High Growth Tech Stocks To Watch In Australia September 2024

Reviewed by Simply Wall St

The Australian market has shown mixed performance recently, with the ASX200 closing up 0.3% at 8,099.9 points, driven by gains in the Materials and Real Estate sectors while Financials lagged behind. In this dynamic environment, identifying high-growth tech stocks becomes crucial as they offer potential for significant returns amid fluctuating economic indicators and sector performances.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.41% | 27.42% | ★★★★★★ |

| Pureprofile | 14.94% | 80.73% | ★★★★★☆ |

| AVA Risk Group | 32.56% | 118.83% | ★★★★★★ |

| ImExHS | 20.47% | 111.20% | ★★★★★★ |

| DUG Technology | 10.90% | 32.21% | ★★★★★☆ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Careteq | 34.13% | 126.60% | ★★★★★☆ |

| Wrkr | 36.31% | 100.29% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| SiteMinder | 19.39% | 60.31% | ★★★★★☆ |

Click here to see the full list of 61 stocks from our ASX High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Nuix (ASX:NXL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nuix Limited offers investigative analytics and intelligence software solutions across various regions including the Asia Pacific, the Americas, Europe, the Middle East, and Africa, with a market cap of A$1.77 billion.

Operations: Nuix Limited generates revenue primarily from its Software & Programming segment, amounting to A$220.62 million. The company operates in regions such as Asia Pacific, the Americas, Europe, the Middle East, and Africa.

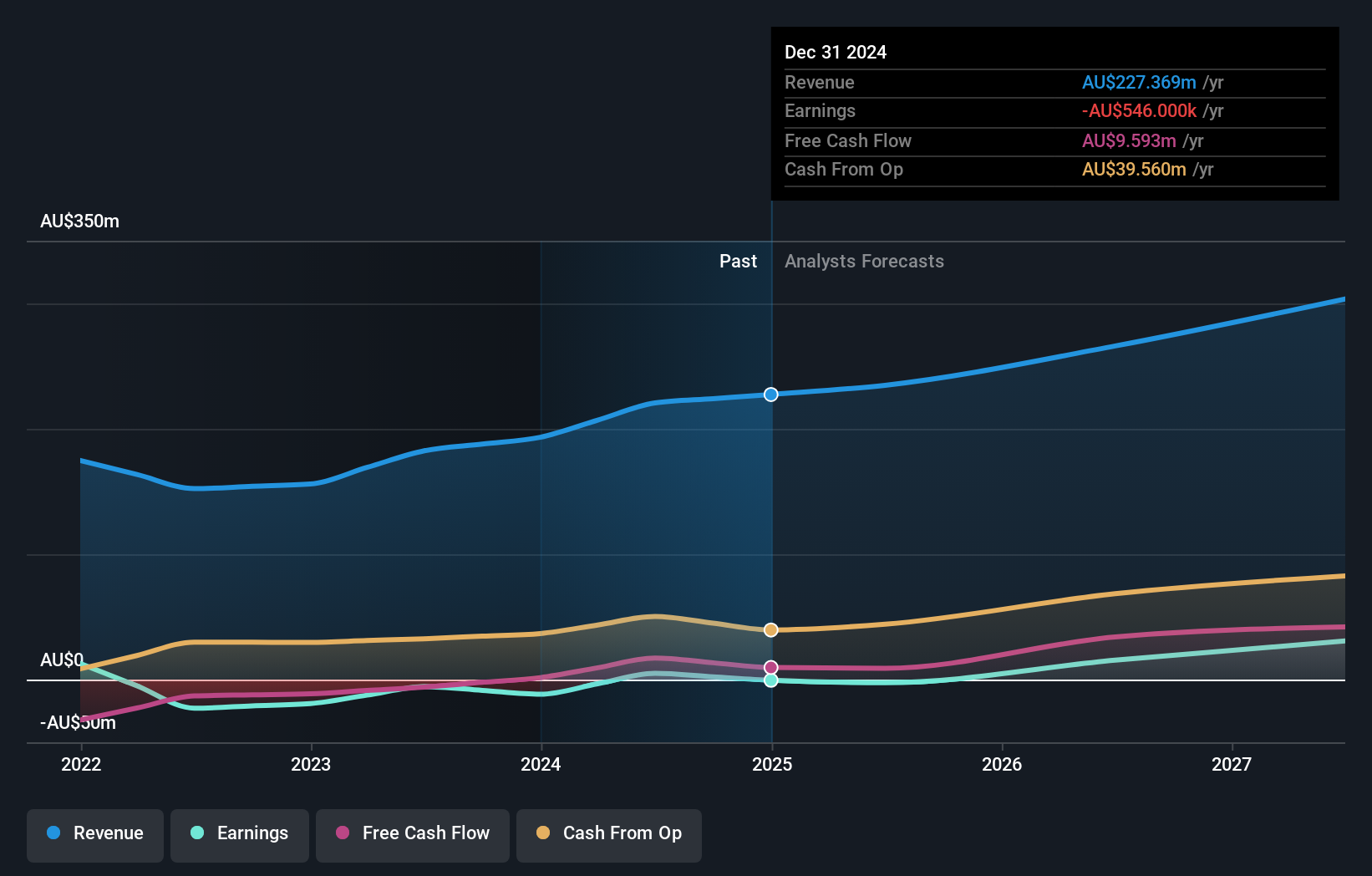

Nuix's revenue growth is forecasted at 11.8% per year, outpacing the Australian market's 5.3%. With earnings projected to grow by an impressive 40.2% annually, Nuix has become profitable this year, reporting a net income of AUD 5.03 million for FY2024 compared to a net loss of AUD 5.59 million the previous year. The strategic partnership with Veritone enhances their eDiscovery and compliance solutions, leveraging AI models to process vast amounts of evidentiary media efficiently.

- Unlock comprehensive insights into our analysis of Nuix stock in this health report.

Evaluate Nuix's historical performance by accessing our past performance report.

Pro Medicus (ASX:PME)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pro Medicus Limited is a healthcare informatics company that develops and supplies imaging software and radiology information system (RIS) software and services to hospitals, imaging centers, and healthcare groups in Australia, North America, and Europe, with a market cap of A$17.52 billion.

Operations: Pro Medicus Limited generates revenue primarily from producing integrated software applications for the healthcare industry, amounting to A$161.50 million. The company focuses on providing imaging and radiology information system (RIS) software services to various healthcare entities across Australia, North America, and Europe.

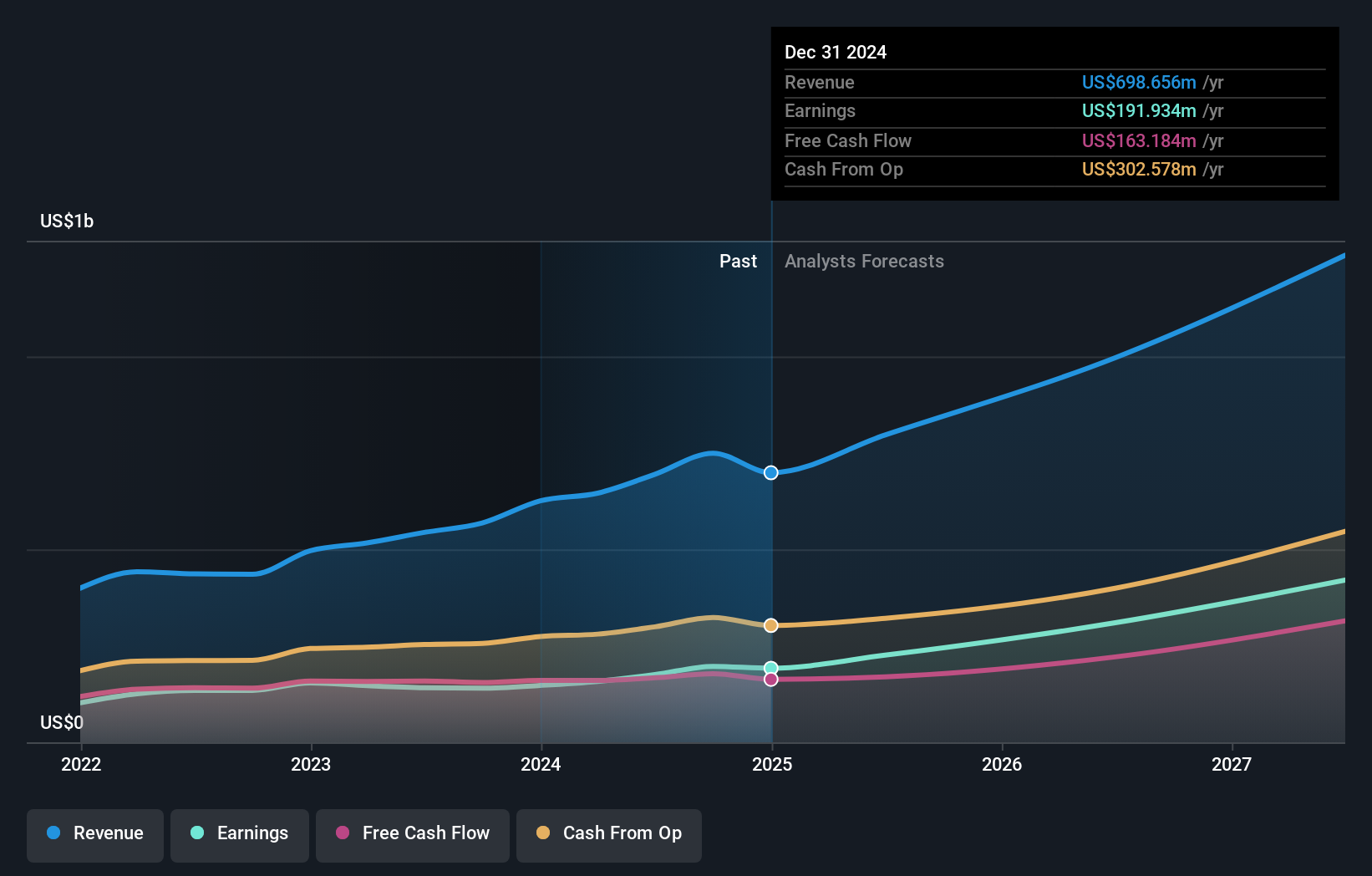

Pro Medicus has shown robust growth, with revenue increasing to AUD 166.33 million from AUD 127.33 million last year and net income rising to AUD 82.79 million from AUD 60.65 million. The company's earnings are forecasted to grow at an annual rate of 18.7%, outpacing the Australian market's average of 12.3%. With a significant focus on R&D, Pro Medicus invested approximately $16M in FY2024, ensuring continued innovation in medical imaging software solutions that cater to high-profile clients like Mayo Clinic and Yale New Haven Health System.

- Take a closer look at Pro Medicus' potential here in our health report.

Assess Pro Medicus' past performance with our detailed historical performance reports.

WiseTech Global (ASX:WTC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: WiseTech Global Limited develops and provides software solutions for the logistics execution industry across the Americas, Asia Pacific, Europe, the Middle East, and Africa with a market cap of A$43.46 billion.

Operations: WiseTech Global Limited primarily generates revenue from its Internet Software & Services segment, amounting to A$1.04 billion. The company focuses on delivering software solutions tailored for the logistics execution industry across various global regions.

WiseTech Global's recent performance highlights its robust growth trajectory, with revenue reaching AUD 1.04 billion and net income rising to AUD 262.8 million for FY2024. The company is heavily investing in innovation, allocating approximately $130 million to R&D, which represents a significant commitment to maintaining competitive advantage through technological advancements. Earnings are projected to grow at an impressive annual rate of 23.9%, outpacing the broader Australian market's average of 12.3%, driven by strong demand for its logistics software solutions from high-profile clients like DHL and FedEx.

Taking Advantage

- Discover the full array of 61 ASX High Growth Tech and AI Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NXL

Nuix

Provides investigative analytics and intelligence software solutions in the Asia Pacific, the Americas, Europe, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.