indicating room for improvement in profitability metrics.

- According our earnings growth report, there's an indication that Audinate Group might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Audinate Group.

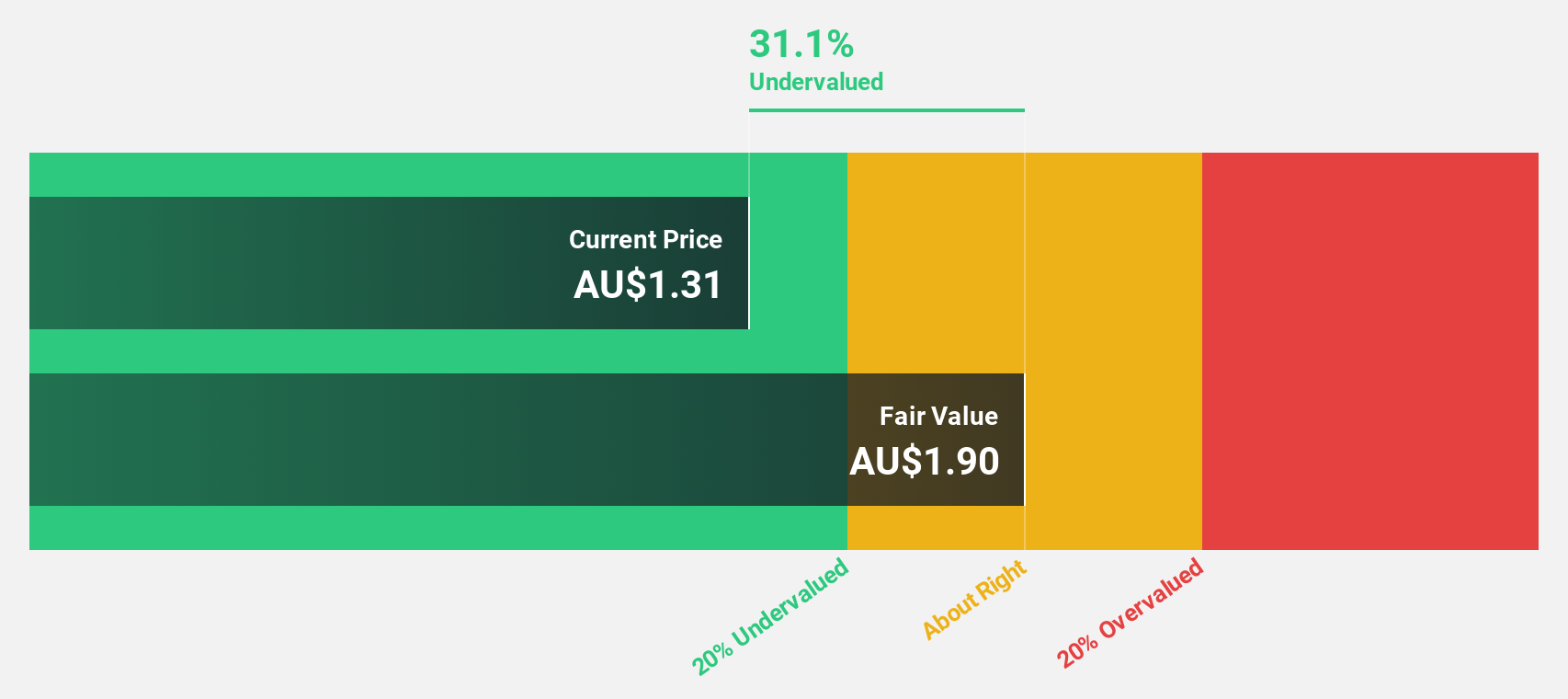

PolyNovo (ASX:PNV)

Overview: PolyNovo Limited designs, manufactures, and sells biodegradable medical devices across the United States, Australia, New Zealand, and internationally with a market cap of A$1.36 billion.

Operations: The company's revenue primarily stems from the development, manufacturing, and commercialization of its NovoSorb Technology, amounting to A$103.23 million.

Estimated Discount To Fair Value: 31.3%

PolyNovo is trading at A$1.92, below its fair value estimate of A$2.79, highlighting potential undervaluation based on discounted cash flow analysis. The company recently became profitable and forecasts indicate earnings growth of 38.24% annually, surpassing the Australian market's growth rate. Revenue increased by 22.8% in the first half of fiscal year 2025 to A$59.9 million, though future revenue growth is expected to be slower than 20% per year but still above market average.

- Our comprehensive growth report raises the possibility that PolyNovo is poised for substantial financial growth.

- Navigate through the intricacies of PolyNovo with our comprehensive financial health report here.

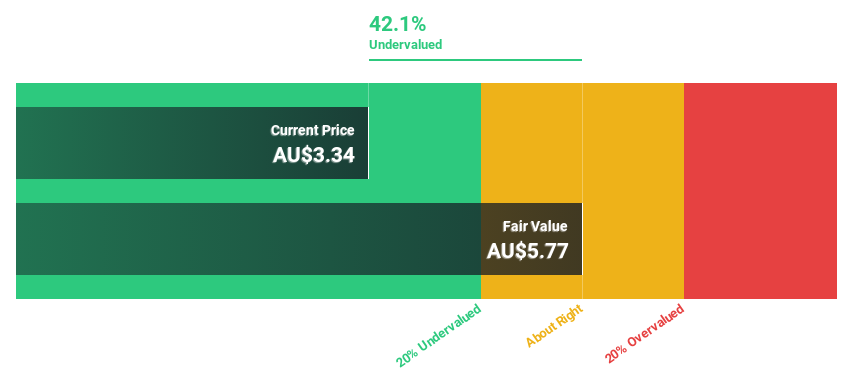

ReadyTech Holdings (ASX:RDY)

Overview: ReadyTech Holdings Limited offers technology-based solutions in Australia and has a market cap of A$396.48 million.

Operations: The company's revenue is derived from three main segments: Workforce Solutions (A$30.74 million), Government and Justice (A$42.51 million), and Education and Work Pathways (A$40.55 million).

Estimated Discount To Fair Value: 41.2%

ReadyTech Holdings is trading at A$3.34, significantly below its estimated fair value of A$5.68, suggesting potential undervaluation based on discounted cash flow analysis. While the company's revenue growth forecast of 10.9% annually is slower than 20%, it still exceeds the Australian market average of 5.9%. Earnings are projected to grow substantially at 25.5% per year, outpacing the broader market's expected growth rate, despite a forecasted low return on equity of 11.7%.

- The analysis detailed in our ReadyTech Holdings growth report hints at robust future financial performance.

- Click here to discover the nuances of ReadyTech Holdings with our detailed financial health report.

Make It Happen

- Discover the full array of 51 Undervalued ASX Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RDY

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives