For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Pro Medicus (ASX:PME). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Pro Medicus

How Fast Is Pro Medicus Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Impressively, Pro Medicus has grown EPS by 32% per year, compound, in the last three years. As a result, we can understand why the stock trades on a high multiple of trailing twelve month earnings.

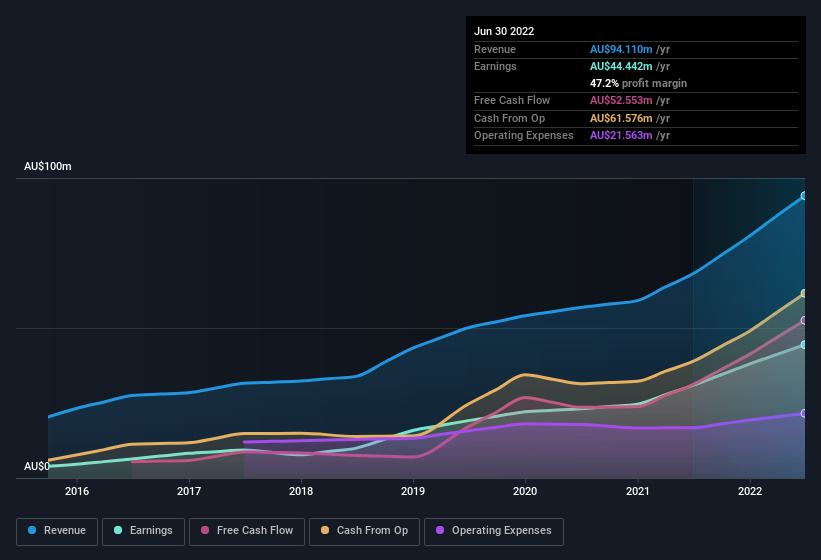

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Pro Medicus is growing revenues, and EBIT margins improved by 3.2 percentage points to 66%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Pro Medicus' future EPS 100% free.

Are Pro Medicus Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We note that Pro Medicus insiders spent AU$84k on stock, over the last year; in contrast, we didn't see any selling. This is a good look for the company as it paints an optimistic picture for the future.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Pro Medicus will reveal that insiders own a significant piece of the pie. In fact, they own 55% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. That level of investment from insiders is nothing to sneeze at.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because Pro Medicus' CEO, Sam Hupert, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations between AU$2.9b and AU$9.3b, like Pro Medicus, the median CEO pay is around AU$3.3m.

The CEO of Pro Medicus only received AU$510k in total compensation for the year ending June 2022. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Pro Medicus Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Pro Medicus' strong EPS growth. Furthermore, company insiders have been adding to their significant stake in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. Of course, profit growth is one thing but it's even better if Pro Medicus is receiving high returns on equity, since that should imply it can keep growing without much need for capital. Click on this link to see how it is faring against the average in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Pro Medicus, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:PME

Pro Medicus

A healthcare informatics company, engages in the development and supply of healthcare imaging software, and radiology information (RIS) system software and services to hospitals, imaging centers, and health care groups in Australia, North America, and Europe.

Exceptional growth potential with outstanding track record.