- Australia

- /

- Healthtech

- /

- ASX:ONE

Oneview Healthcare PLC's (ASX:ONE) Shares May Have Run Too Fast Too Soon

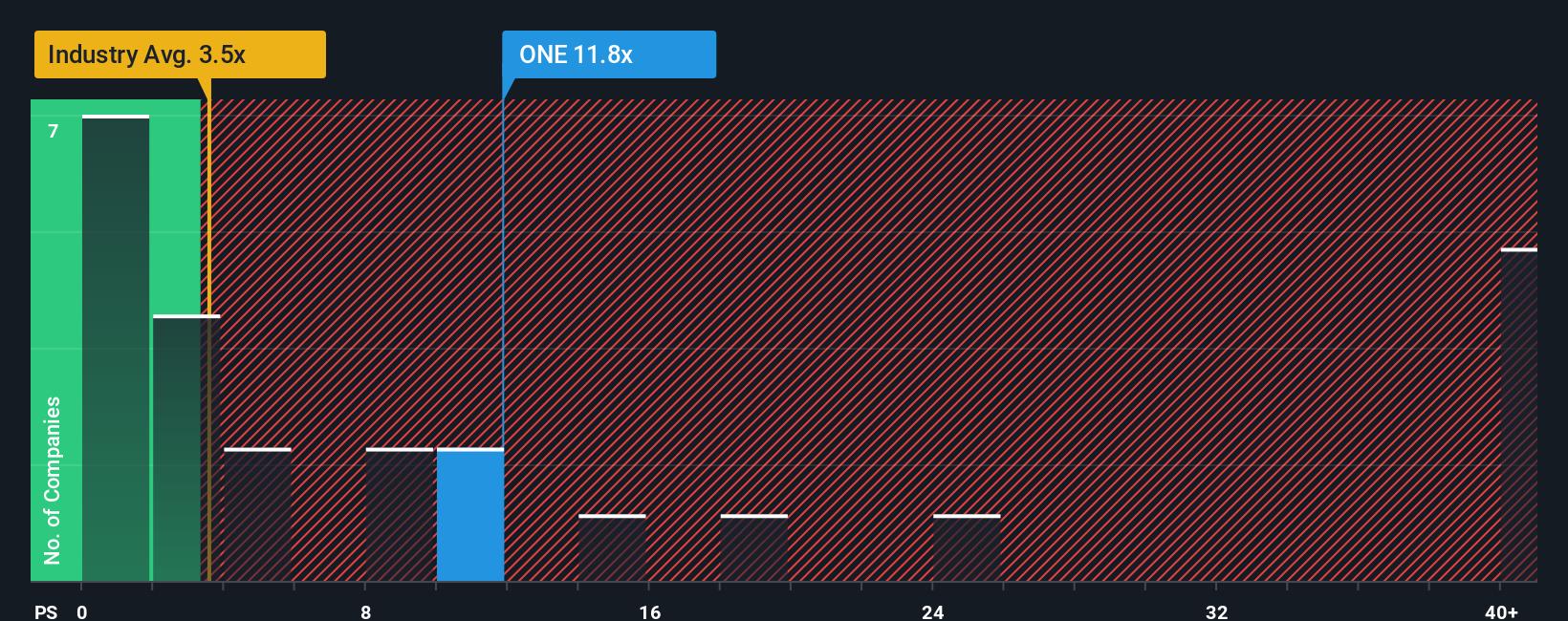

It's not a stretch to say that Oneview Healthcare PLC's (ASX:ONE) price-to-sales (or "P/S") ratio of 11.8x right now seems quite "middle-of-the-road" for companies in the Healthcare Services industry in Australia, where the median P/S ratio is around 10.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Oneview Healthcare

How Oneview Healthcare Has Been Performing

Recent times haven't been great for Oneview Healthcare as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Oneview Healthcare.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Oneview Healthcare's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.3% last year. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 41% each year as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 175% per annum, which is noticeably more attractive.

In light of this, it's curious that Oneview Healthcare's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at the analysts forecasts of Oneview Healthcare's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Oneview Healthcare with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ONE

Oneview Healthcare

Develops and sells software services for the healthcare sector in Ireland, the United States, Australia, Ireland, the Middle East, and Asia.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives