- Australia

- /

- Specialty Stores

- /

- ASX:CTT

3 ASX Growth Stocks With Insider Ownership Up To 33%

Reviewed by Simply Wall St

The Australian stock market has recently seen the ASX200 reach a new intraday record, buoyed by strong performances in financials and industrials, although energy stocks have lagged due to revised demand forecasts from OPEC. In this context of fluctuating sector performance, growth companies with significant insider ownership can be particularly appealing as they often indicate confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Genmin (ASX:GEN) | 12% | 117.7% |

| Catalyst Metals (ASX:CYL) | 17% | 45.8% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Liontown Resources (ASX:LTR) | 14.7% | 61% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 70.2% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Pointerra (ASX:3DP) | 20.1% | 126.4% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Here's a peek at a few of the choices from the screener.

Cettire (ASX:CTT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cettire Limited operates as an online luxury goods retailer in Australia, the United States, and internationally, with a market cap of A$865.41 million.

Operations: The company's revenue is primarily generated from online retail sales, amounting to A$742.26 million.

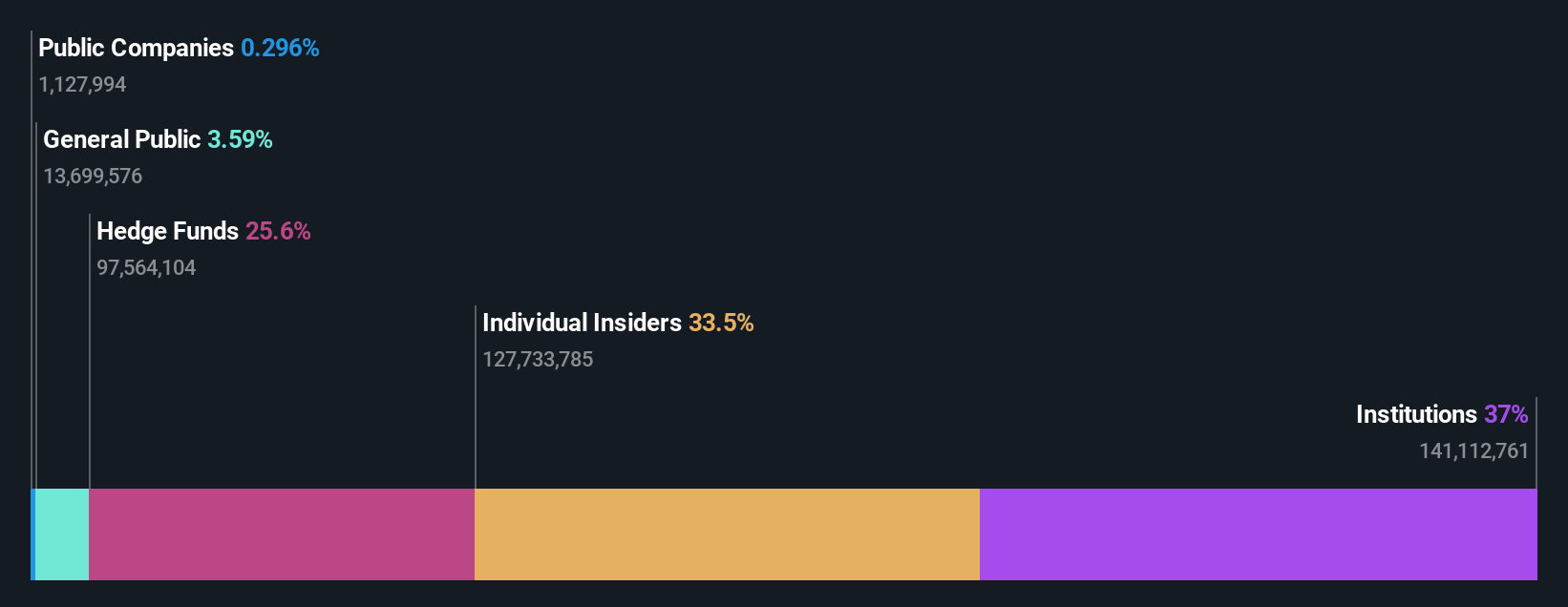

Insider Ownership: 33.5%

Cettire demonstrates strong growth potential with earnings expected to increase significantly at 29% annually, outpacing the Australian market. Despite recent volatility in its share price and declining profit margins from 3.8% to 1.4%, insider buying has been substantial, indicating confidence in future prospects. The company trades at a discount of 22.9% below estimated fair value, while revenue forecasts suggest slower growth than earnings but still above the market average. Recent board changes may enhance strategic direction.

