- Australia

- /

- Healthtech

- /

- ASX:ONE

Subdued Growth No Barrier To Oneview Healthcare PLC (ASX:ONE) With Shares Advancing 27%

The Oneview Healthcare PLC (ASX:ONE) share price has done very well over the last month, posting an excellent gain of 27%. The annual gain comes to 165% following the latest surge, making investors sit up and take notice.

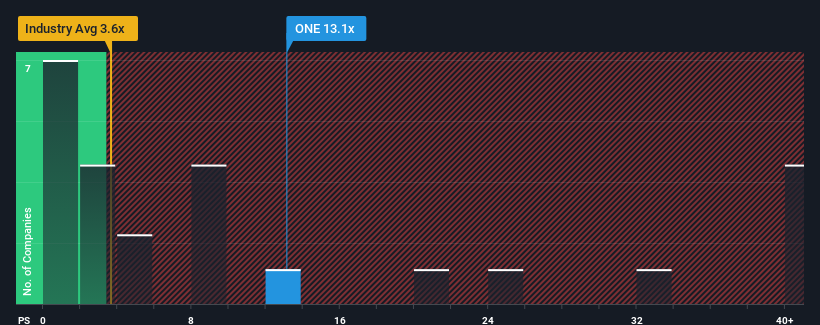

After such a large jump in price, Oneview Healthcare may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 13.1x, when you consider almost half of the companies in the Healthcare Services industry in Australia have P/S ratios under 8x and even P/S lower than 2x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Oneview Healthcare

How Oneview Healthcare Has Been Performing

Oneview Healthcare could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Oneview Healthcare.How Is Oneview Healthcare's Revenue Growth Trending?

Oneview Healthcare's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.6%. Even so, admirably revenue has lifted 43% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 29% each year during the coming three years according to the one analyst following the company. That's shaping up to be materially lower than the 51% per annum growth forecast for the broader industry.

In light of this, it's alarming that Oneview Healthcare's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Oneview Healthcare's P/S Mean For Investors?

Shares in Oneview Healthcare have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It comes as a surprise to see Oneview Healthcare trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

Before you take the next step, you should know about the 5 warning signs for Oneview Healthcare (2 don't sit too well with us!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ONE

Oneview Healthcare

Develops and sells software and related consultancy services for the healthcare sector in Ireland, the United States, Australia, Asia, and the Middle East.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives