As the ASX200 shows a modest increase of 0.45% amidst steady unemployment rates and sector-specific fluctuations, investors are keenly observing growth opportunities within the Australian market. In this environment, companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those who know the business best, aligning well with current trends in IT and Financials sectors which have shown resilience.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Medallion Metals (ASX:MM8) | 12.9% | 72.7% |

| Catalyst Metals (ASX:CYL) | 14.8% | 33.1% |

| Genmin (ASX:GEN) | 12.3% | 117.7% |

| Acrux (ASX:ACR) | 18.4% | 91.6% |

| AVA Risk Group (ASX:AVA) | 15.7% | 77.3% |

| Pointerra (ASX:3DP) | 20.8% | 126.4% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 67.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Here's a peek at a few of the choices from the screener.

Alpha HPA (ASX:A4N)

Simply Wall St Growth Rating: ★★★★★☆

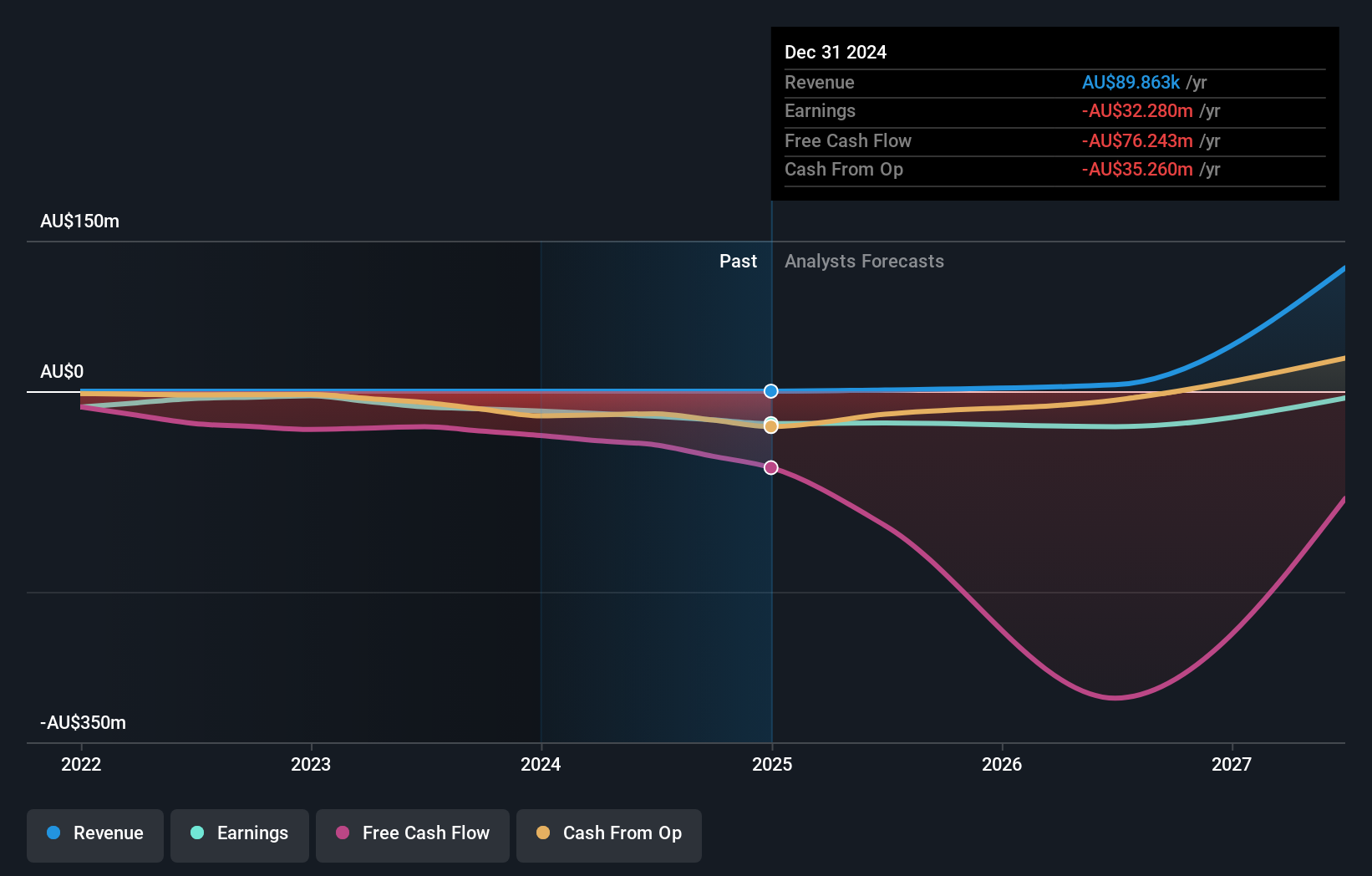

Overview: Alpha HPA Limited is a specialty metals and technology company with a market capitalization of A$1.11 billion.

Operations: The company's revenue is primarily derived from its HPA First Project, contributing A$0.04 million.

Insider Ownership: 12.6%

Alpha HPA is experiencing significant revenue growth, forecasted at 103% per year, outpacing the Australian market's average of 5.7%. Despite its low current revenue (A$44K) and a net loss of A$24.98 million for the last fiscal year, it is expected to become profitable within three years. However, shareholders faced dilution over the past year, and its return on equity is projected to remain low at 3.8%.

- Click here to discover the nuances of Alpha HPA with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Alpha HPA shares in the market.

PolyNovo (ASX:PNV)

Simply Wall St Growth Rating: ★★★★★☆

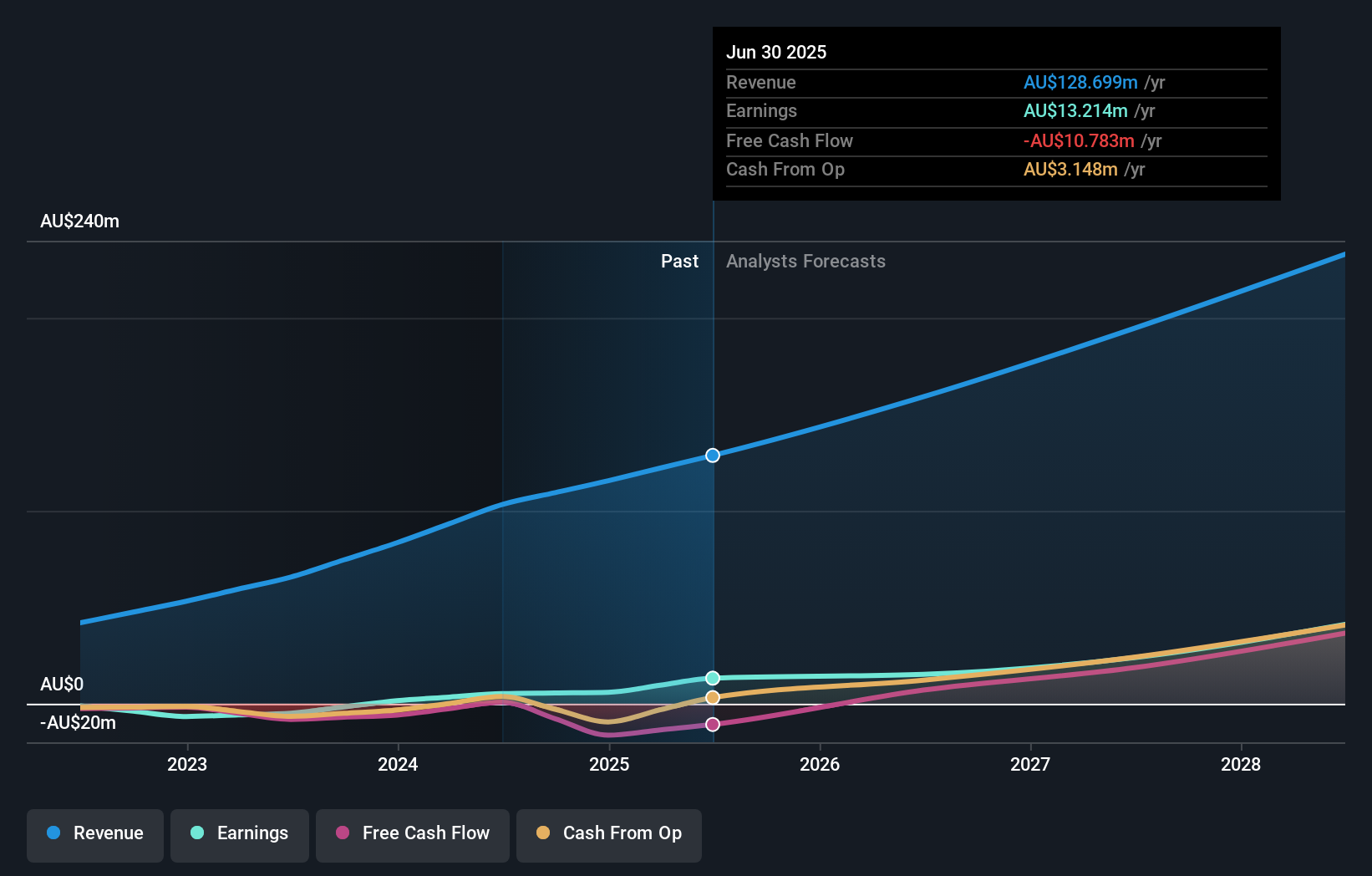

Overview: PolyNovo Limited designs, manufactures, and sells biodegradable medical devices in the United States, Australia, New Zealand, and internationally with a market cap of A$1.42 billion.

Operations: The company's revenue primarily stems from the development, manufacturing, and commercialization of the NovoSorb Technology, amounting to A$103.23 million.

Insider Ownership: 10.2%

PolyNovo's earnings are forecast to grow significantly at 38.4% annually, outpacing the Australian market. Despite recent changes in executive leadership with the retirement of a long-standing director, insider activity shows more shares bought than sold recently, indicating confidence in its growth trajectory. The company reported A$104.76 million in revenue for the fiscal year ending June 2024, marking substantial improvement from the previous year's results and achieving profitability with net income of A$5.26 million.

- Unlock comprehensive insights into our analysis of PolyNovo stock in this growth report.

- Our comprehensive valuation report raises the possibility that PolyNovo is priced higher than what may be justified by its financials.

Technology One (ASX:TNE)

Simply Wall St Growth Rating: ★★★★☆☆

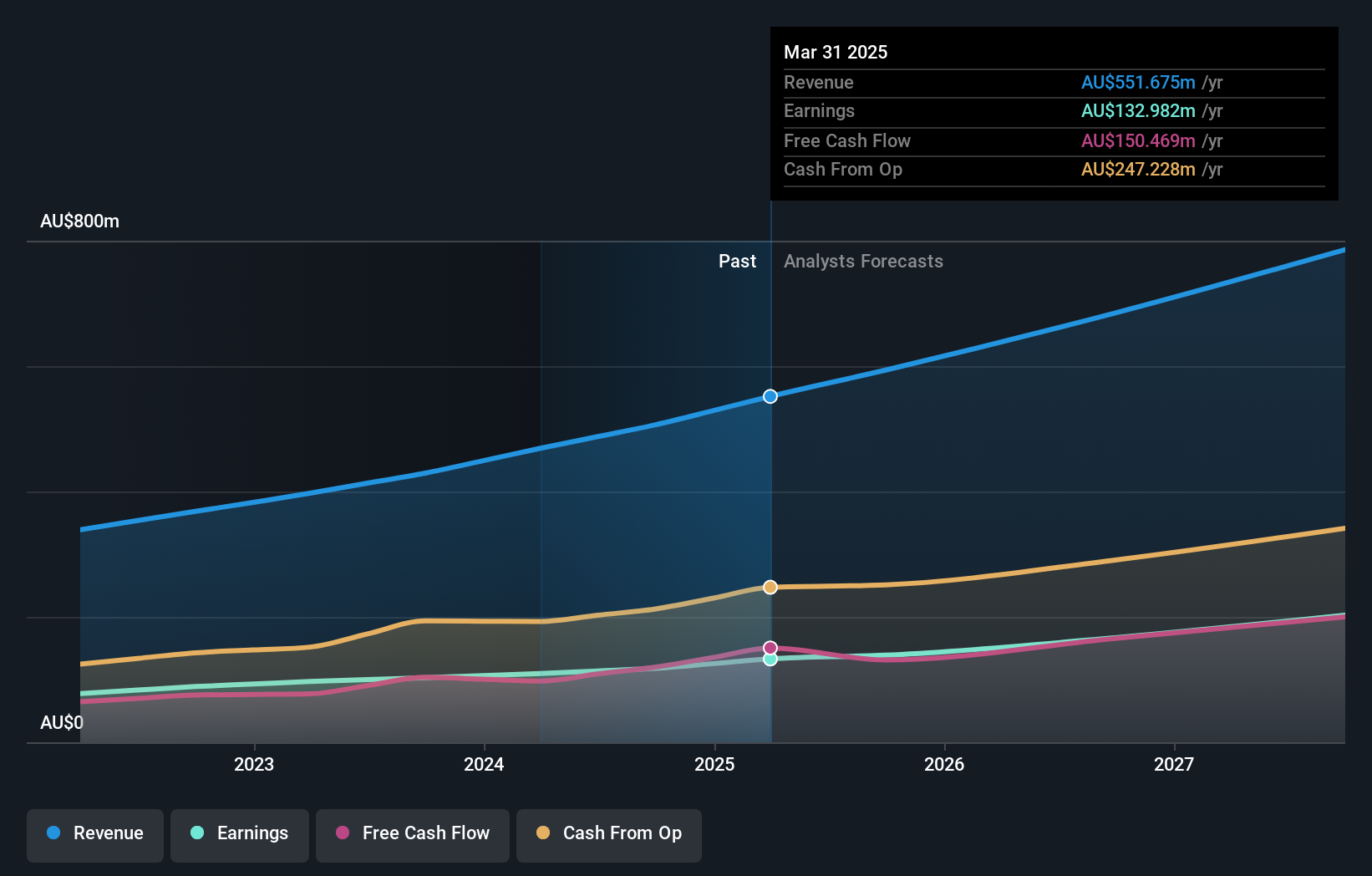

Overview: Technology One Limited develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally with a market cap of A$8.66 billion.

Operations: The company's revenue segments consist of Software at A$317.24 million, Corporate at A$83.83 million, and Consulting at A$68.13 million.

Insider Ownership: 12.3%

Technology One is positioned for growth with its earnings forecast to increase by 13.6% annually, surpassing the Australian market average. Despite no recent substantial insider trading activity, its high insider ownership aligns interests with shareholders. The company has demonstrated steady performance with a 13.1% earnings growth over the past year and revenue projected to grow at 10.8% annually, faster than the overall market rate of 5.7%.

- Dive into the specifics of Technology One here with our thorough growth forecast report.

- Our expertly prepared valuation report Technology One implies its share price may be too high.

Seize The Opportunity

- Take a closer look at our Fast Growing ASX Companies With High Insider Ownership list of 91 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Technology One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:TNE

Technology One

Engages in the development, marketing, sale, implementation, and support of integrated enterprise business software solutions in Australia and internationally.

Flawless balance sheet with reasonable growth potential.