- Click here to discover the nuances of Cettire with our detailed analytical future growth report.

- Our expertly prepared valuation report Cettire implies its share price may be too high.

Emerald Resources (ASX:EMR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.64 billion.

Operations: The company generates revenue primarily from its mine operations, totaling A$366.04 million.

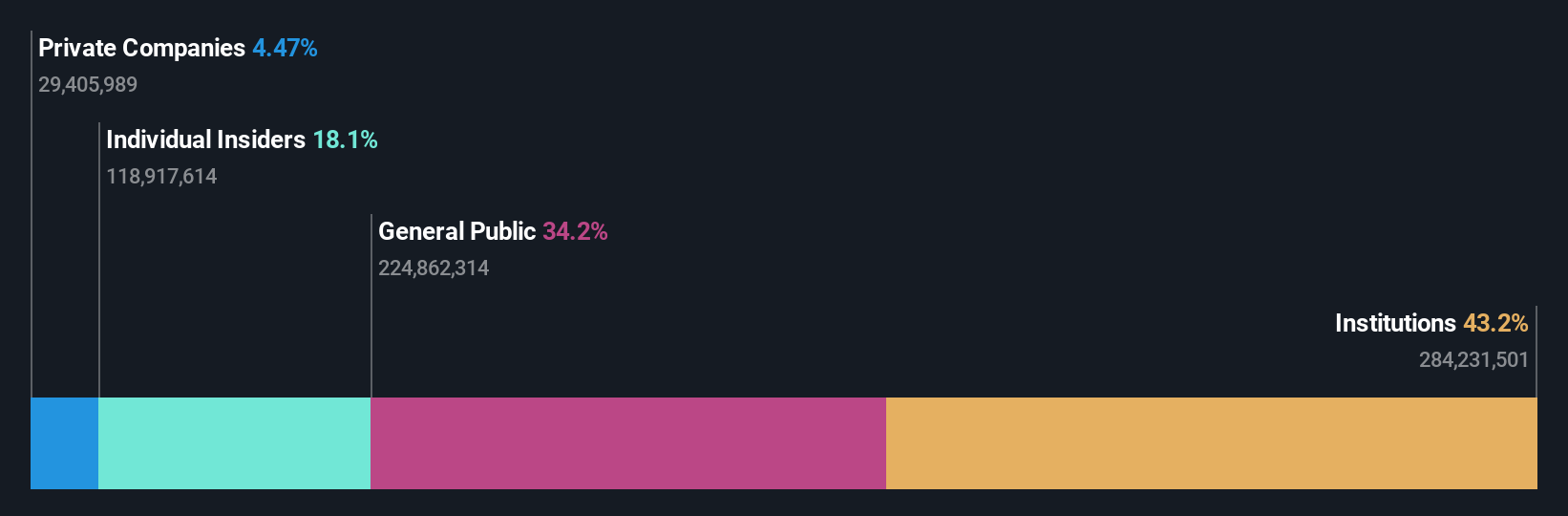

Insider Ownership: 18%

Emerald Resources shows promising growth with revenue expected to rise at 35.2% annually, surpassing the Australian market's 5.5%. Earnings grew by 41.9% last year, and future profit growth is projected at 16.2% per year, above market average but not significantly high. Recent earnings report highlighted a net income increase to A$84.27 million from A$59.36 million previously, while insider ownership remains stable despite past dilution concerns and no recent insider trading activity noted.

- Get an in-depth perspective on Emerald Resources' performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Emerald Resources' share price might be on the expensive side.

PolyNovo (ASX:PNV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PolyNovo Limited designs, manufactures, and sells biodegradable medical devices in the United States, Australia, New Zealand, and internationally with a market cap of approximately A$1.62 billion.

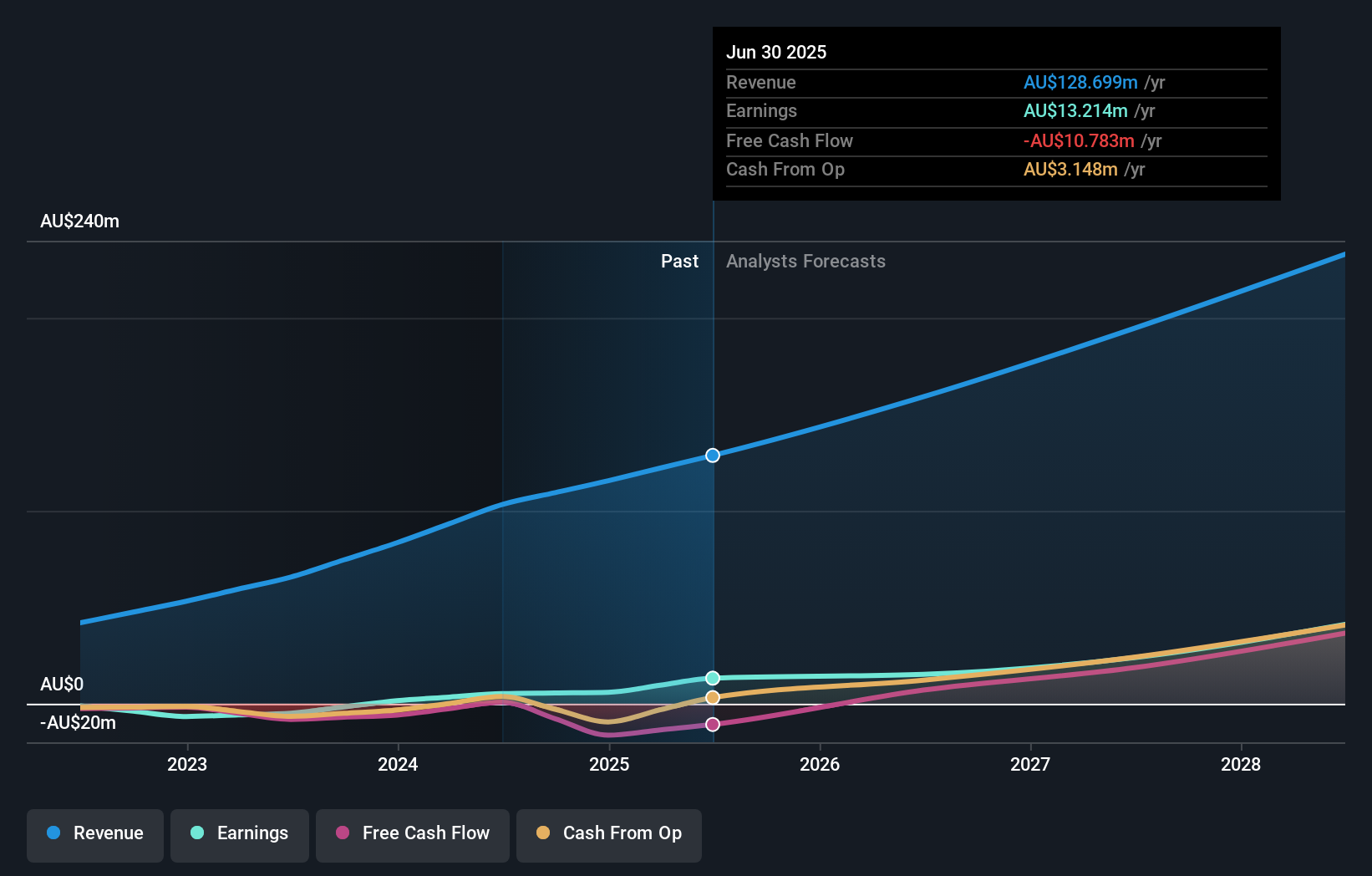

Operations: The company's revenue is primarily derived from the development, manufacturing, and commercialization of its NovoSorb Technology, amounting to A$103.23 million.

Insider Ownership: 10.2%

PolyNovo's recent financial performance indicates a significant turnaround, reporting net income of A$5.26 million compared to a prior loss. Earnings are expected to grow at 38.3% annually, outpacing the Australian market's average growth rate. Despite no substantial insider buying in the past three months, insider ownership remains strong with more shares bought than sold recently. The company's revenue growth forecast of 17.5% annually surpasses market expectations, although it falls short of high-growth benchmarks.

- Dive into the specifics of PolyNovo here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, PolyNovo's share price might be too optimistic.

Next Steps

- Click here to access our complete index of 98 Fast Growing ASX Companies With High Insider Ownership.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CTT

Cettire

Engages in the online luxury goods retailing business in Australia, the United States, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives