The Australian market has shown signs of nervousness, aligning with its Asian counterparts as investors anticipate the upcoming Federal Reserve rate cut decision, while profit-taking activities have tempered recent gains. In this climate of cautious optimism and fluctuating sentiment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential and resilience amidst broader economic uncertainties.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pureprofile | 11.53% | 37.56% | ★★★★★☆ |

| Infomedia | 7.00% | 20.05% | ★★★★★☆ |

| Clinuvel Pharmaceuticals | 21.20% | 24.78% | ★★★★★☆ |

| Pro Medicus | 19.65% | 21.16% | ★★★★★☆ |

| Wrkr | 53.03% | 122.27% | ★★★★★★ |

| BlinkLab | 104.90% | 101.40% | ★★★★★★ |

| Artrya | 49.60% | 61.45% | ★★★★★☆ |

| PYC Therapeutics | 10.34% | 33.76% | ★★★★★☆ |

| Immutep | 103.62% | 42.06% | ★★★★★☆ |

| FINEOS Corporation Holdings | 10.00% | 57.30% | ★★★★☆☆ |

Click here to see the full list of 23 stocks from our ASX High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Pro Medicus (ASX:PME)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pro Medicus Limited is a healthcare informatics company that develops and supplies imaging software and radiology information system services to hospitals, imaging centers, and healthcare groups across Australia, North America, and Europe with a market cap of A$30.82 billion.

Operations: The company generates revenue primarily through the production of integrated software applications for the healthcare industry, amounting to A$212.98 million.

Pro Medicus, a standout in Australia's tech landscape, demonstrates robust growth with a notable 39.2% increase in earnings over the past year, outpacing the Healthcare Services industry's 13.2%. This growth is underpinned by significant investment in innovation, as evidenced by its R&D expenses which are integral to its strategy for maintaining technological leadership. The firm's recent activities include presenting at a major healthcare conference and successfully completing a share buyback program for AUD 1.5 million, underscoring its proactive management and commitment to shareholder value. Moreover, Pro Medicus announced an increased dividend payout following strong financial performance with net income soaring to AUD 115.22 million from AUD 82.79 million last year, reflecting not only profitability but also operational efficiency and market confidence.

- Dive into the specifics of Pro Medicus here with our thorough health report.

Assess Pro Medicus' past performance with our detailed historical performance reports.

PYC Therapeutics (ASX:PYC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PYC Therapeutics Limited is a drug-development company focused on discovering and developing novel RNA therapeutics for treating genetic diseases in Australia, with a market cap of A$495.77 million.

Operations: The company generates revenue primarily from the discovery and development of novel RNA therapeutics, amounting to A$23.49 million.

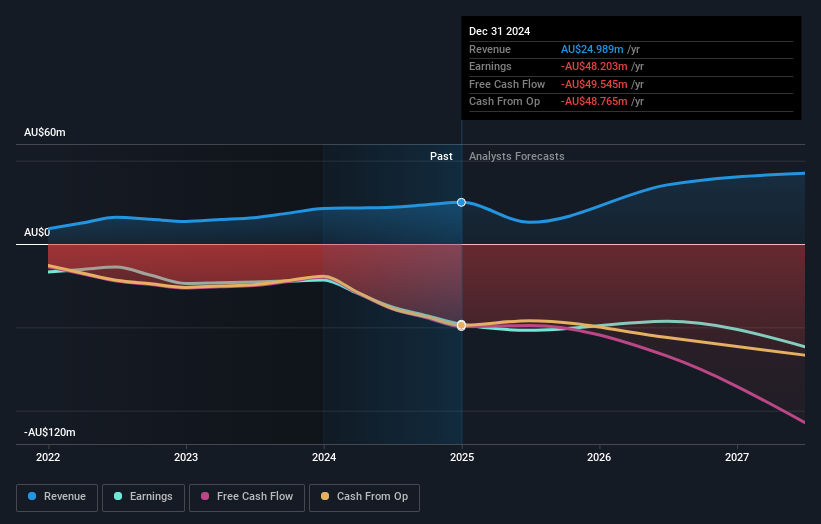

Despite facing challenges, PYC Therapeutics is navigating through a transformative phase with strategic focus on R&D investments. The company reported a revenue increase to AUD 26.17 million this year, up from AUD 22.86 million, marking a growth of 10.3% annually. However, it's grappling with widening losses—AUD 50.3 million compared to last year’s AUD 37.73 million—which underscores the high costs associated with its developmental pipeline and innovation efforts in biotechnology. Looking ahead, PYC is expected to achieve profitability within three years, supported by an anticipated earnings growth of 33.76% per annum and revenue projections outpacing the Australian market's average growth rate (5.5%). This forward-looking optimism hinges on their ability to convert R&D into viable products amidst existing financial pressures and market dynamics highlighted by recent auditor concerns over its long-term viability.

Xero (ASX:XRO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xero Limited is a company that offers online business solutions for small businesses and their advisors across Australia, New Zealand, the United Kingdom, North America, and other international markets with a market cap of approximately A$26.67 billion.

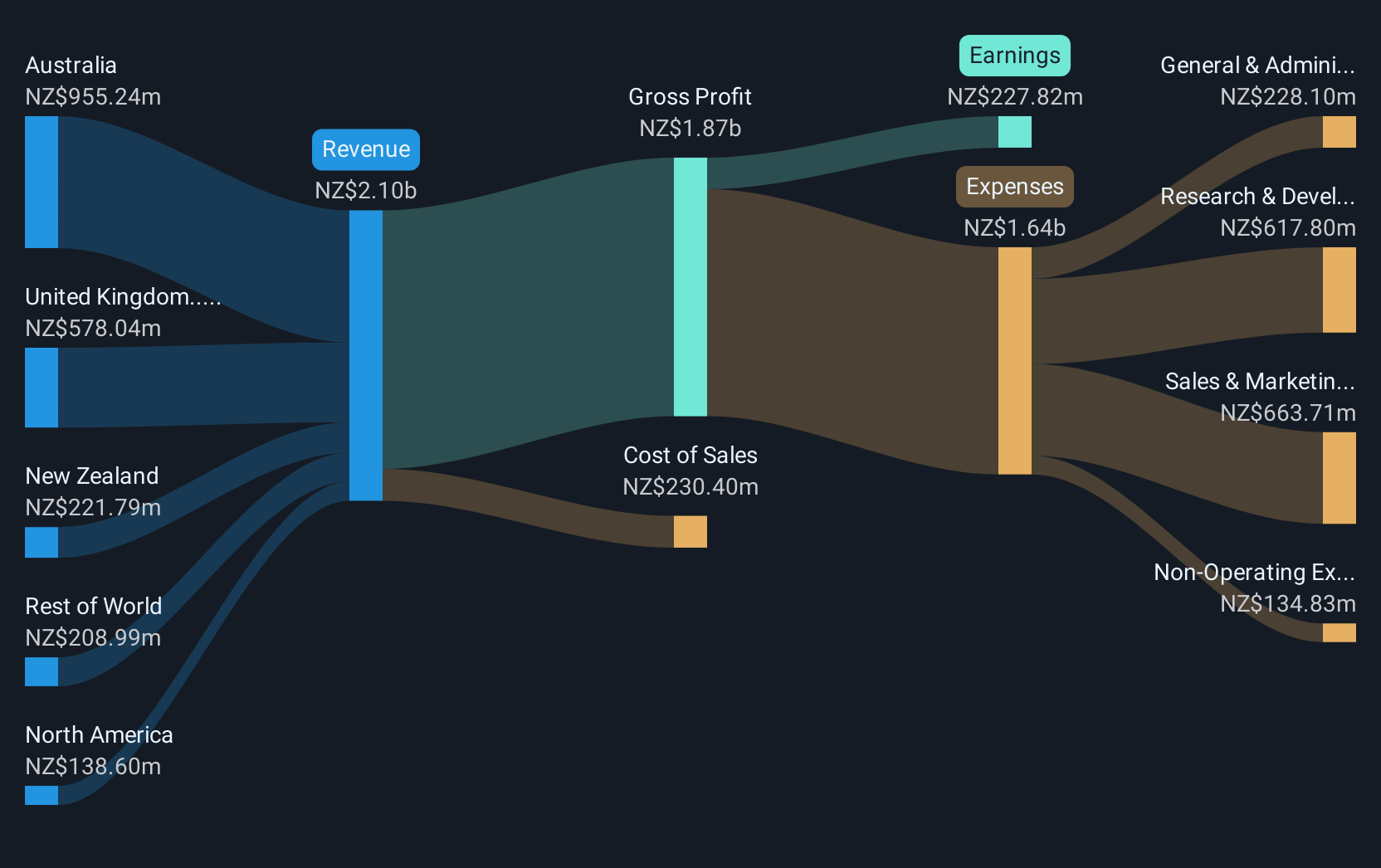

Operations: Xero generates revenue primarily through providing online solutions for small businesses and their advisors, amounting to NZ$2.10 billion. The company operates in multiple regions including Australia, New Zealand, the UK, and North America.

Xero, a leader in cloud-based accounting software, recently showcased robust growth with a 14.3% increase in annual revenue and an impressive 24.8% rise in earnings. This growth is supported by strategic R&D investments totaling AUD 150 million, which represent a significant portion of their revenue, emphasizing their commitment to innovation and market expansion. Recent events such as the successful completion of a substantial AUD 1.85 billion equity offering further bolster their financial flexibility to pursue aggressive expansion strategies and technological advancements. Additionally, the integration of Integra Balance.AI into the Xero App Store highlights Xero's focus on enhancing its platform's capabilities through AI-driven solutions, ensuring they remain at the forefront of transforming financial management practices globally.

- Delve into the full analysis health report here for a deeper understanding of Xero.

Evaluate Xero's historical performance by accessing our past performance report.

Make It Happen

- Click this link to deep-dive into the 23 companies within our ASX High Growth Tech and AI Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PYC

PYC Therapeutics

A drug-development company, engages in the discovery and development of novel RNA therapeutics for the treatment of genetic diseases in Australia.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives